When you work on a contract with a public sector client, or any medium or large-sized client outside the public sector that falls inside IR35, they are obliged to deduct tax and national insurance from your invoice.

This process attempts to explain how to account for this in QuickBooks as well as how things are reported to HMRC.

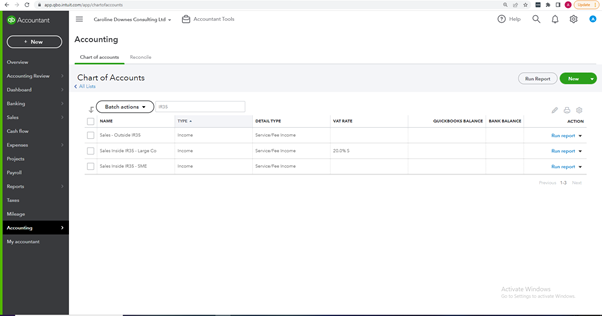

When contracting we advise setting up the 3 revenue accounts below in your Chart of Accounts –

Note: we appreciate this may not be possible if you already have a complex list of revenue account codes, the main reason for doing this is to see clearly for this demonstration how each item is treated differently. It is also important to note that clients that are small businesses or outside IR35 are not covered in this article – instead, they are covered here.

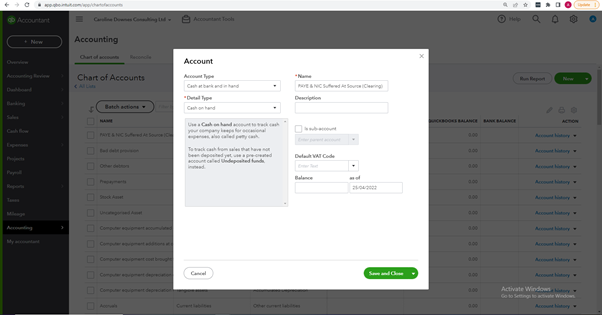

In addition to this, you will also need to create an account code on the Balance Sheet with the Account Type Cash at the bank and in hand:

Now you have set up the Account Codes you should be ready to follow the steps below when using QuickBooks to charge your large private or public sector clients that fall inside IR35.

At each stage we have detailed the double-entry bookkeeping transactions that take place, should you be bookkeeping professional. Don’t worry, if you are not a professional, please feel free to ignore these sections.

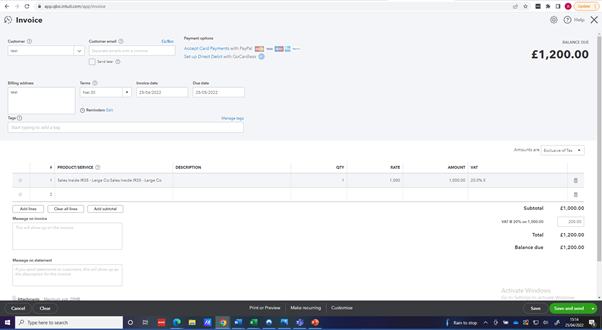

This is done in the normal way by going to Sales > Invoices > Create Invoice. You do not need to reference the eventual tax and national insurance being withheld. If you are super keen to make the process clean at this stage, you can choose to use the sales account code we suggested named ‘Sales Inside IR35 - Large Co’.

Professional example:

Assuming we issue an invoice for £1000 plus VAT the double-entry transaction should be:

| Debit | Credit | |

| Sales Inside IR35 - Large Co | 1000 | |

| VAT | 200 | |

| Account Receivable | 1200 |

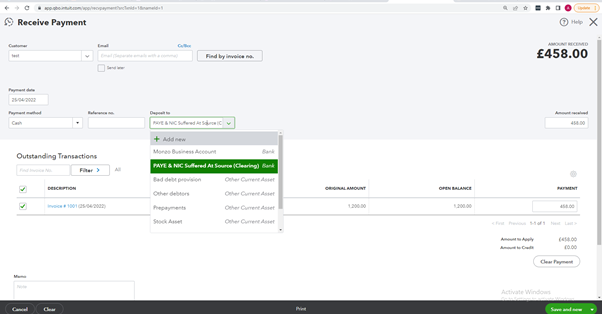

When you receive the monies from your customer it will be less your total invoice amount. Your client should have provided you with a payslip so you can reconcile and check the shortfall against the tax and national insurance amounts deducted. This payslip should have your personal name on it, not the name of your business.

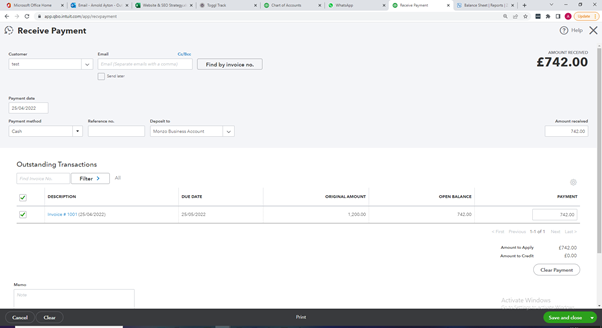

In QuickBooks, you go to Sales > Invoices and find the invoice you want to make as paid. From here you make to record 2 payments, with the first being a payment for the tax and national insurance amount withheld from your invoice against the Account Code you create named ‘PAYE & NIC Suffered At Source (Clearing)’

The second payment you need to create is for the balance of the invoice, ensuring that it matches what you received in your bank account.

WARNING – to ensure you bank account is reconciled, please go to the Banking module and match both payments you created above against your bank statement line.

Professional example:

The associate double entry should be:

| Debit | Credit | |

| Bank | 742 | |

| Tax and National Insurance (Suffered at Source) | 458 | |

| Account Receivable | 1200 |

It is important to note that this process assumes that your client has already applied PAYE correctly to your income, so when you withdraw the funds from the limited company you do not need to put this amount through payroll as taxable income.

Please see from the bank the amount from your bank account. Within QuickBooks go to Banking and select the relevant bank account, before manually categorising the payment against Gross Pay or Salaries on your Profit and Loss statement.

It might be sensible to speak to your accountant about this step as it invoices a manual journal.

On a periodic basis, you will need to post a manual journal to move the balance of your new Balance Sheet account code named ‘Tax and National Insurance (Suffered at Source)’ to the Profit & Loss statement.

The associated journal should be:

| Debit | Credit | |

| Tax and National Insurance (Suffered at Source) | 458 | |

| Salaries (P&L) | 458 |

The net impact on the P&L from the above steps should be NIL as the entire amounts are expensed, leaving a profit of Zero in the limited company for this transaction.