Tax-Free Childcare is a valuable government scheme designed to support working parents in managing the cost of childcare. For every £8 you pay into your Tax-Free Childcare account, the government adds £2, up to a maximum of £2,000 per year per child (or £4,000 per year if your child is disabled). Confusingly, it is completely and entirely separate to the 15 or 30 free hours scheme but uses a similar system. Here is a comprehensive guide on how to apply for tax free childcare, who is eligible, and what information you will need to hand.

Who Is Eligible?

To qualify for Tax-Free Childcare, you, and your partner (if you have one) must meet the following criteria:

Work Status:

- You must both be working, either as an employee or self-employed.

- If only one of your works, you might still be eligible if the other partner is unable to work due to disability, caring responsibilities, or other specified reasons.

2. Earnings:

- You (and your partner) must each earn at least the National Minimum Wage or Living Wage for 16 hours per week. This usually means a minimum of £152 per week.

- Your individual income should not exceed £100,000 per year for you or your partner.

3. Child’s Age:

- Your child must be 11 years old or younger.

- If your child has a disability, they can be eligible until they are 17.

4. Living Situation:

- Your child must live with you and be your legal responsibility.

What Information Will You Need to Hand?

Before you start the application process, it is helpful to gather the necessary information to ensure a smooth experience. Here is what you will need:

1. Personal Information:

- Your National Insurance number (and your partner’s, if applicable).

- Your date of birth and your partner’s date of birth.

2. Employment Details:

- Your employer’s name, address, and PAYE reference.

- If self-employed, you will need details about your business, such as your Unique Taxpayer Reference (UTR).

3. Child’s Details:

- Full name, date of birth and address of your child or children.

4. Bank Account Information:

- The bank details of the account you will use to make payments into your Tax-Free Childcare account.

5. Income Information:

- Your most recent payslips or proof of self-employed income to verify your earnings.

How to Apply

- Complete the application form, which is straightforward and should only take about 20 minutes. Keep checking back into the account to find confirmation of when your application has been approved.

- Once your application is approved, you can start paying into your Tax-Free Childcare account, using the bank details provided within the account. Ensure to use the reference that they have detailed. The government will top up your transfer by 20%.

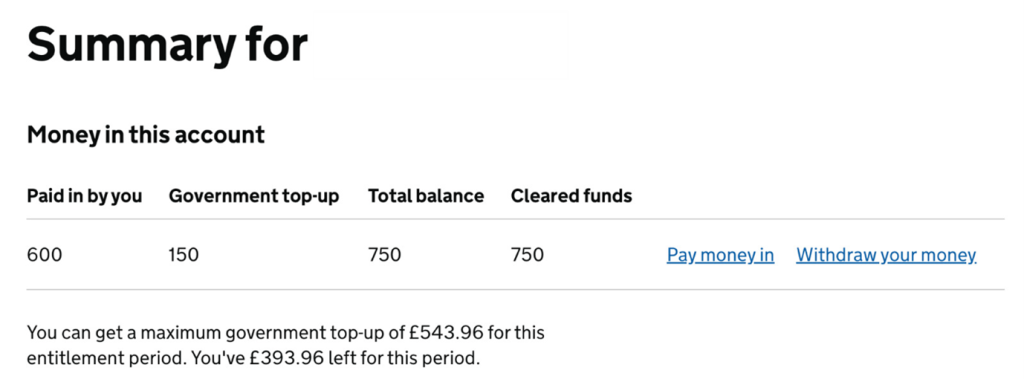

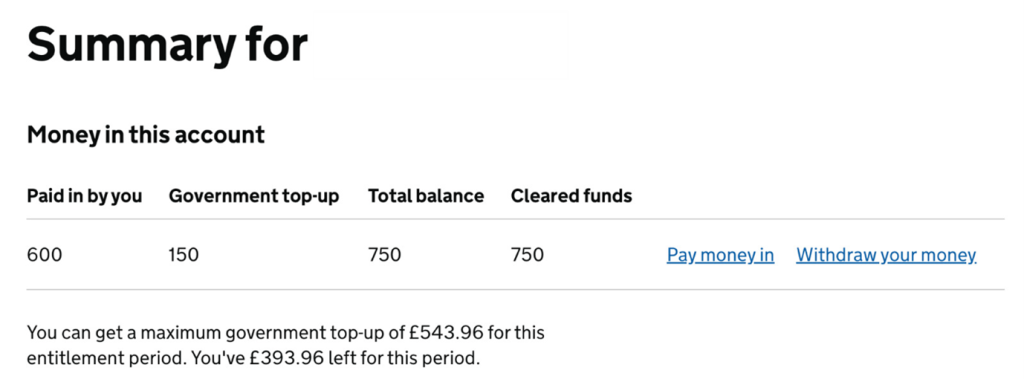

We advise transferring a lump sum and then you will be shown something like the below, which then informs you how much you have been topped up by and how much you have left of your allowance for this “term.”

Be aware that funds may take 24 hours to clear into your Childcare account. And then another 24 hours to be cleared to make payment to your childcare provider.

- You can then use the funds to pay for registered childcare providers, such as nurseries, nannies, and after-school clubs. Click the below button within your Childcare account and add your relevant provider. You can then either set up a repeating direct payment or you can manually make payment to your childcare provider. Ensure you provide your childcare provider with the payment reference detailed in your Tax-free Childcare Account so they can trace your payment.

Please note, the Government asks that you reconfirm your situation is the same once every 3 months. You can do this within your Childcare account.

Need to speak to someone at HMRC? Here is the Number to Call

If you encounter any issues during the application process or have any questions, you can contact the HMRC helpline for assistance.

Tax-Free Childcare Helpline: 0300 123 4097

The helpline is available Monday to Friday, 8 am to 6 pm. Be sure to have your National Insurance number and any relevant application details on hand when you call to expedite the process.

Applying for Tax-Free Childcare can significantly reduce your childcare costs, making it easier for you to balance work and family life. By ensuring you meet the eligibility criteria and having the necessary information ready, you can complete your application smoothly and start enjoying the benefits of this valuable scheme.

Spondoo can help you decide if you are eligible and has personal experience in the confusing, overly complicated tax-free childcare scheme. Contact us today and we can help make the process that little bit easier!