Migrating from Xero to Zoho Books

If you want to migrate from Xero to Zoho Books, you must export data out of your Xero account and import it separately into Zoho Books - in the form of CSV, TSV or XLS files. However, you don’t have to figure out how to do it yourself – you can contact the Spondoo accounting systems migration team for accurate and efficient migration services.

Follow this 10-Step process to switch over to Zoho Books from Xero effortlessly.

Step 1: Export data from Xero

First, you must export your historical data from your Xero account. However, before you start exporting data, you must ensure:

- All your bank accounts in your chart of accounts have codes.

- Export your data in - CSV, TSV or XLS file formats - because Zoho books only supports these file formats when importing data.

To export accounting data from Xero, follow the following processes:

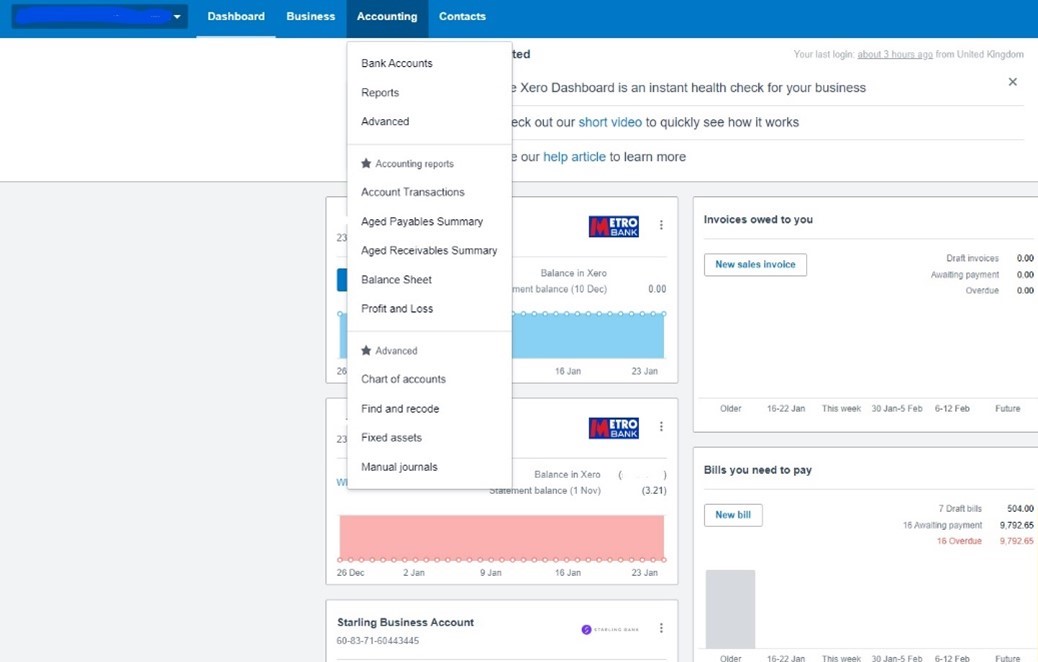

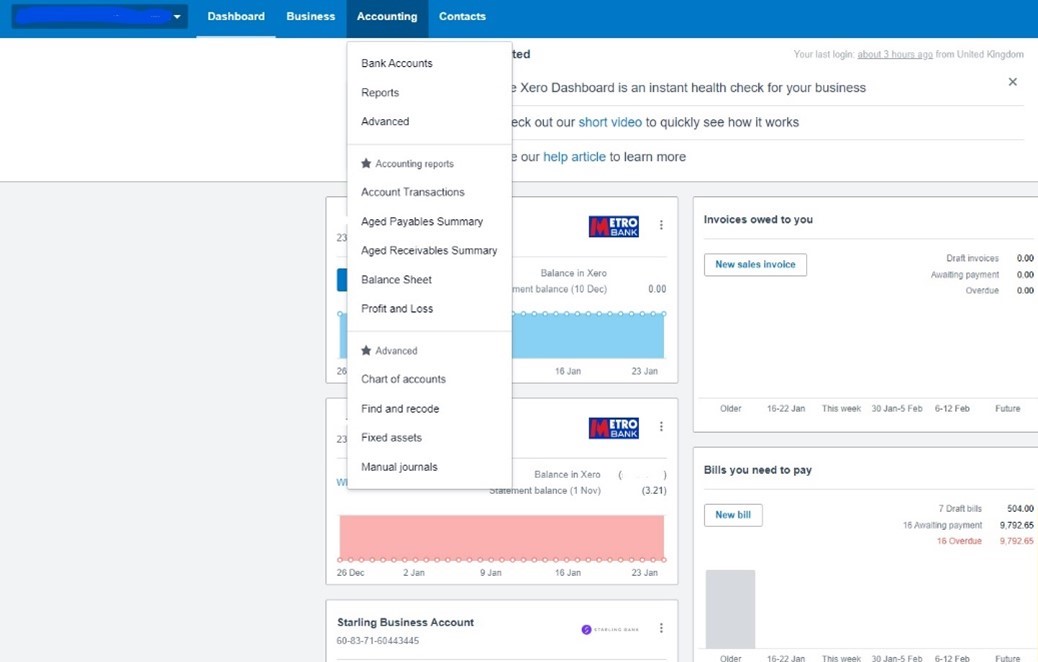

- Log in to your Xero account and navigate to the Accounting menu.

- Select Advanced

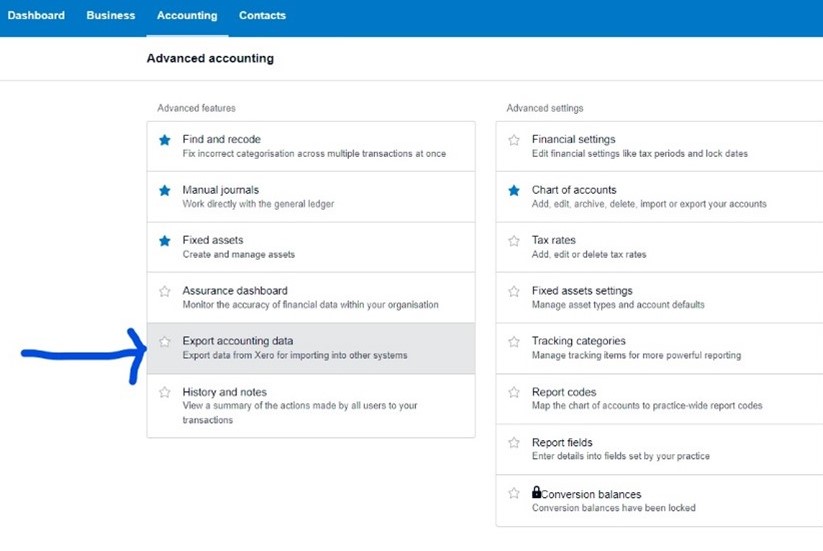

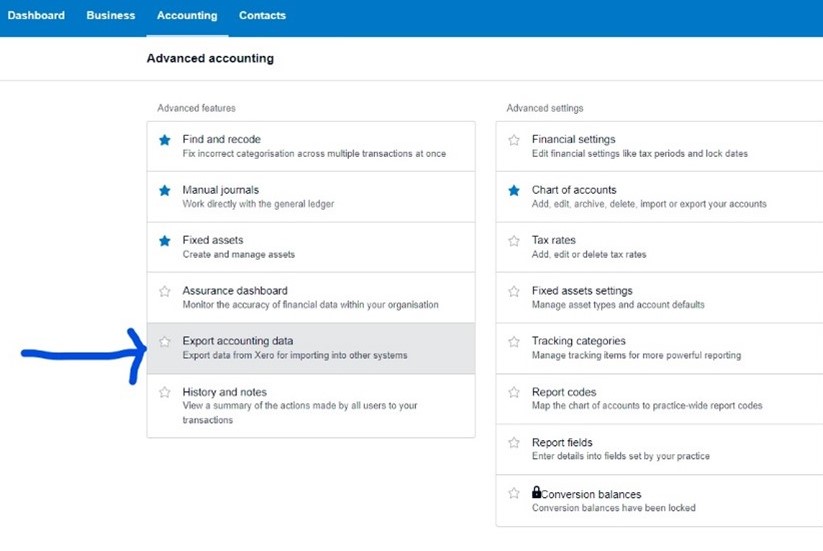

- Click Export accounting data.

- Add a code to accounts in your chart of accounts if prompted.

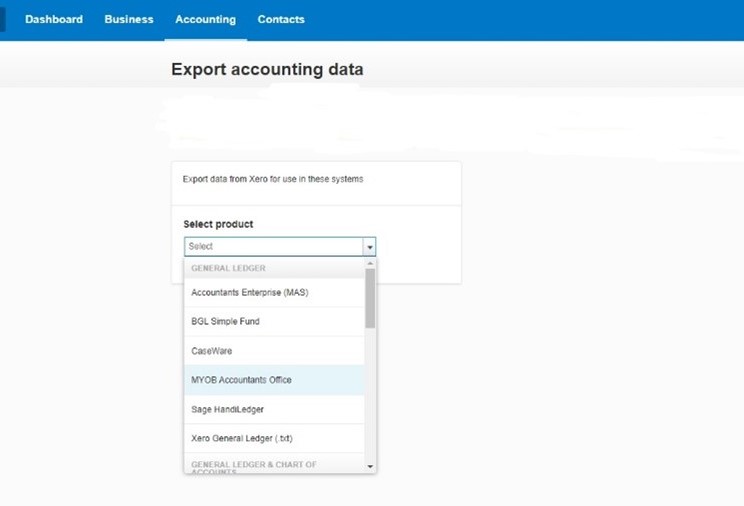

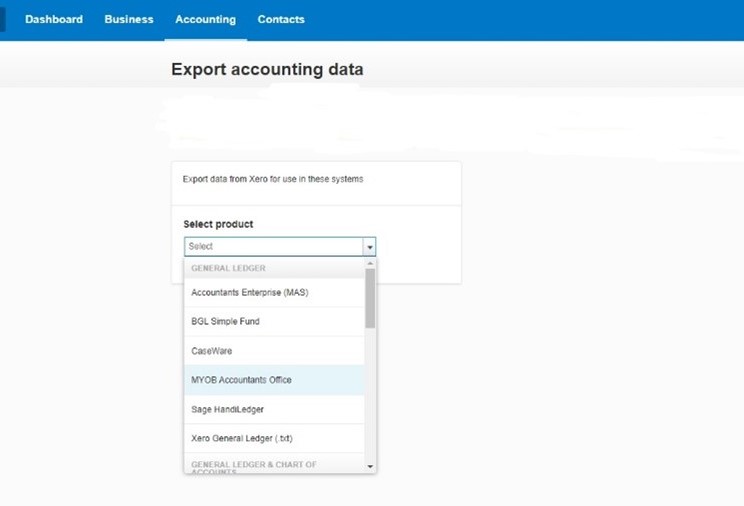

- Select the correct product or tax authority.

- Select the date range of the data.

- Click Download.

- Save the file.

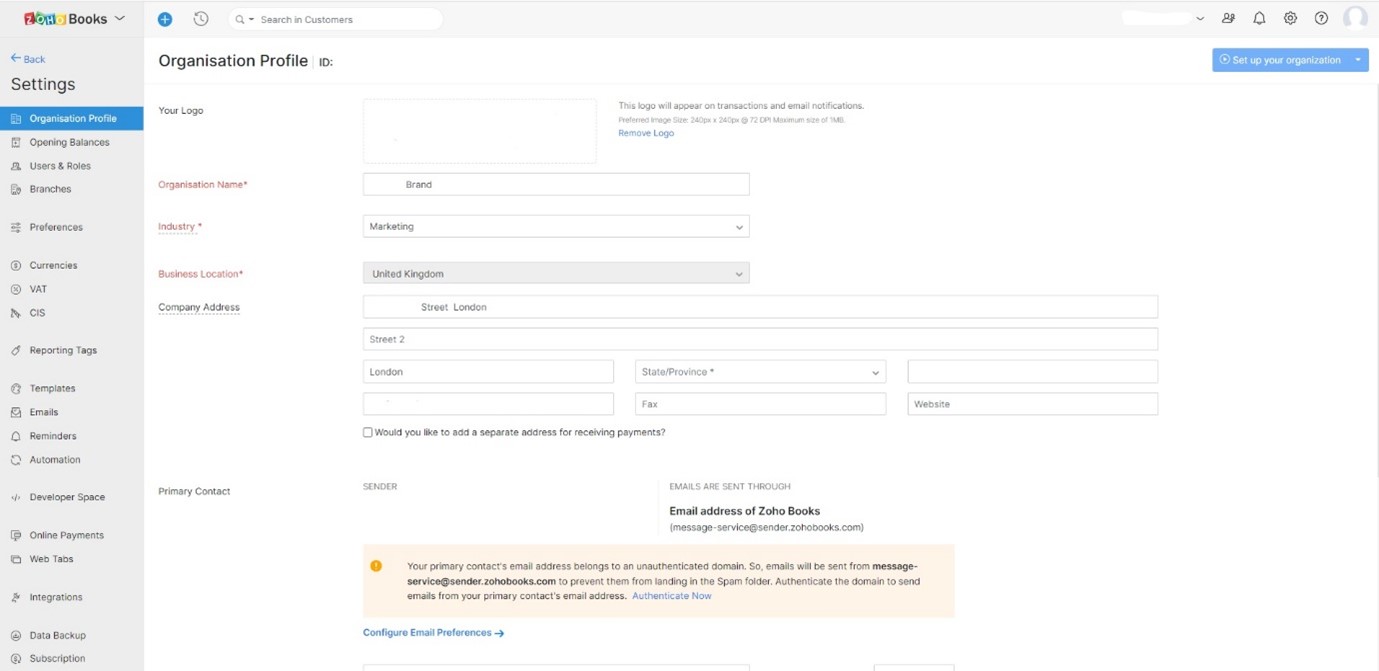

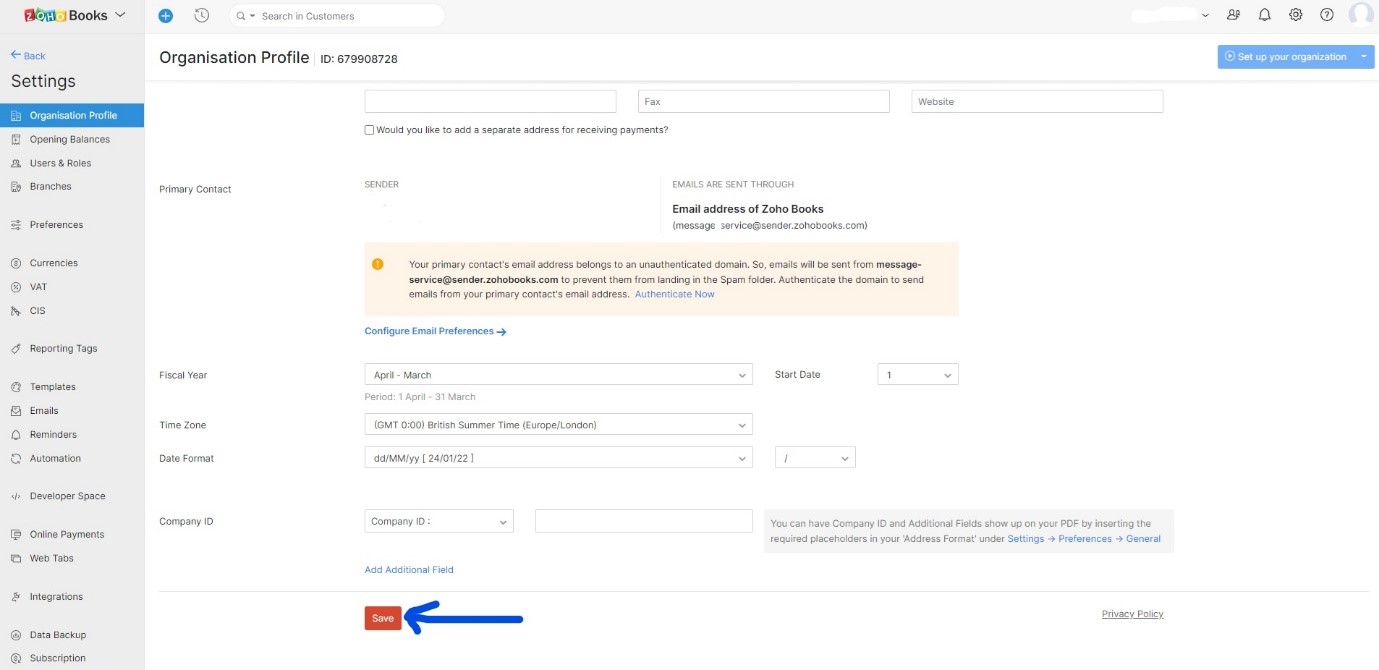

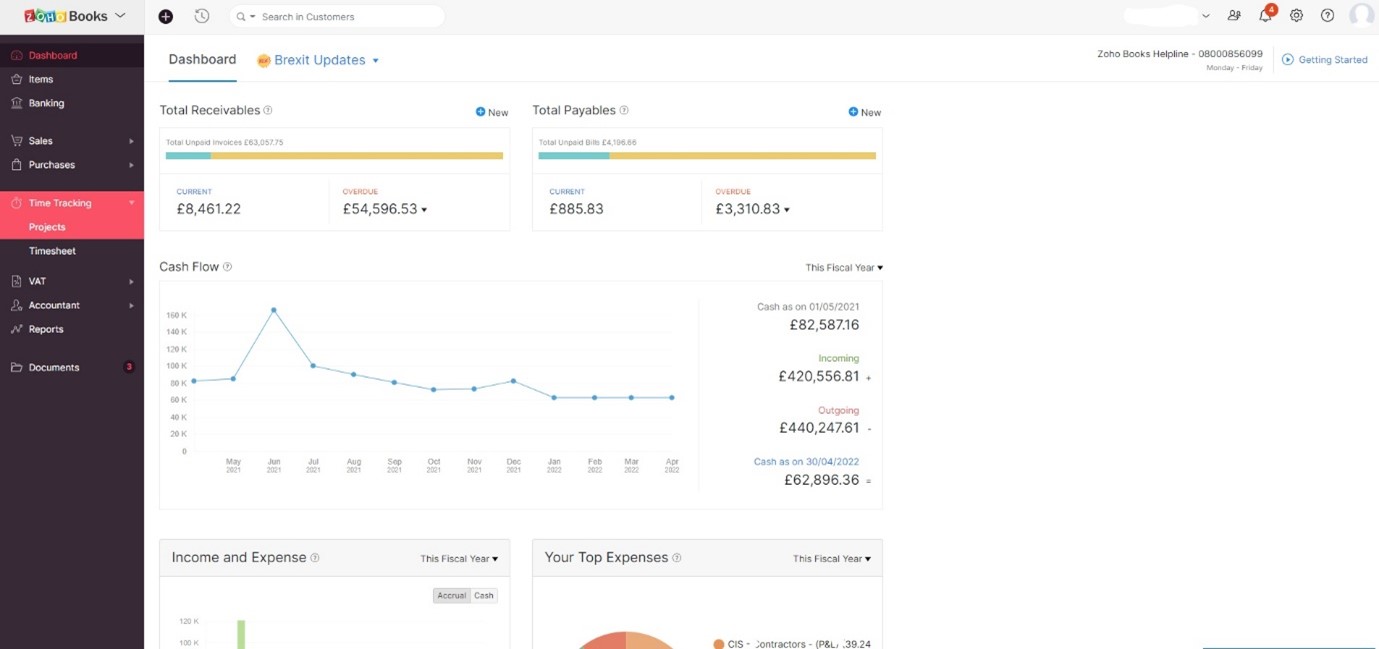

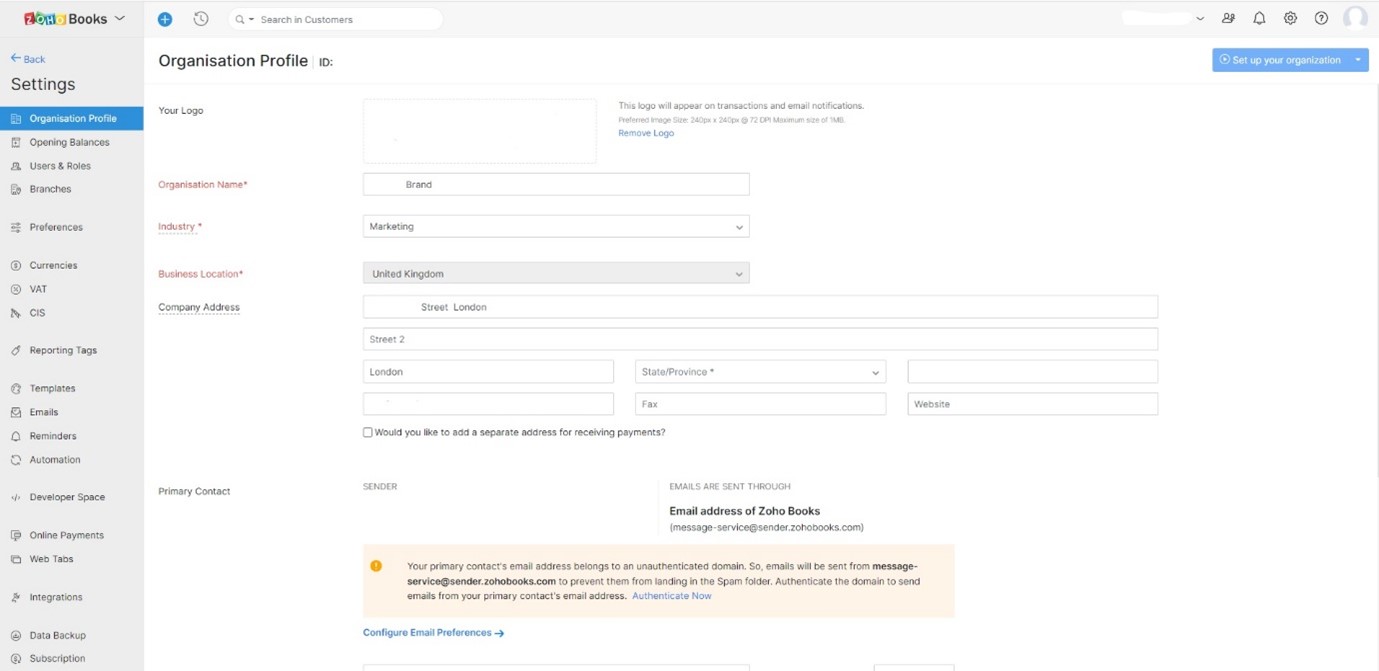

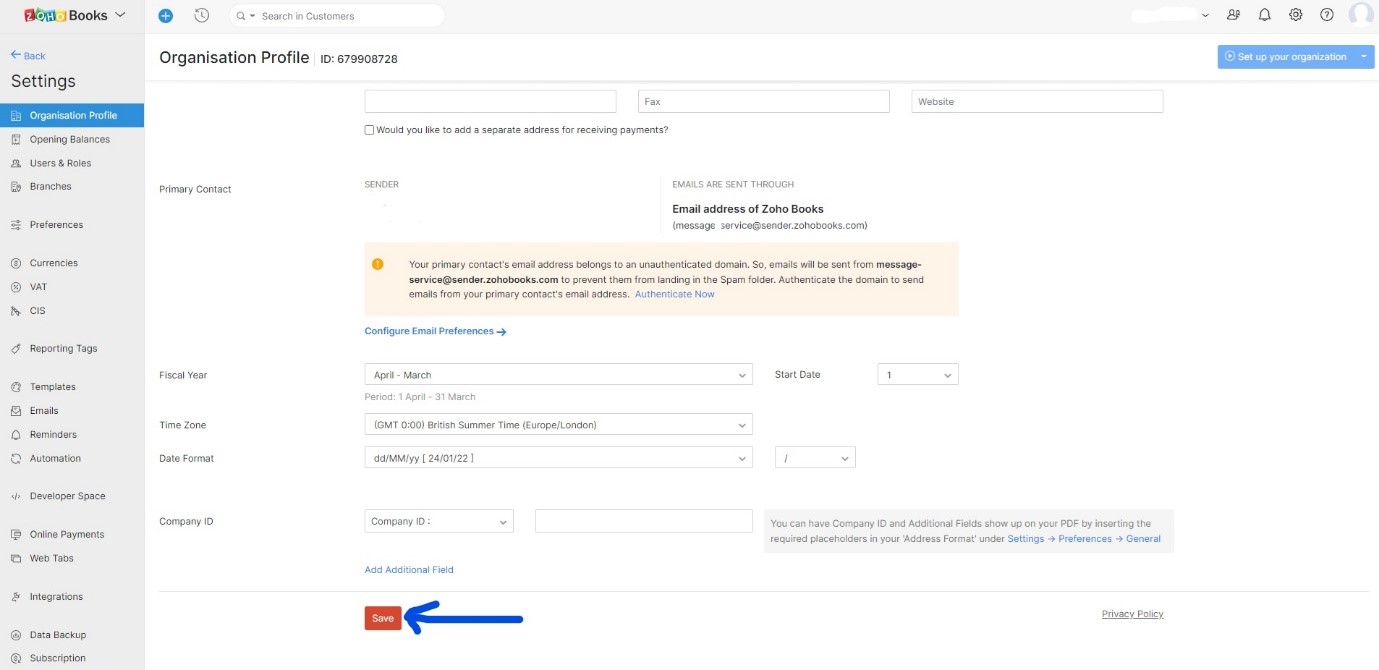

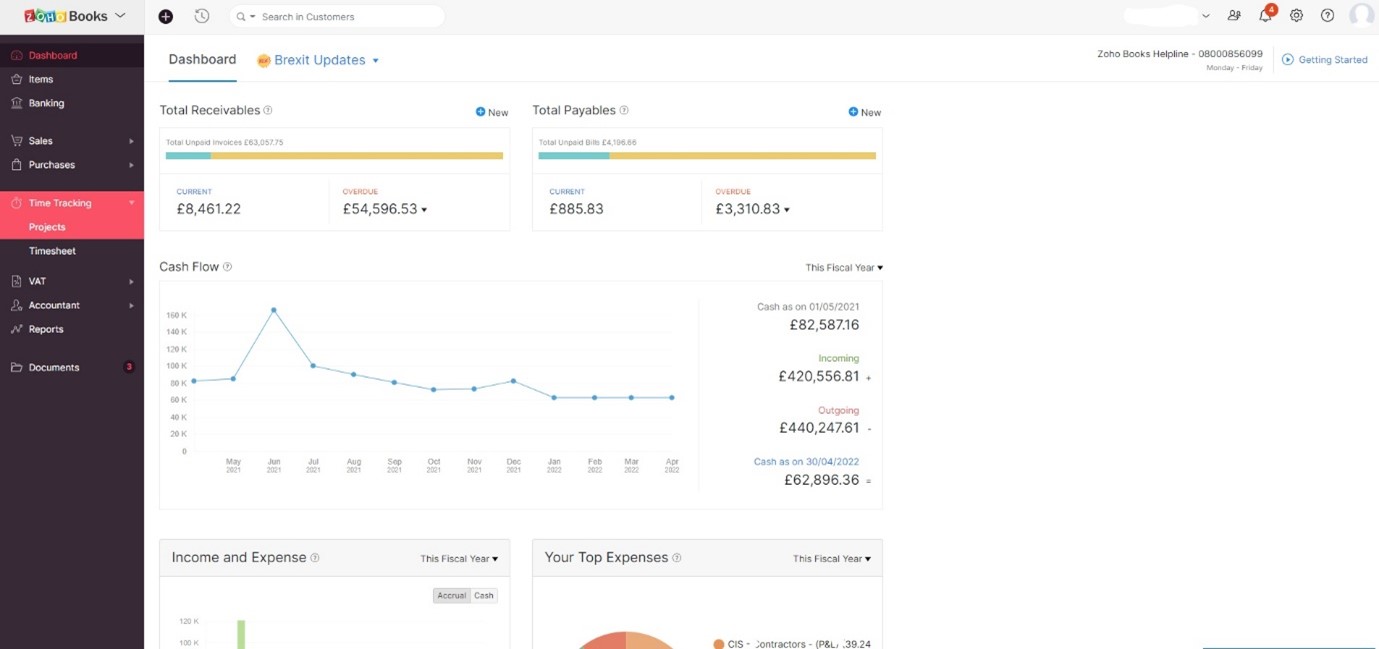

Step 2: Set Up your Zoho Books Organisation profile

To set up your organisation's profile, follow these simple steps:

- Sign up to Zoho Books

- Sign in to your Zoho account.

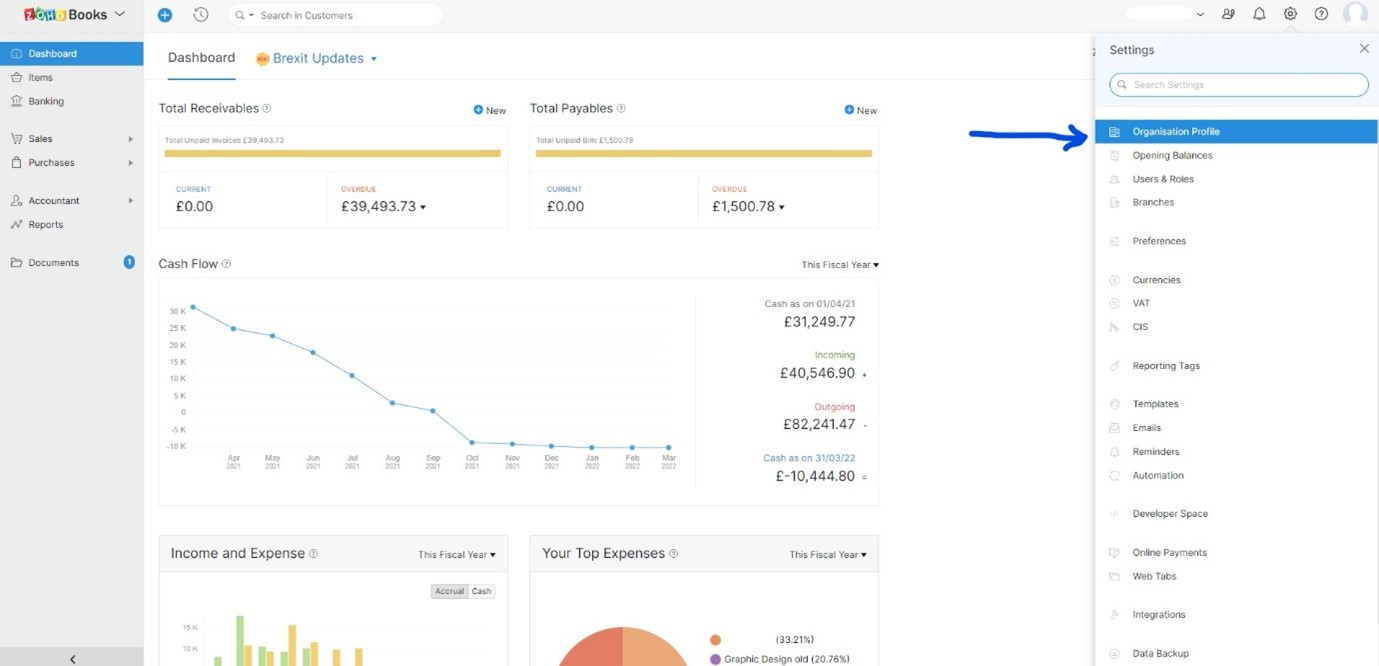

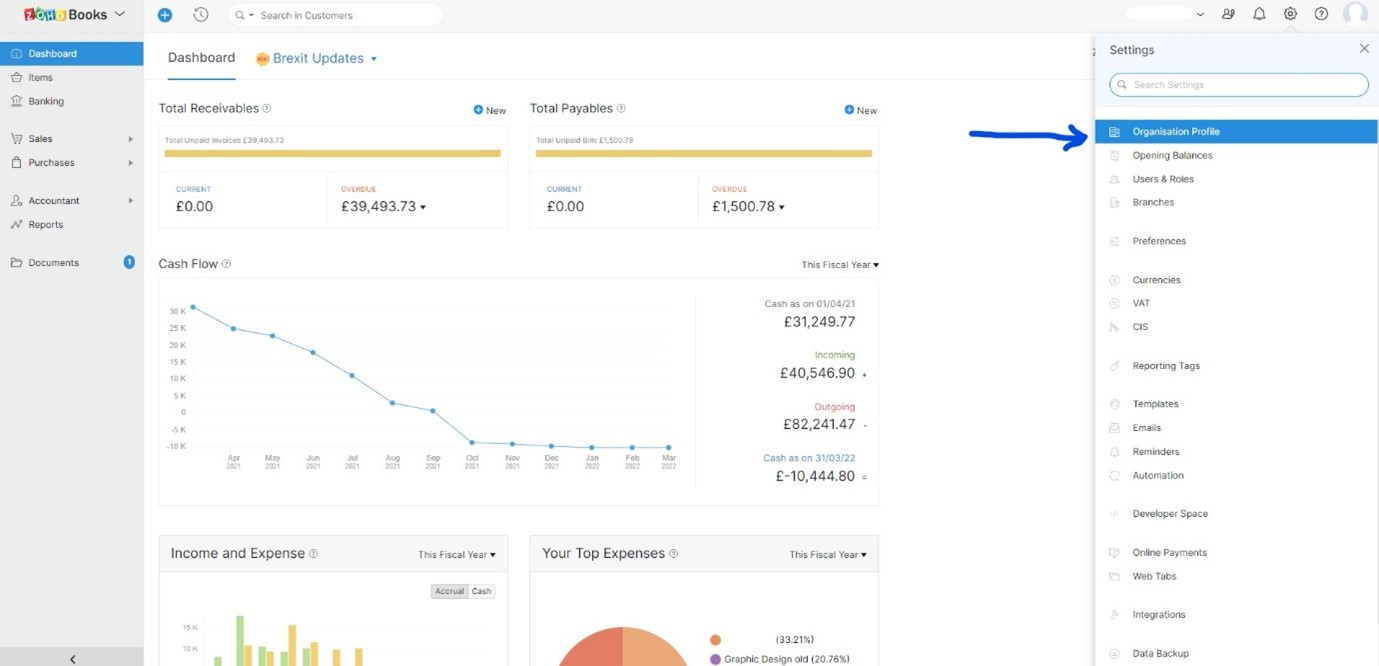

- Navigate to the Settings Gear icon in the top-right corner.

- Choose Organisation Profile.

- Fill out your organisation's details.

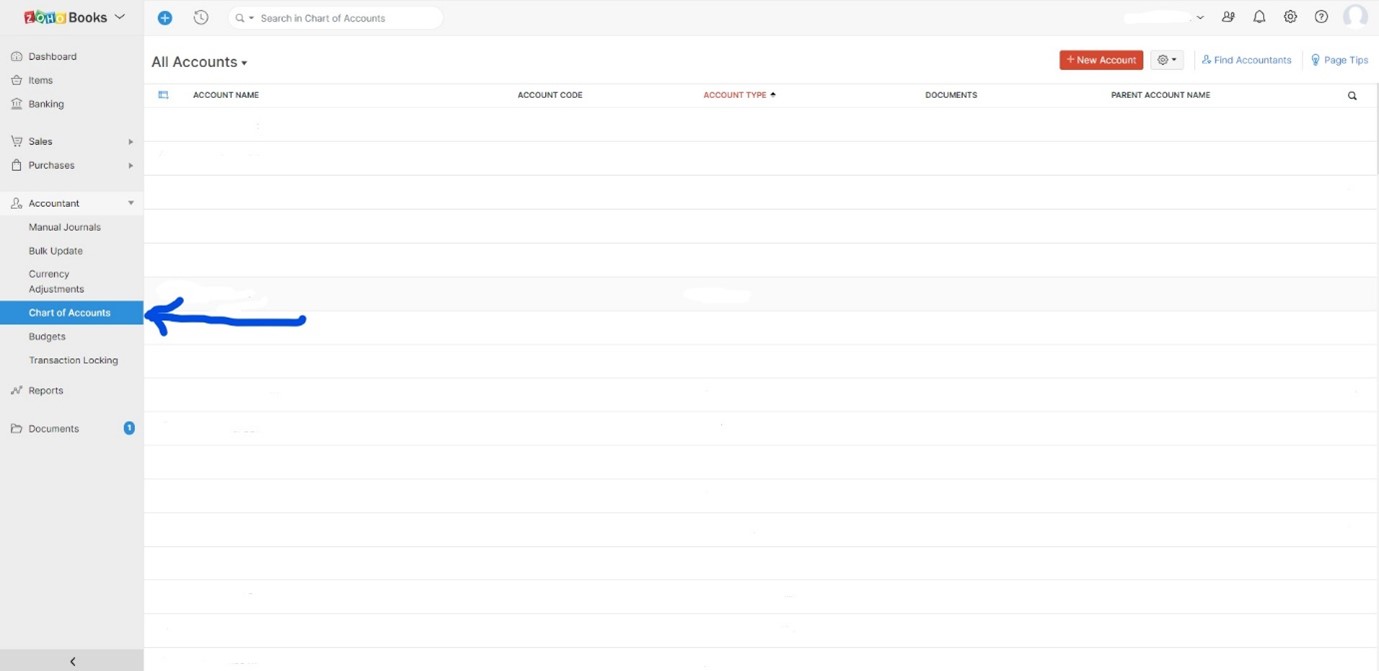

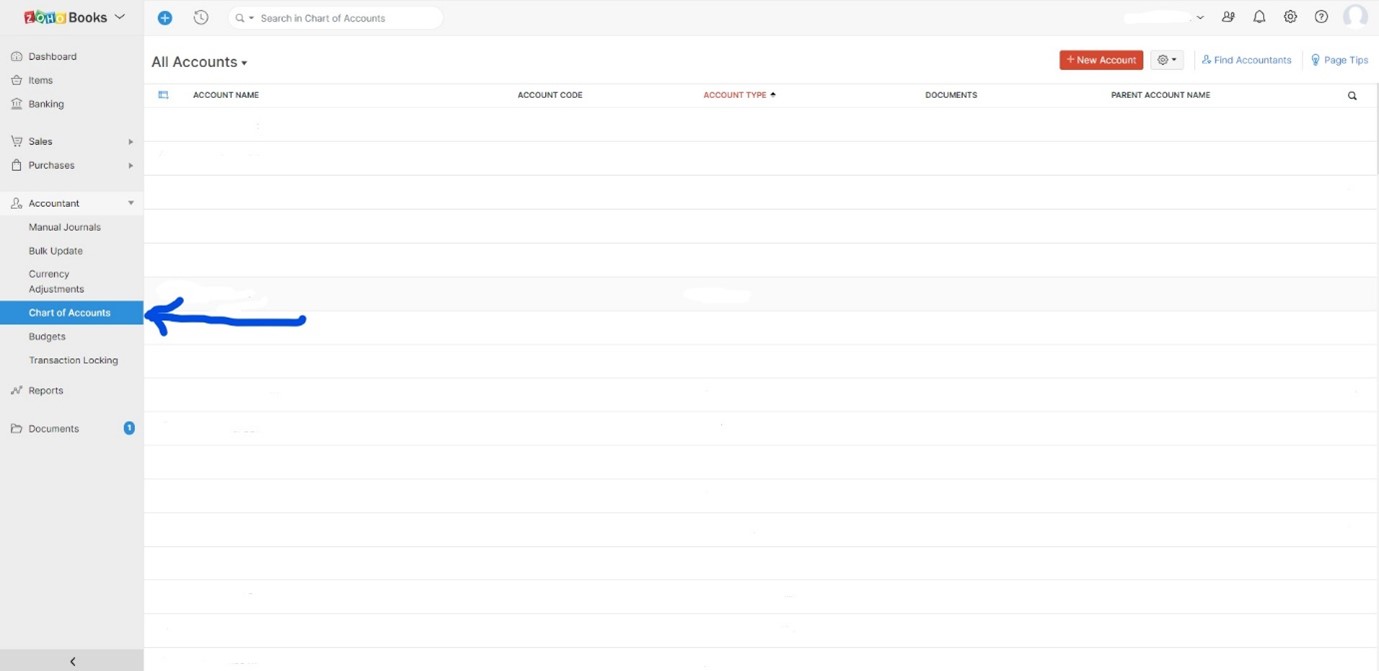

Step 3: Import Chart of Accounts

To export your chart of accounts from Xero: In the Accounting menu > Choose Advanced > Click Chart of accounts > Click Export.

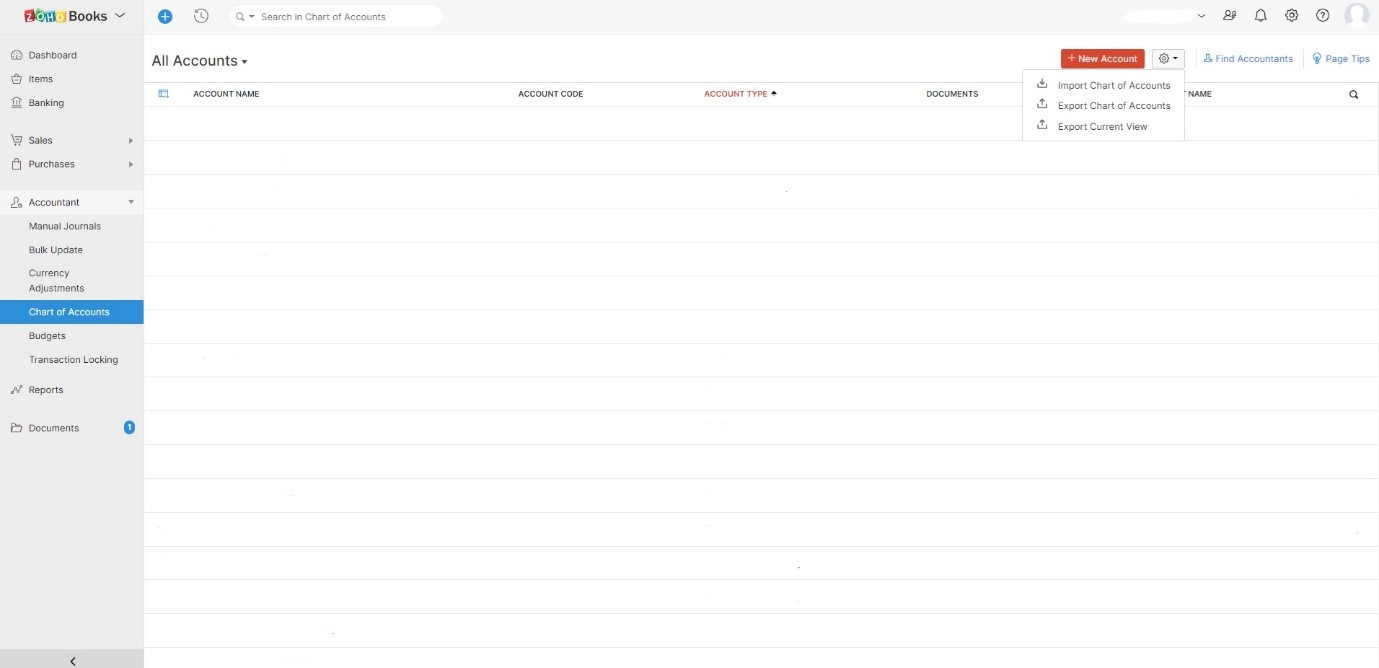

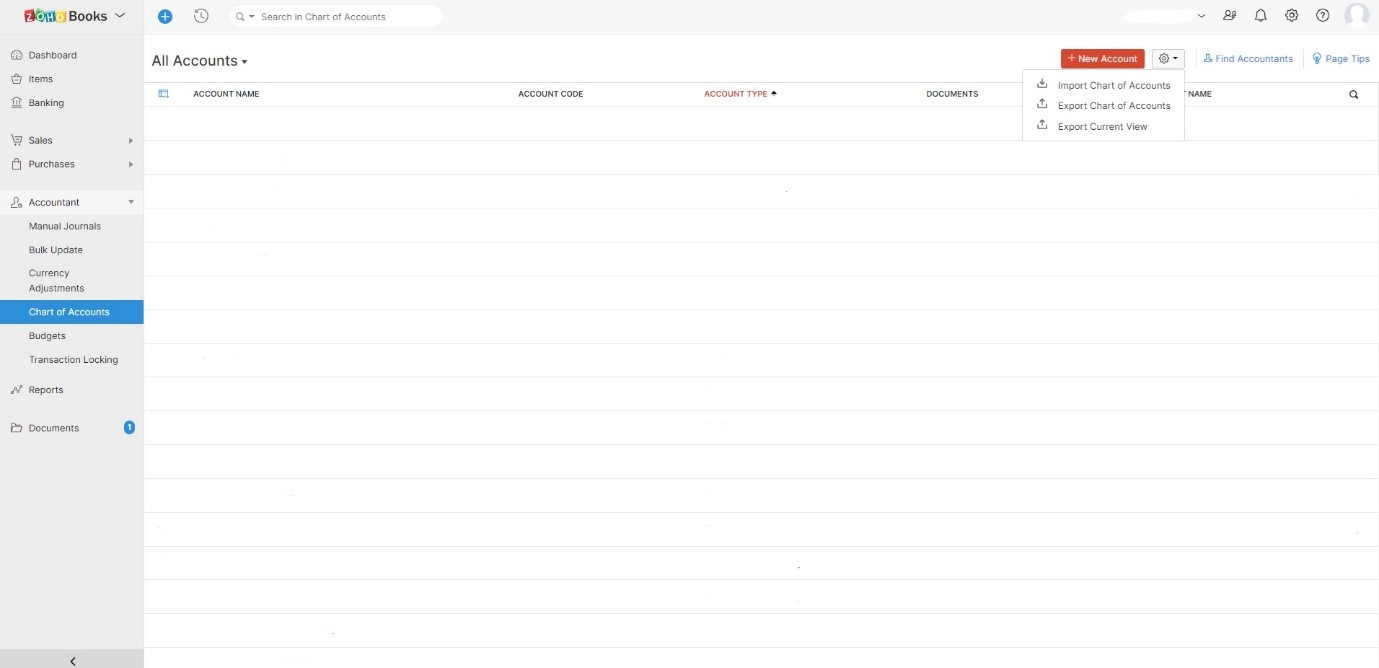

Follow the following steps to import the chart of accounts to Zoho Books:

- Navigate to the Accountant module - it is on the left sidebar.

- Choose Chart of Accounts.

- Choose the file import/export Gear icon in the top-right corner and select Import Chart of Accounts.

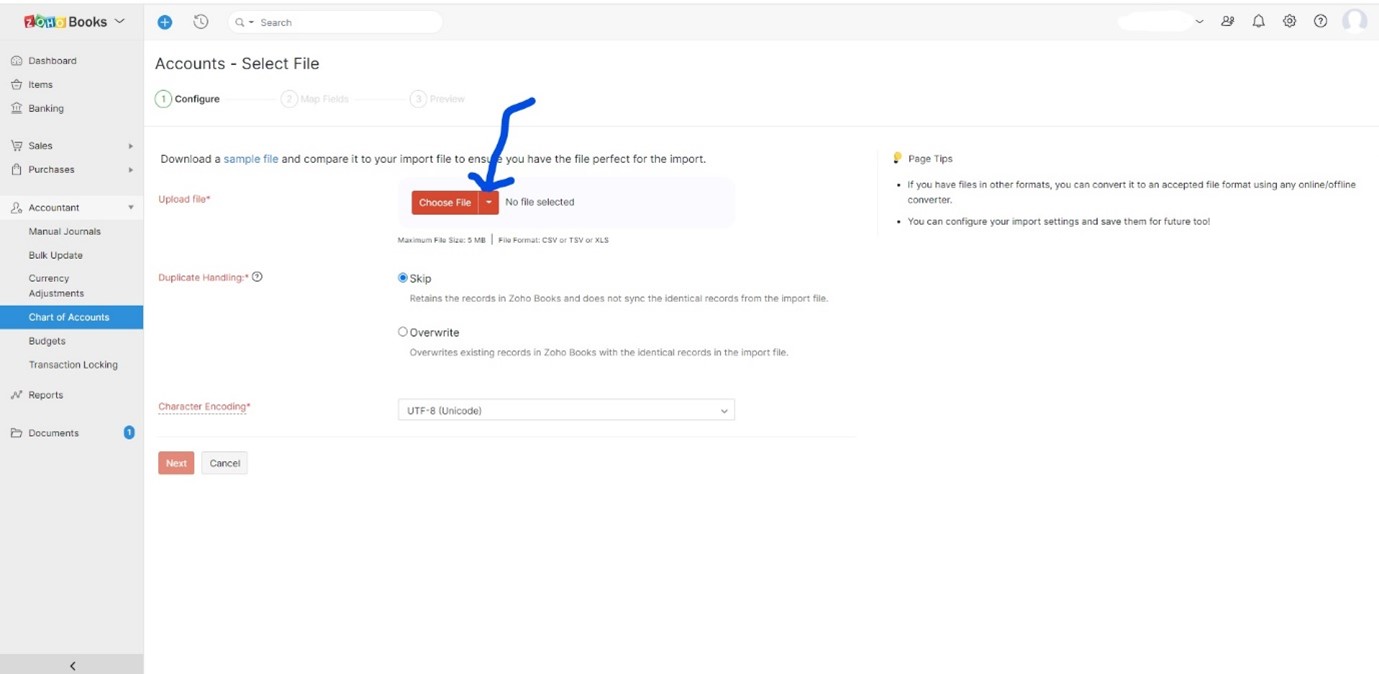

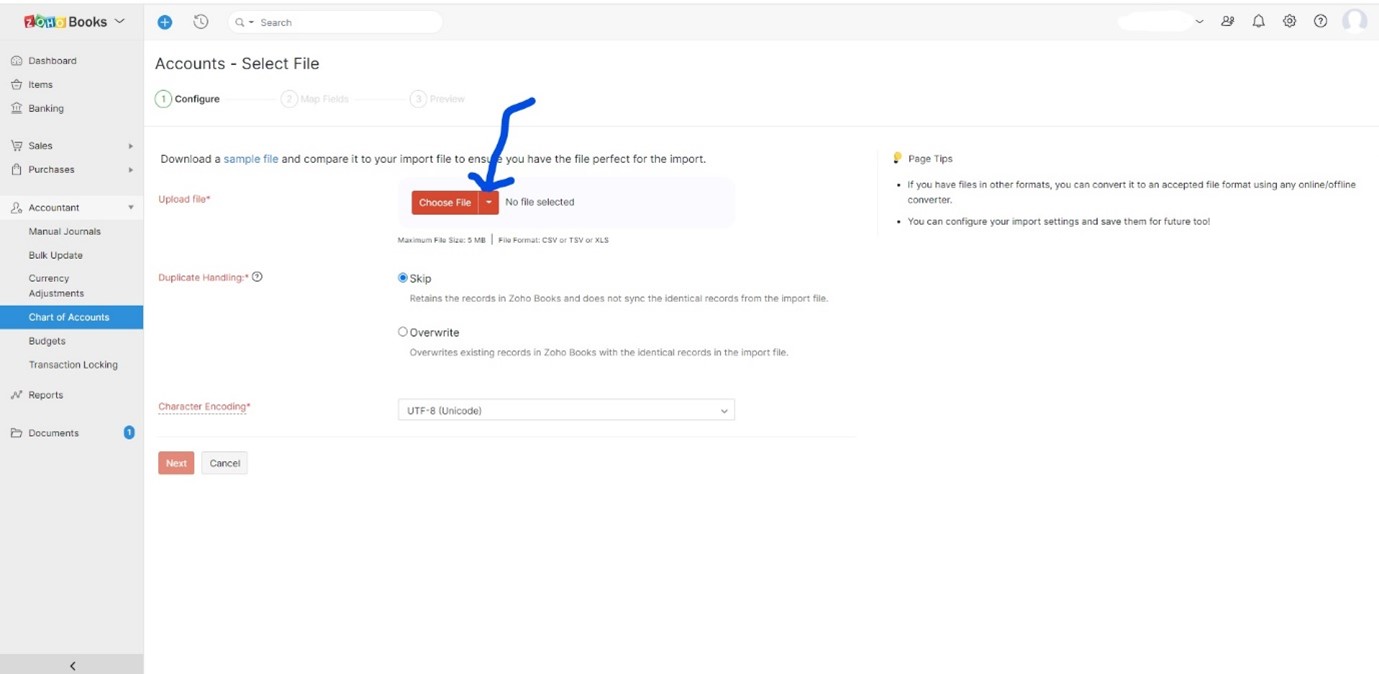

- Select the file to be imported by clicking Choose File.

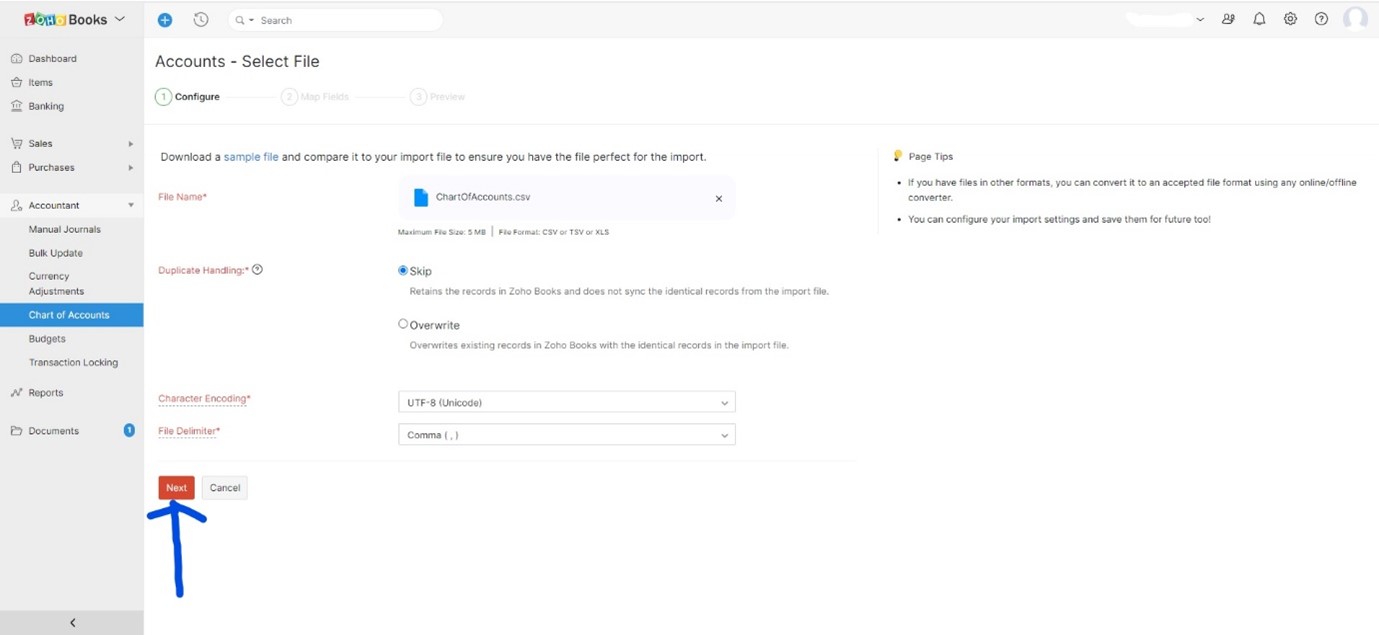

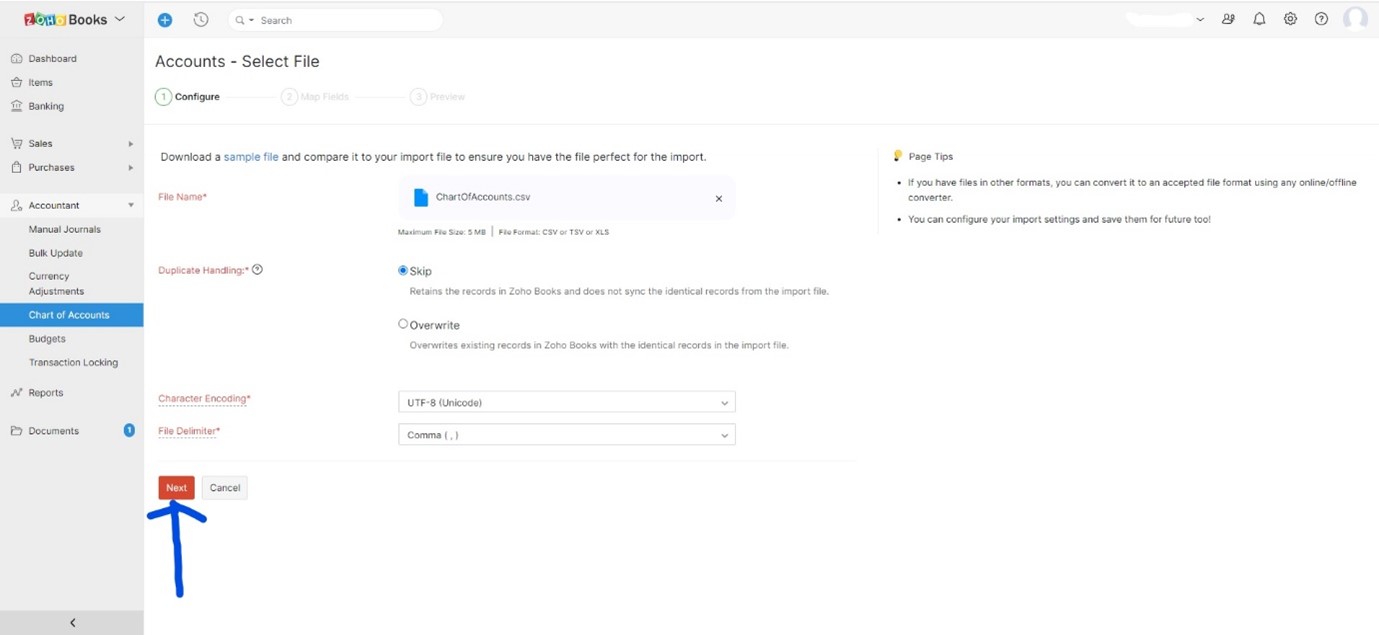

- Choose the correct Character Encoding and File Delimiter according to your import file and click Next.

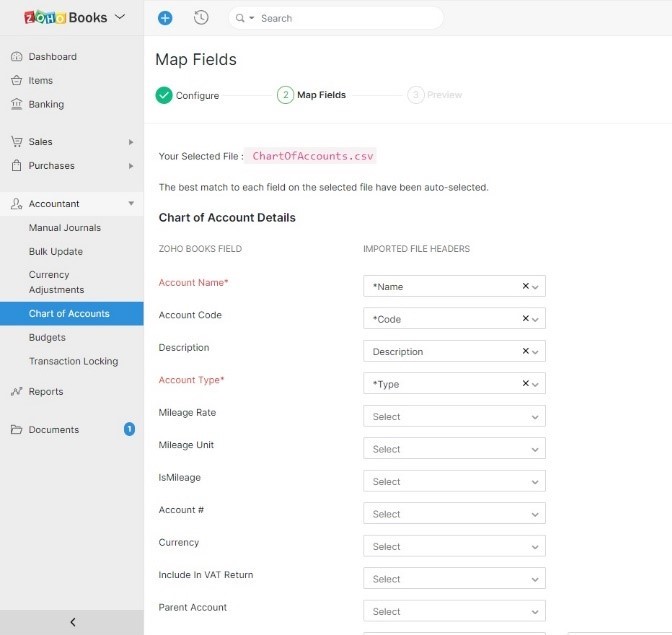

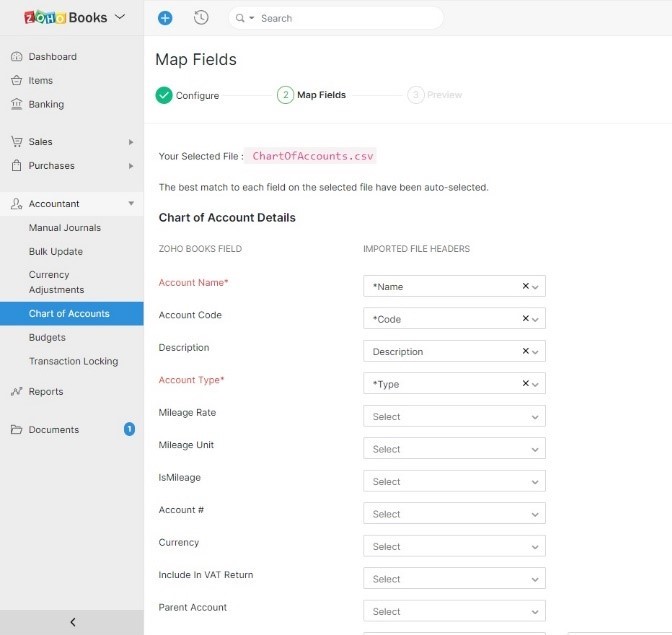

- Select the headers in your import file to be mapped with their corresponding Zoho Books fields on the Map Fields page.

- Select Next.

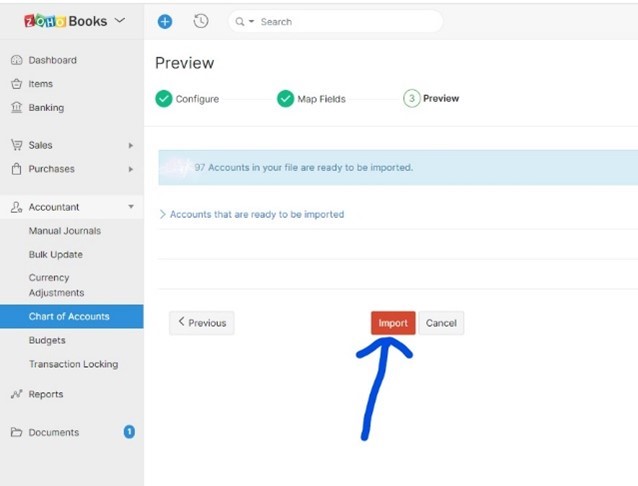

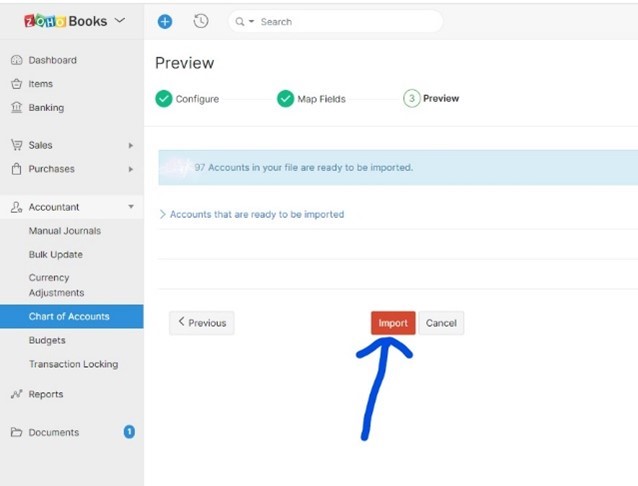

- Check the summary of your data on the Preview page - then click Import.

Step 4: Settings configuration

Zoho Books allows you to tailor your organisation to suit your business requirements by letting you: Enable Required Modules, Configure Module Preferences and Set up Taxes. We will discuss what to do in each case.

How to enable the Required Modules

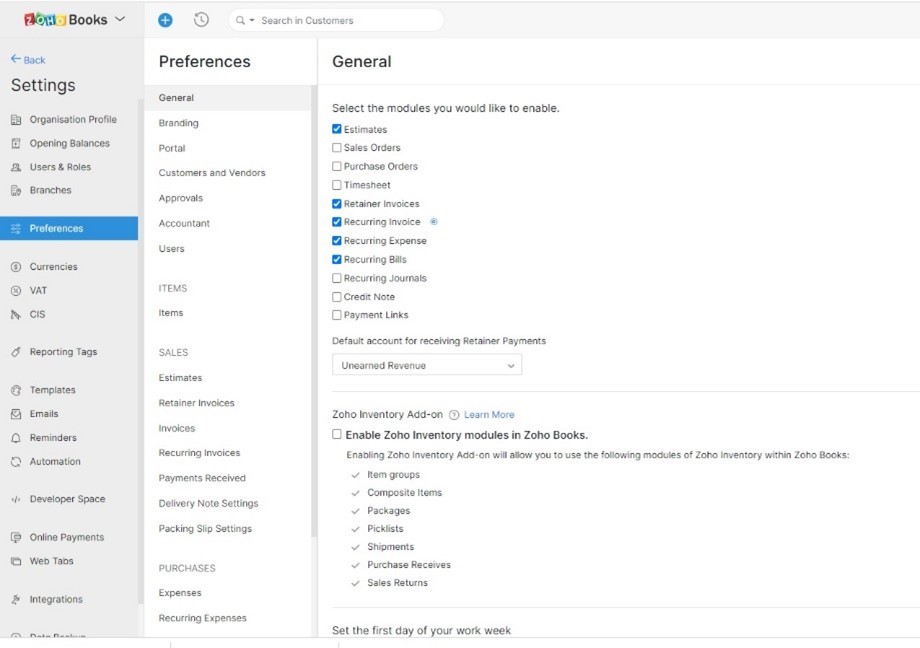

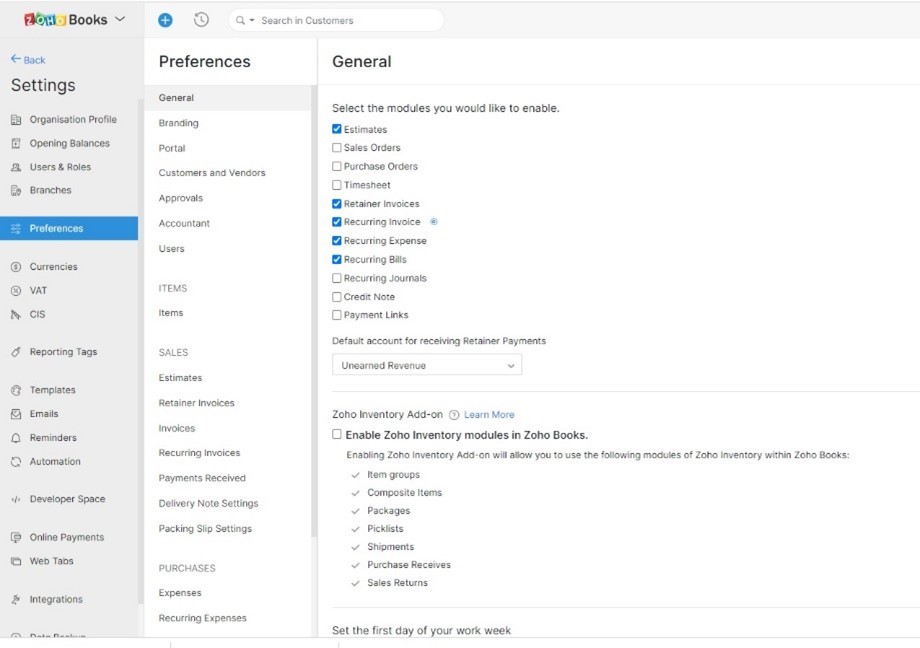

You can enable your business centred Zoho modules (Estimates, Timesheet, Recurring Bills, and Debit Note etc.) by:

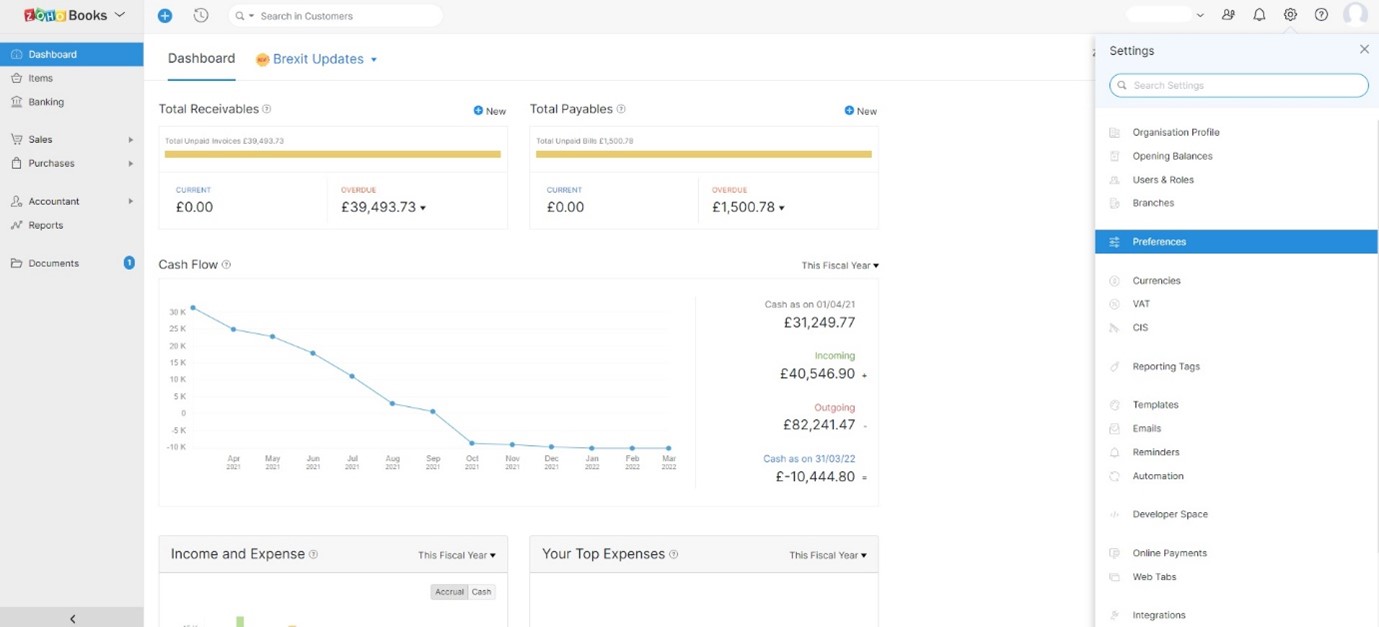

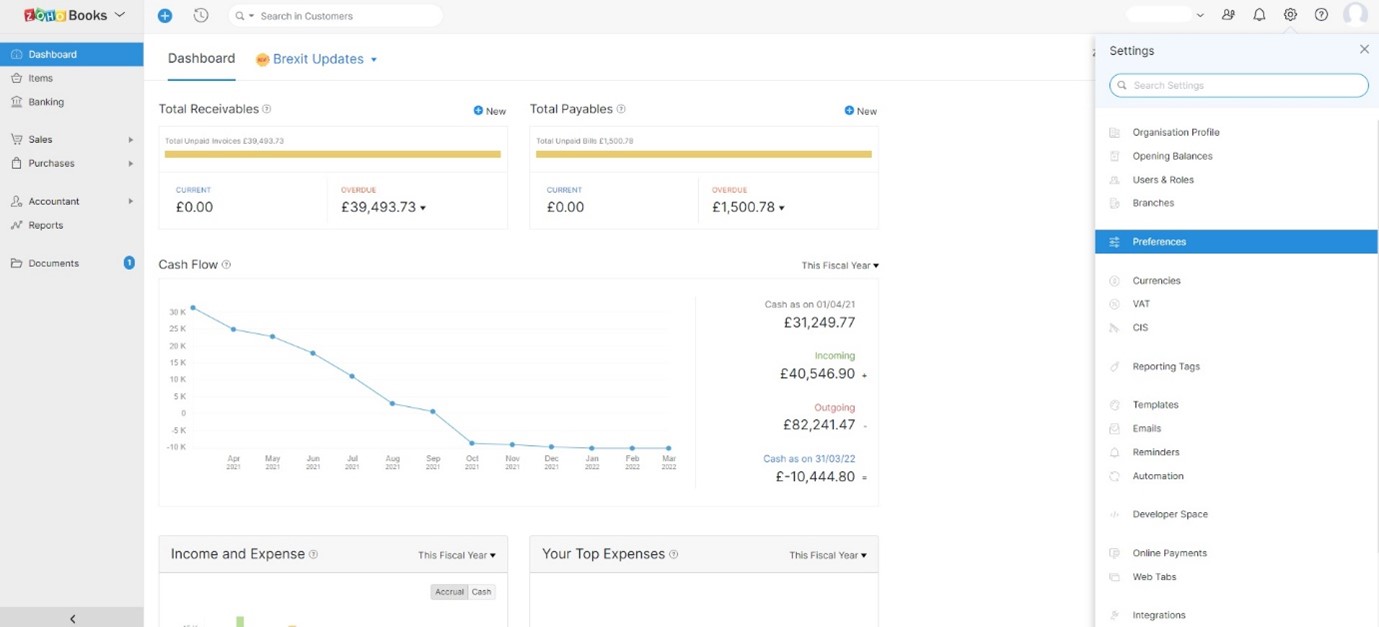

- Navigate to Settings and then choose Preferences.

- Choose General

- Select the modules that are relevant to your business under Select the modules you would like to enable the option.

- After configuring all the required details, select Save – it is on the lower side of the screen.

How to Configure Module Preferences

After enabling the modules required for your business, you may still configure their preferences by customising each module to suit your business needs by:

- Navigate to Settings

- Choose Preferences

- Choose the module that you want to customise. You can select you preferred module from the sidebar.

- Customise your module with the different options provided by Zoho Books.

How to Set up Taxes

Zoho Books has country-specific taxes that you can shape to meet your business’ tax obligations. It also allows you to create a new tax that you can:

- Link to your items.

- Apply it when making a transaction.

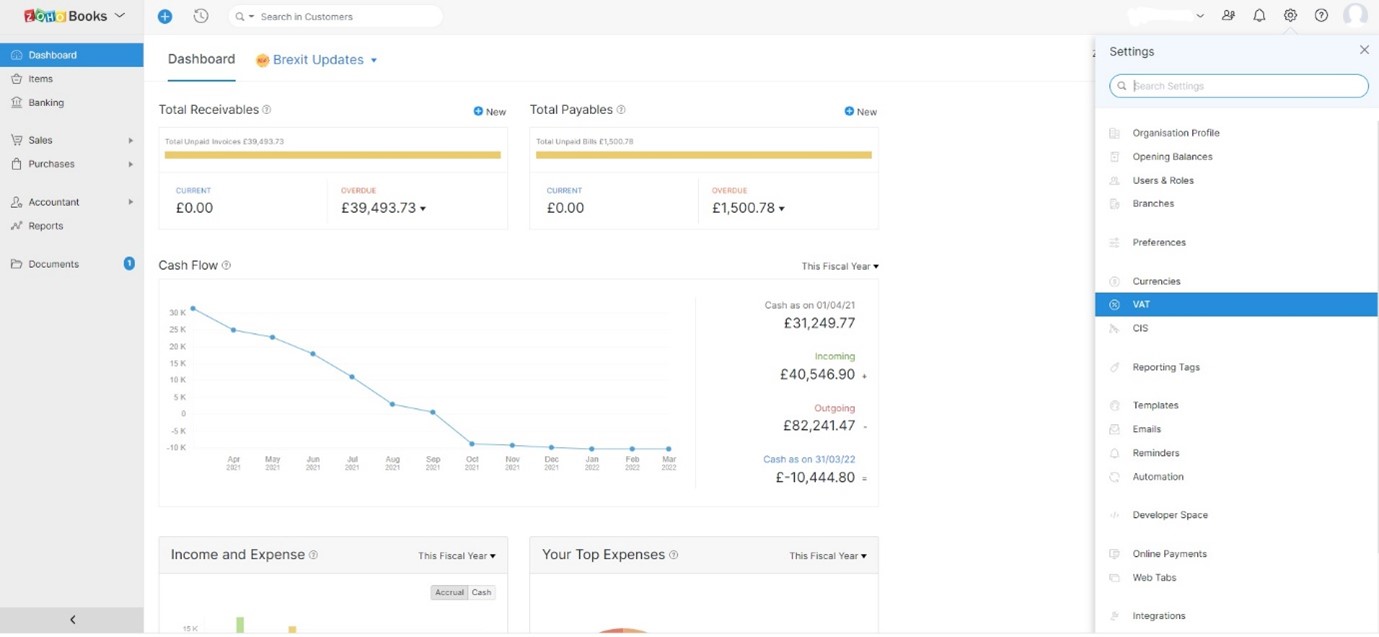

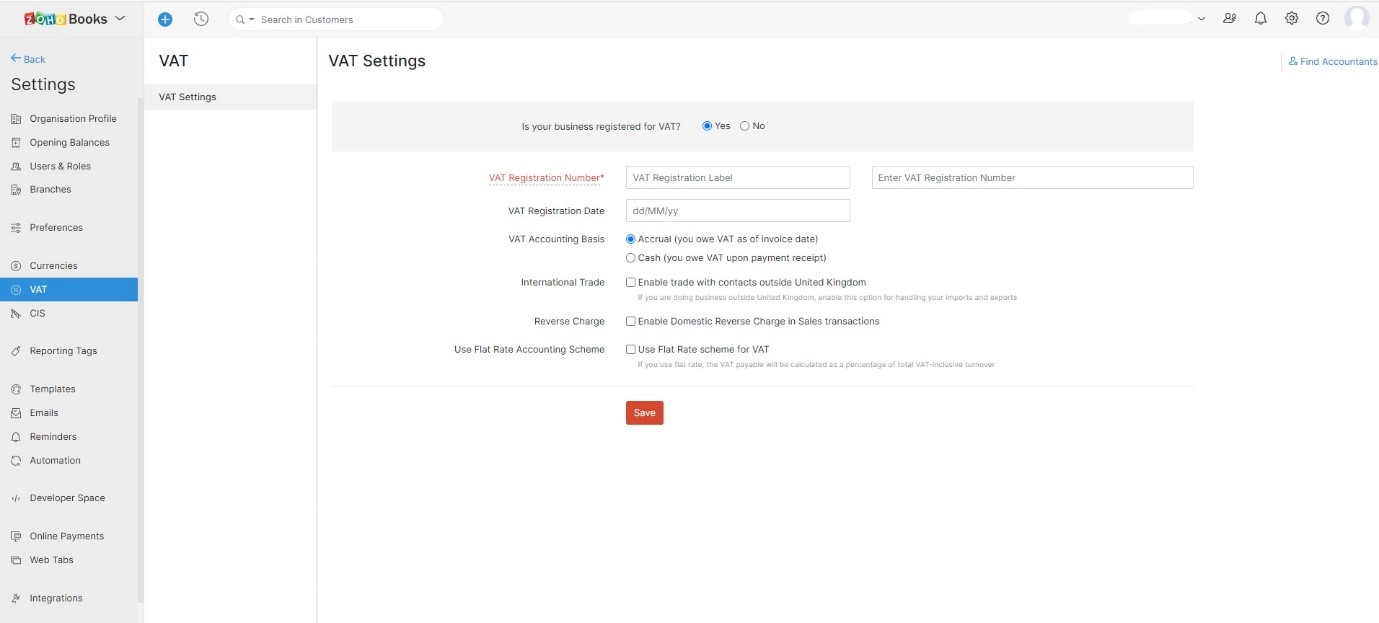

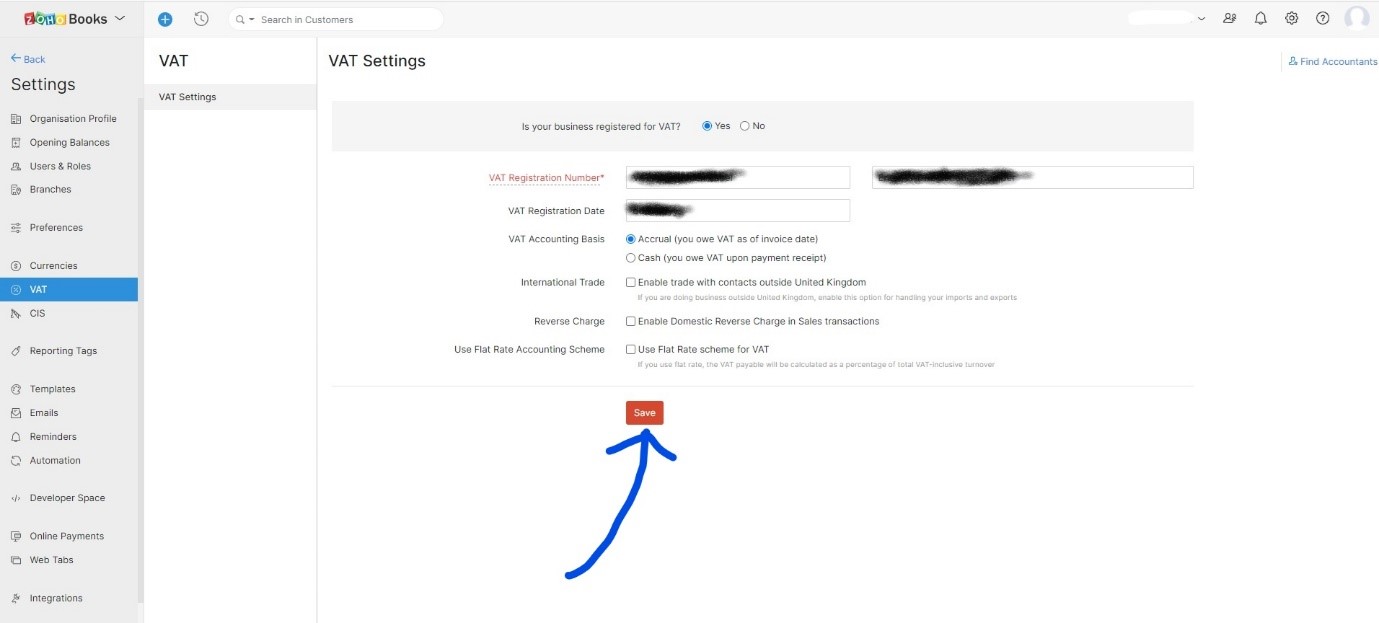

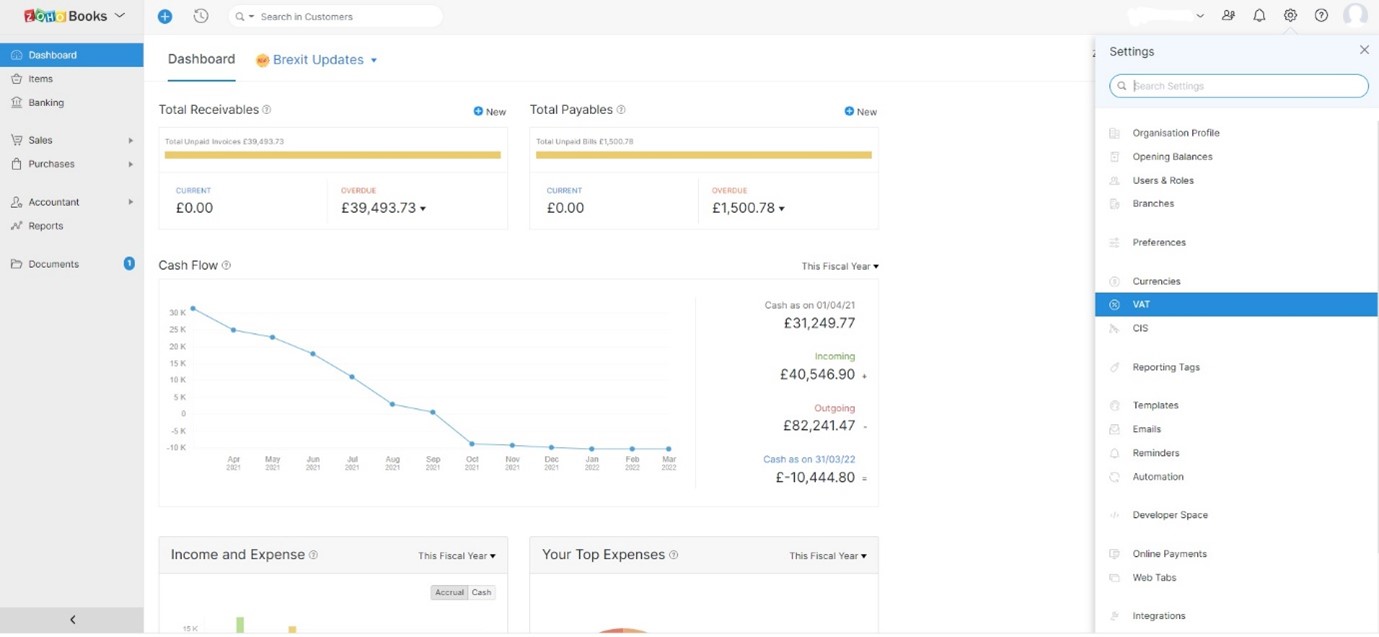

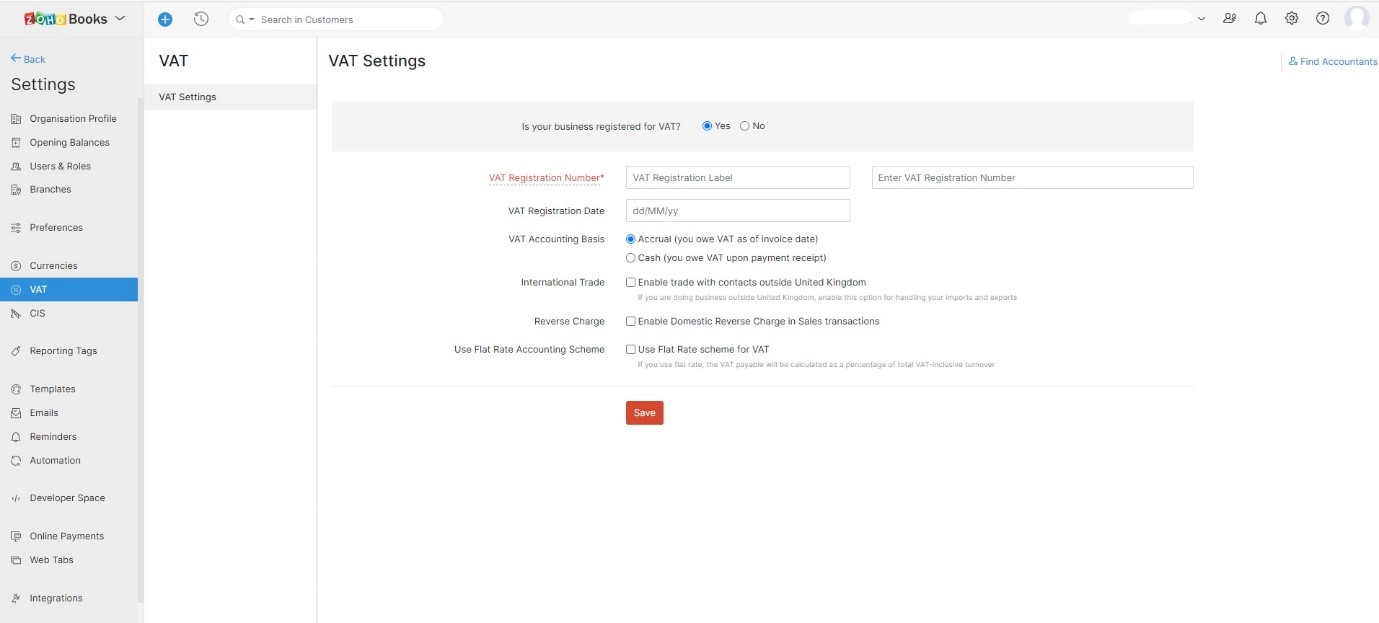

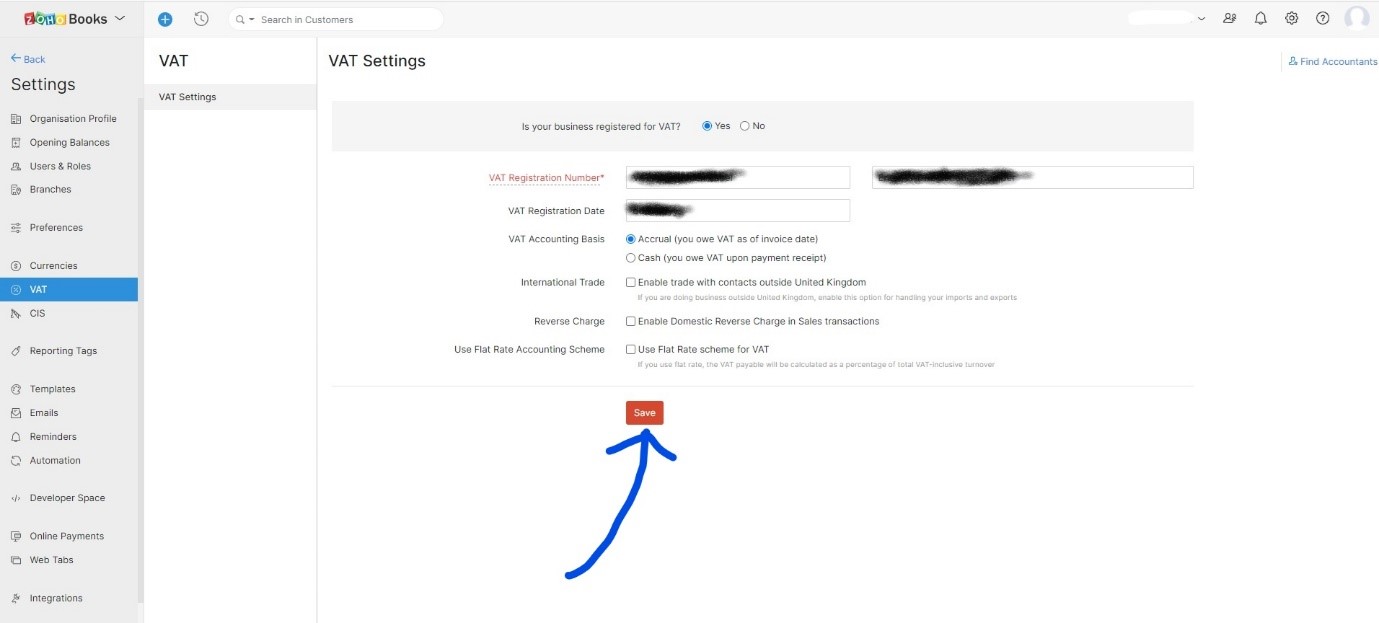

VAT-registered businesses can complete their VAT business details to Zoho Books by:

- Navigate to Settings and choose VAT.

- Click VAT Settings.

- Choose Yes for the ‘Is your business registered for VAT?’ option.

- Fill in your VAT Registration Number.

- Enter the other details and click Save.

Step 5: Importing Customers and Vendors

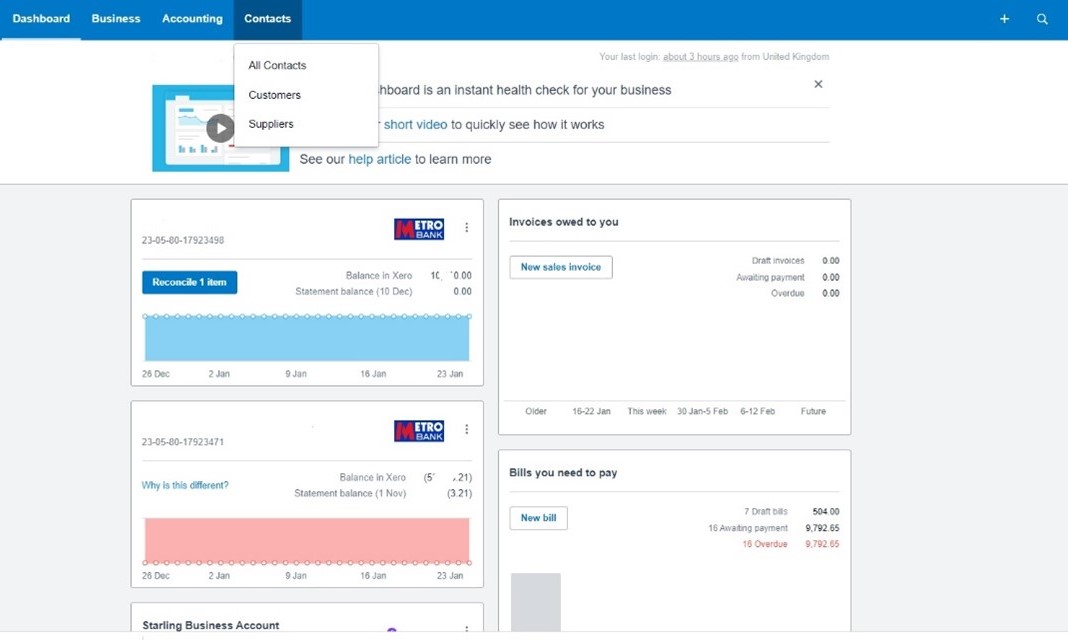

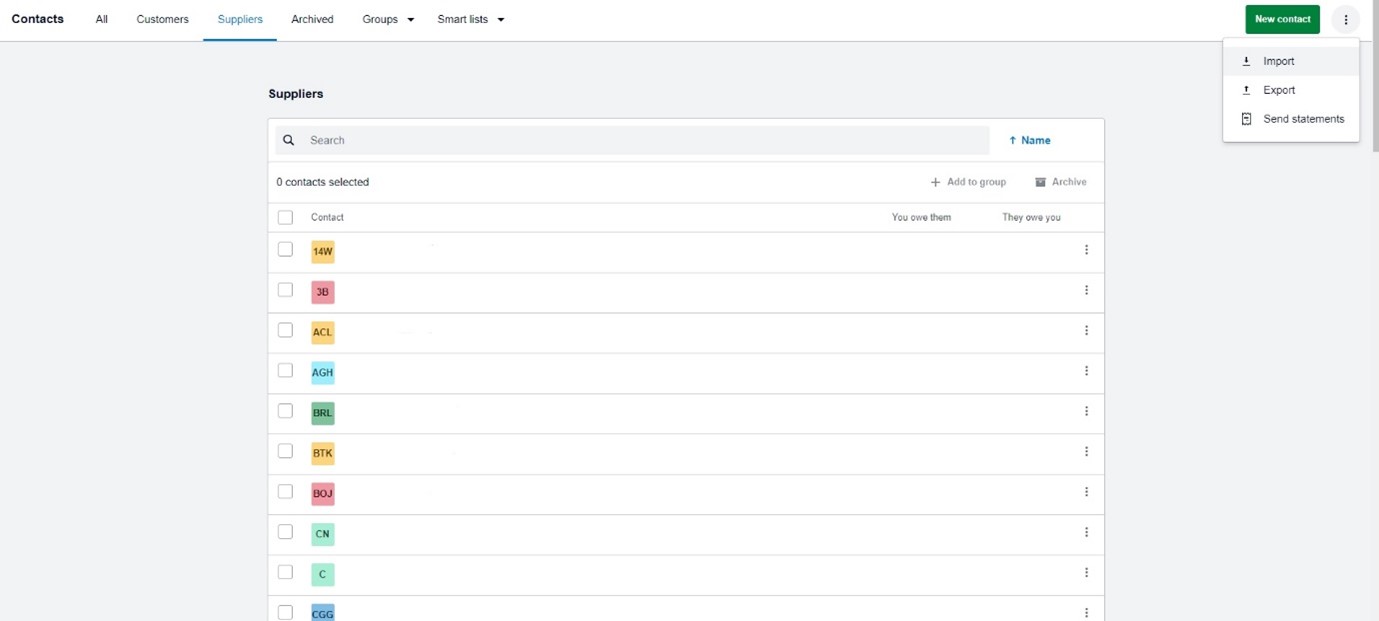

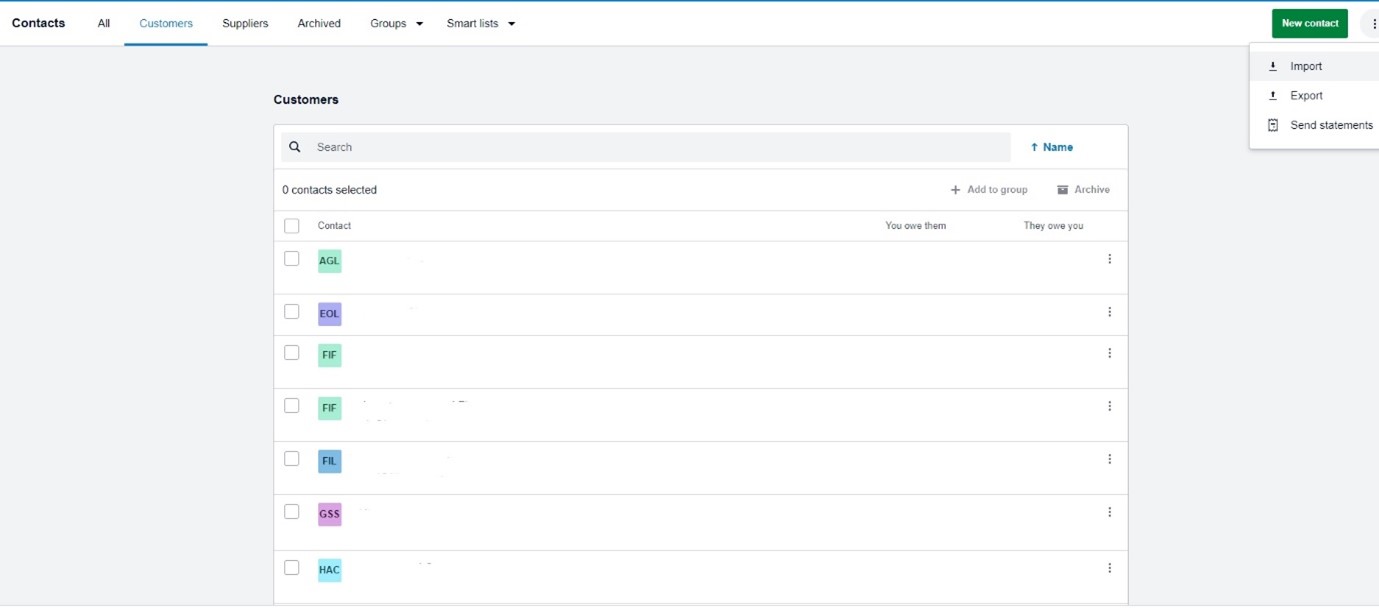

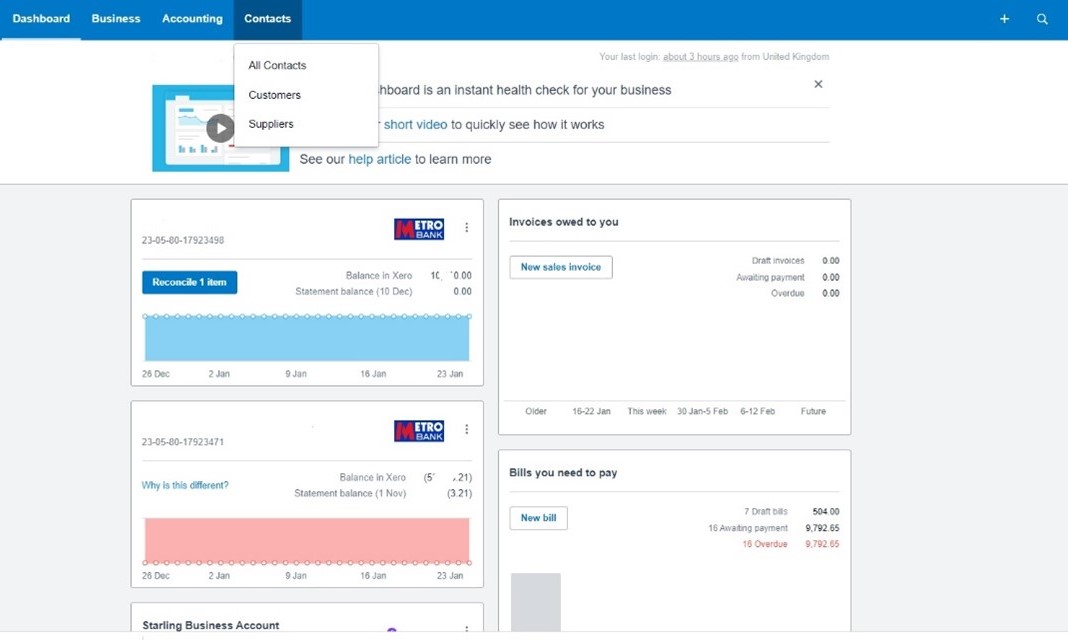

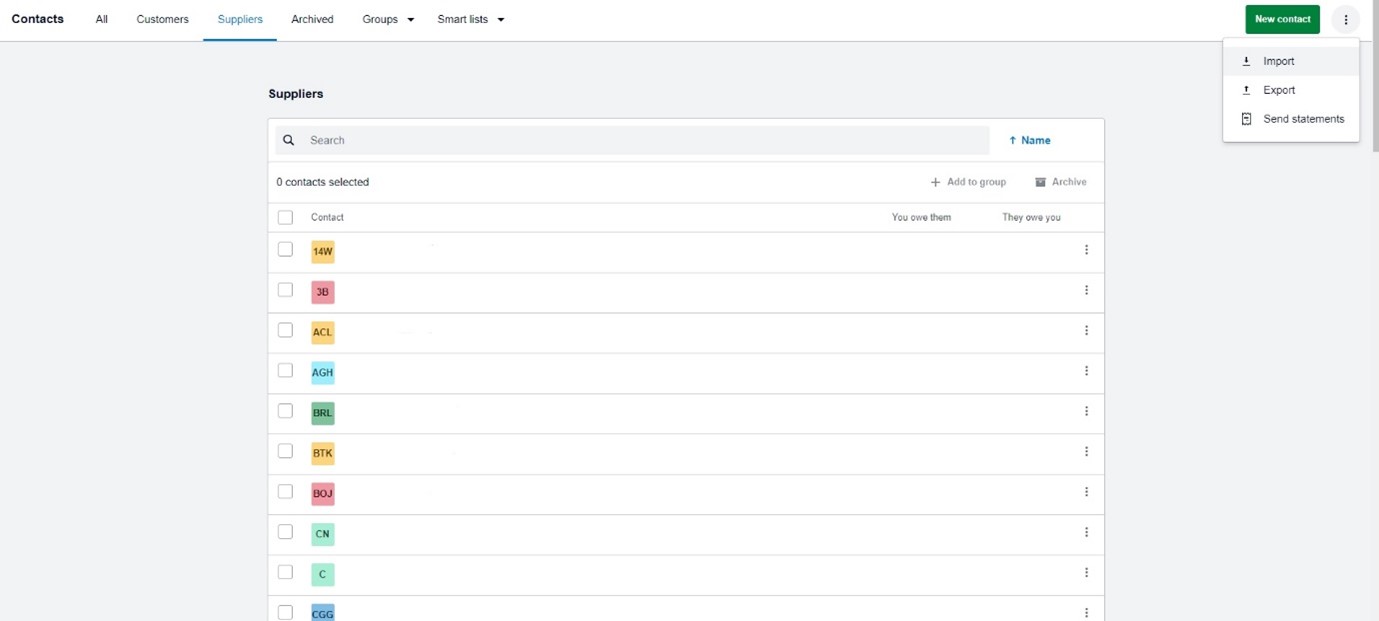

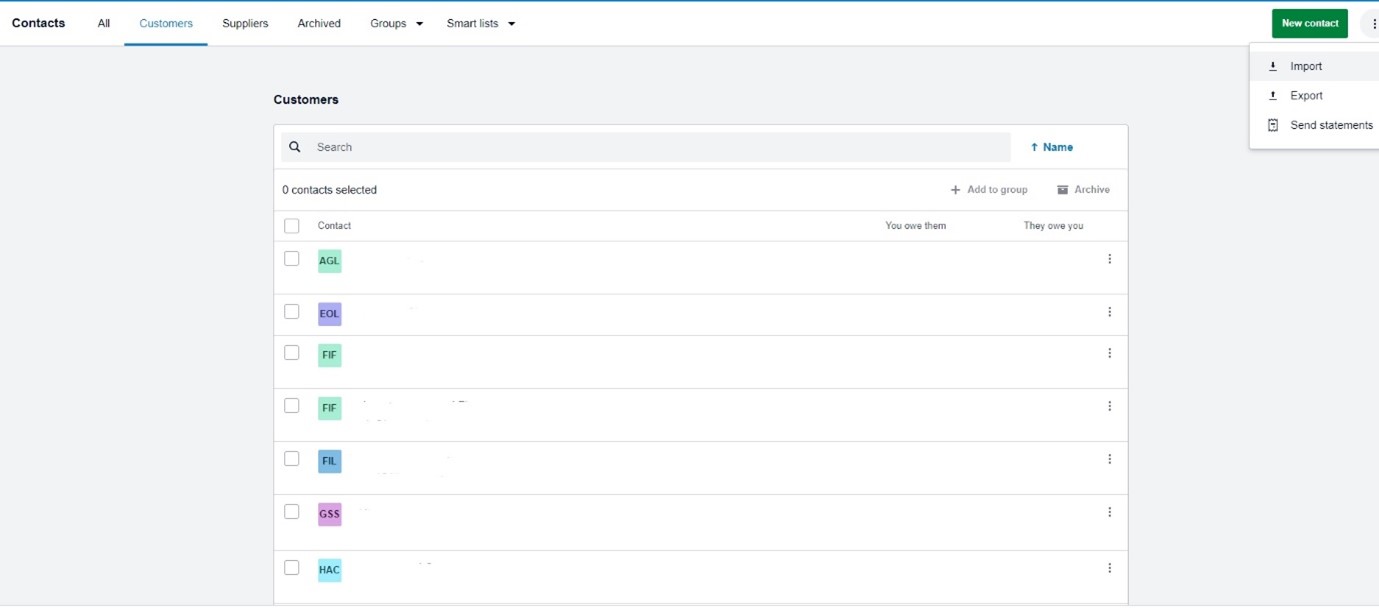

You can export contacts from Xero as:

- Suppliers: From the Contacts menu > Select suppliers > Click the menu icon Image of three dots in a vertical line > Select Export.

- Customers: From the Contacts menu > Select Customers > Click the menu icon Image of three dots in a vertical line > Select Export.

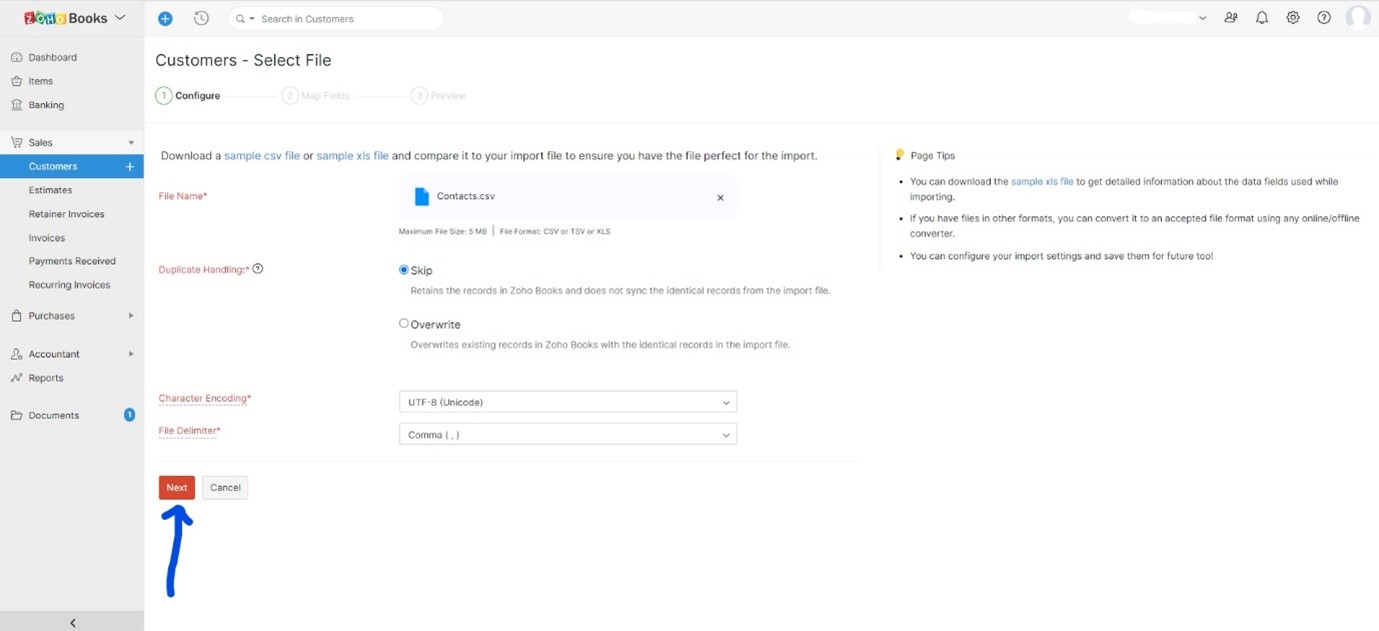

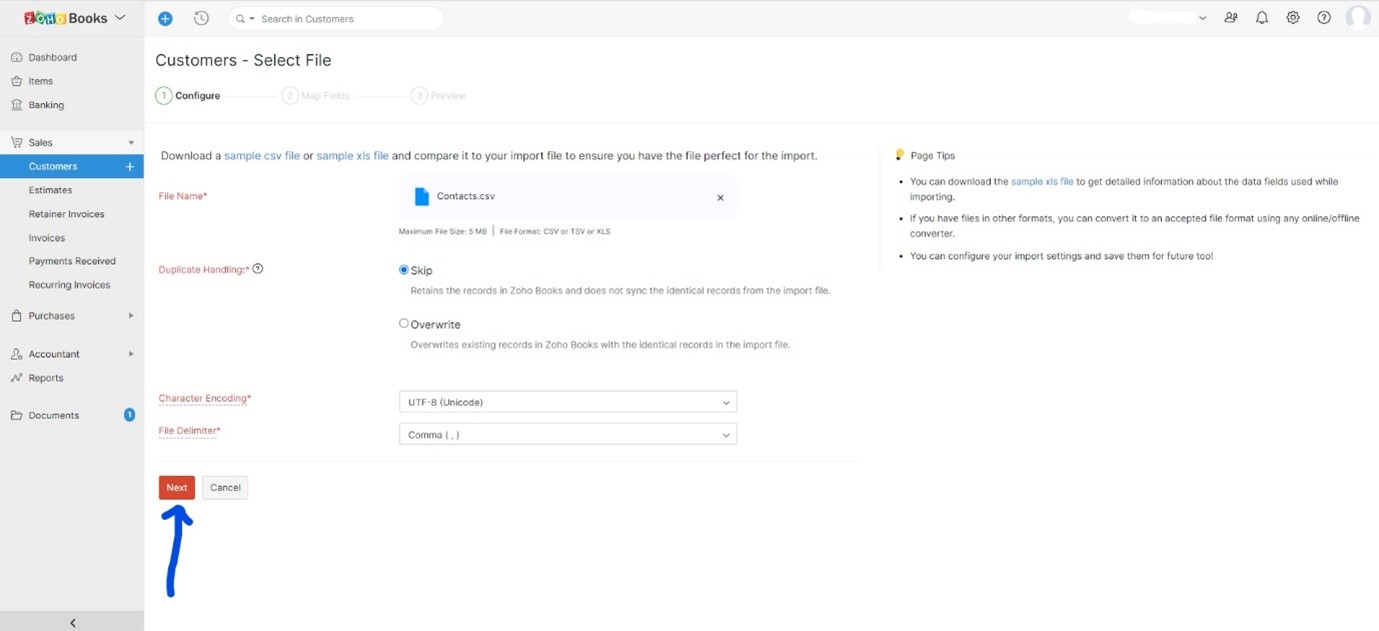

To import your customers to Zoho Book, follow these steps:

- Navigate to the Sales module. It is on the left sidebar.

- Choose Customers.

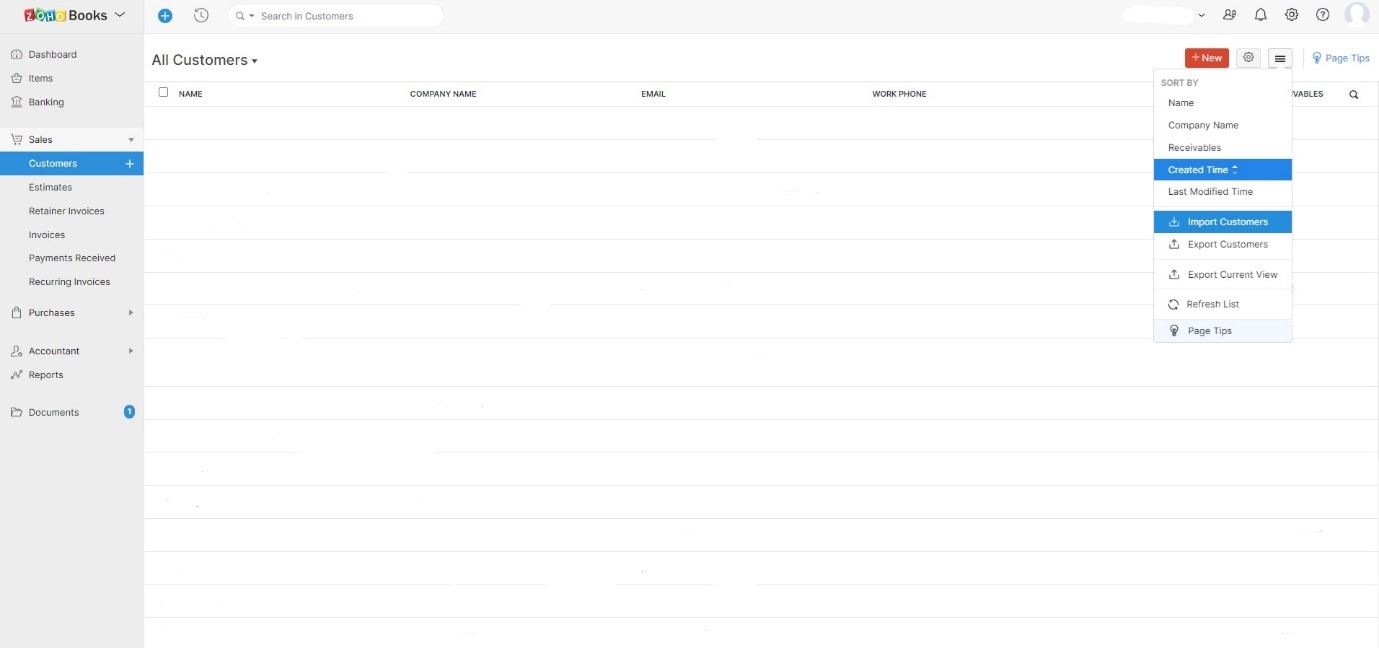

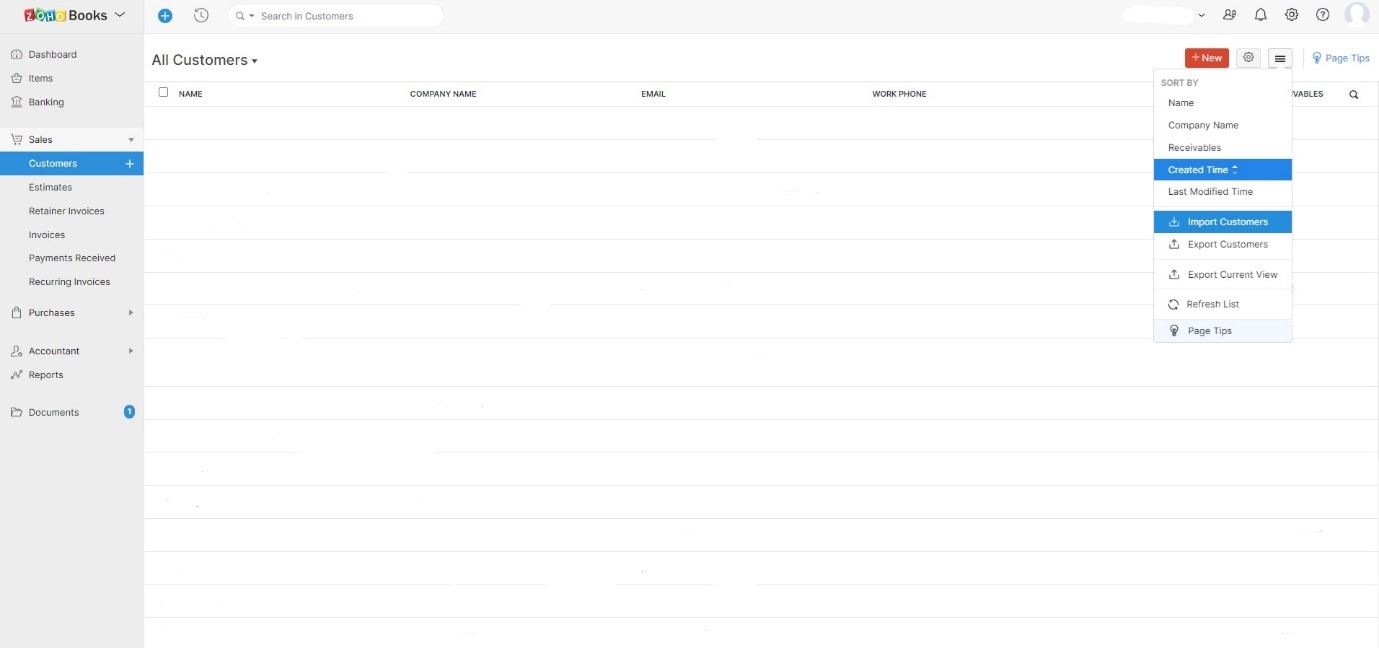

- Select the Hamburger icon on the top-right corner and choose Import Customers from the drop down menu.

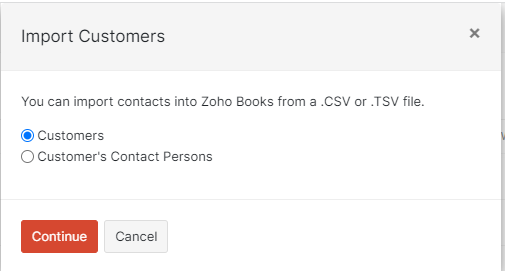

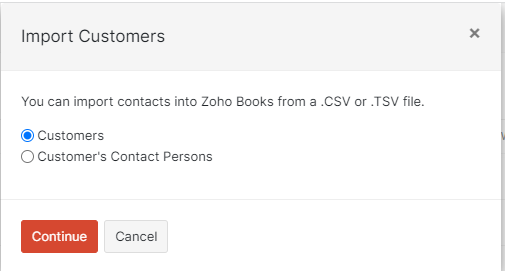

- In the pop-up window that appears, Choose Customers and click Continue.

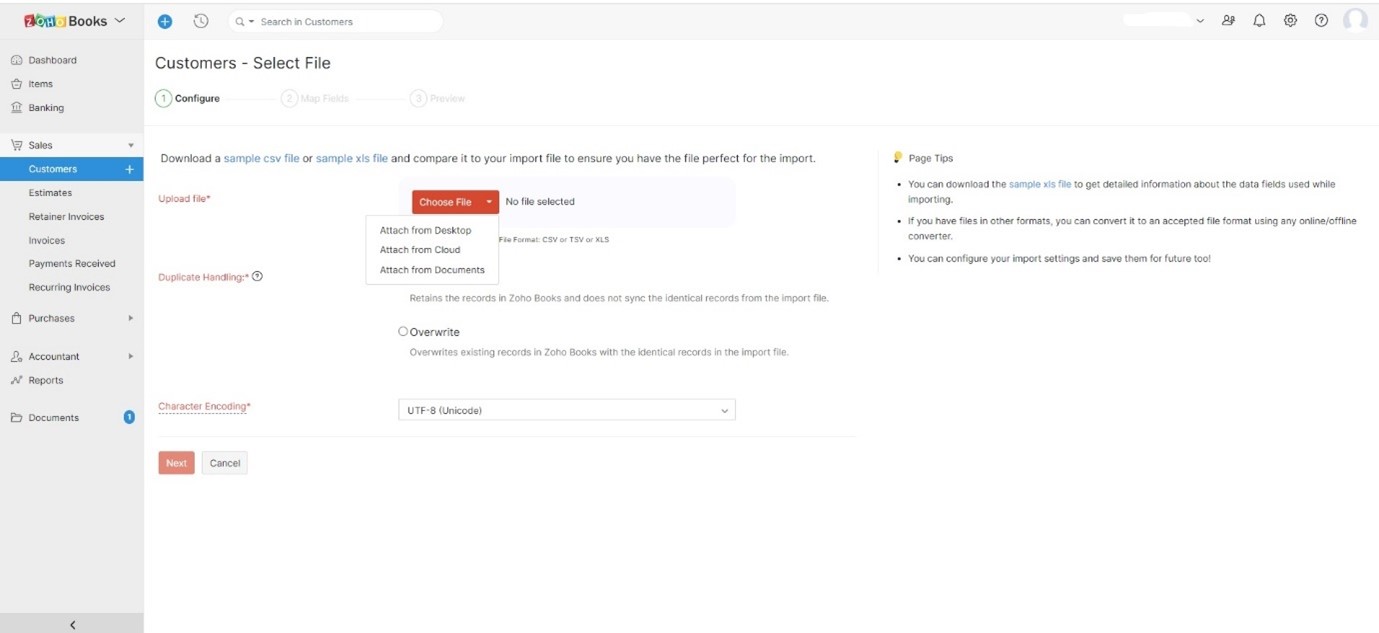

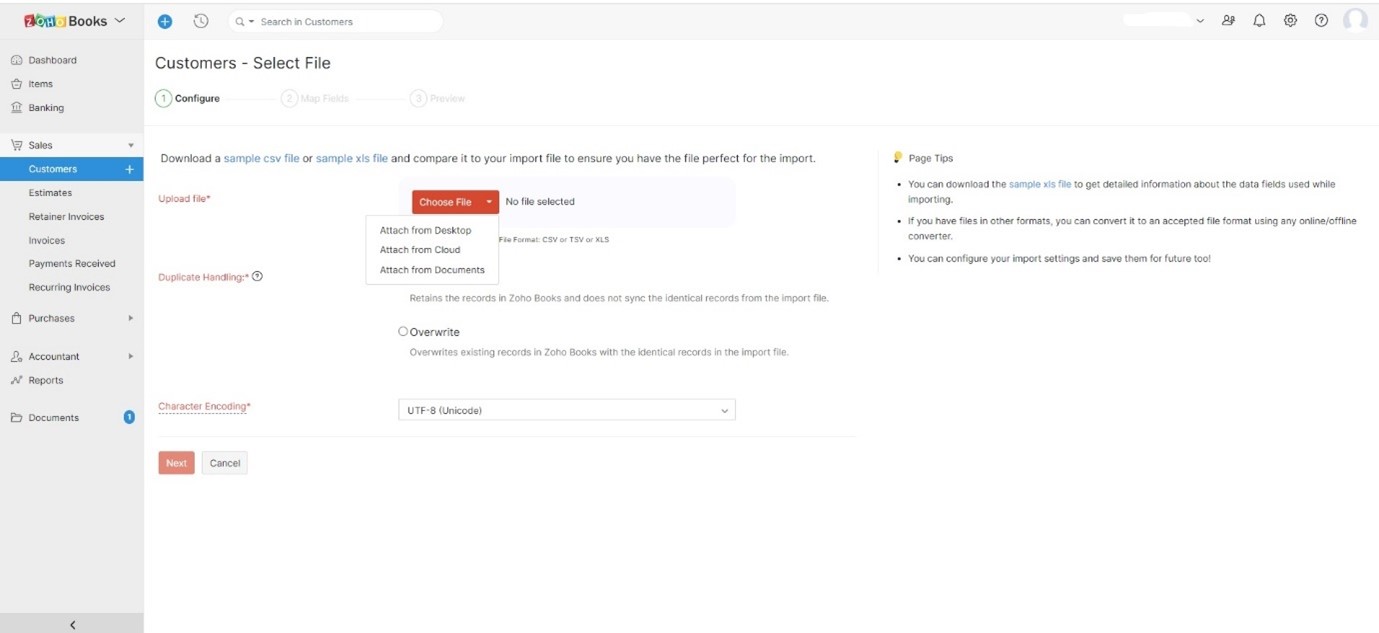

- To select the file to be imported, click on Choose File.

- Choose the correct Character Encoding and File Delimiter according to your import file - and click Next.

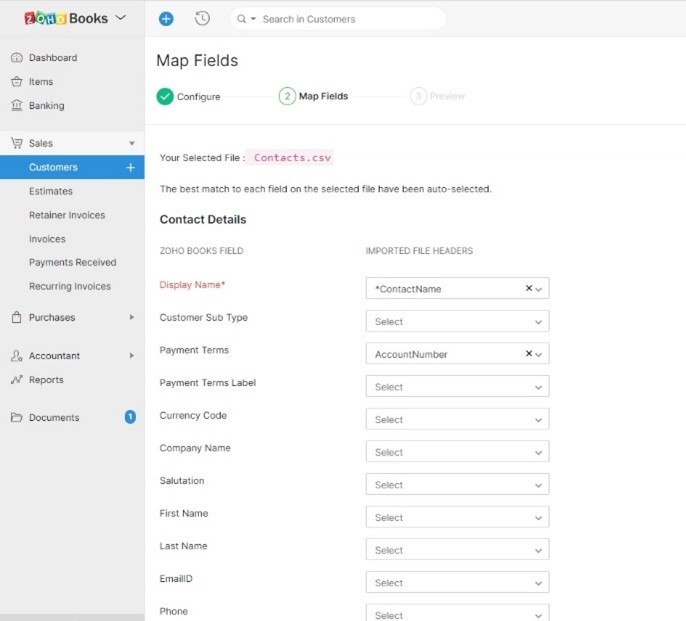

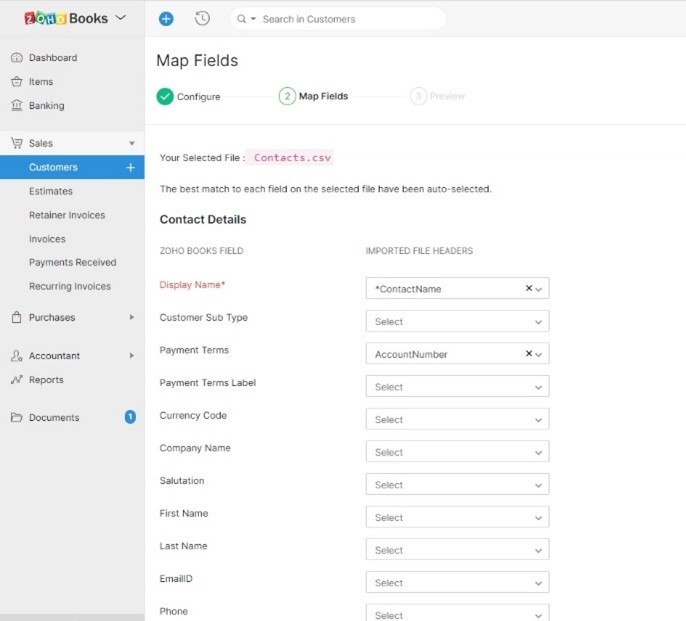

- Choose the headers in your import file to be mapped with their corresponding Zoho Books fields on the Map Fields page.

- Click Next - at the bottom of the screen.

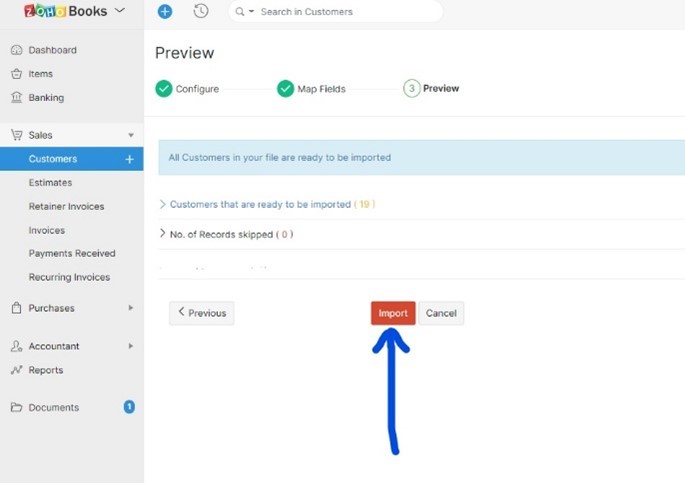

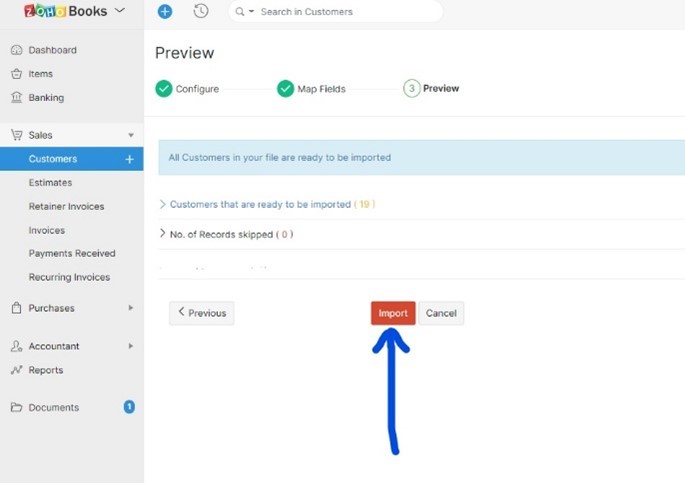

- The preview screen lets you check the summary of your data. You can then select Import.

The process of importing vendors is closely similar. You can import vendors by:

- Navigate to the Purchases module from the left sidebar and click Vendors.

- Click the Hamburger icon on the top-right corner of the page.

- Choose Import Vendors from the drop-down menu that appears.

- Afterwards, follow the steps of importing the file for customers as described above – they are the same.

Step 6: How to Import Items to Zoho Books

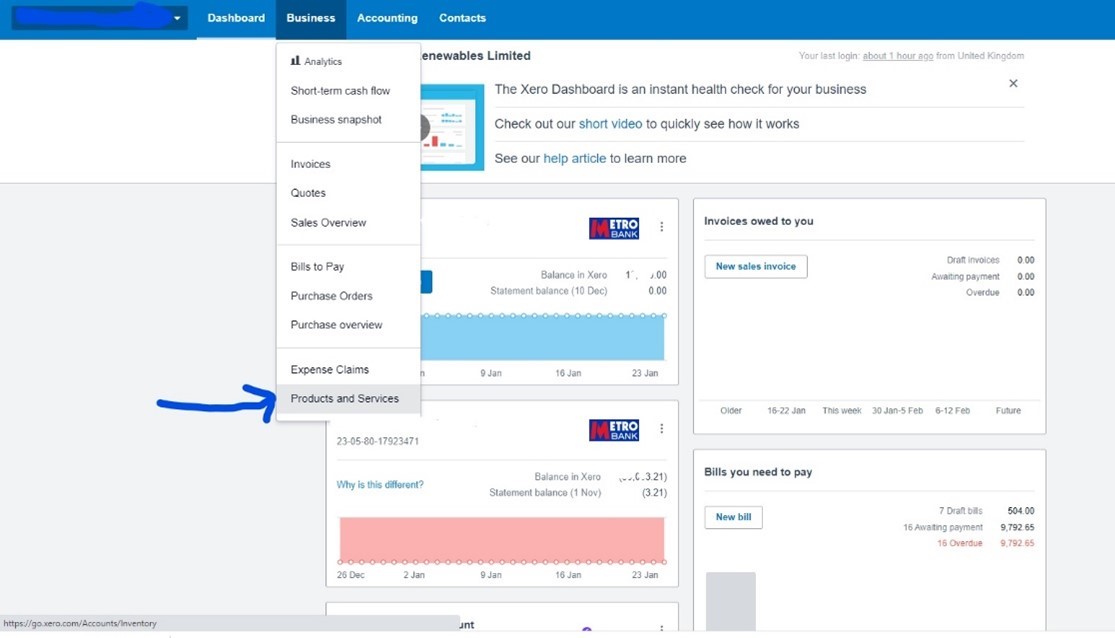

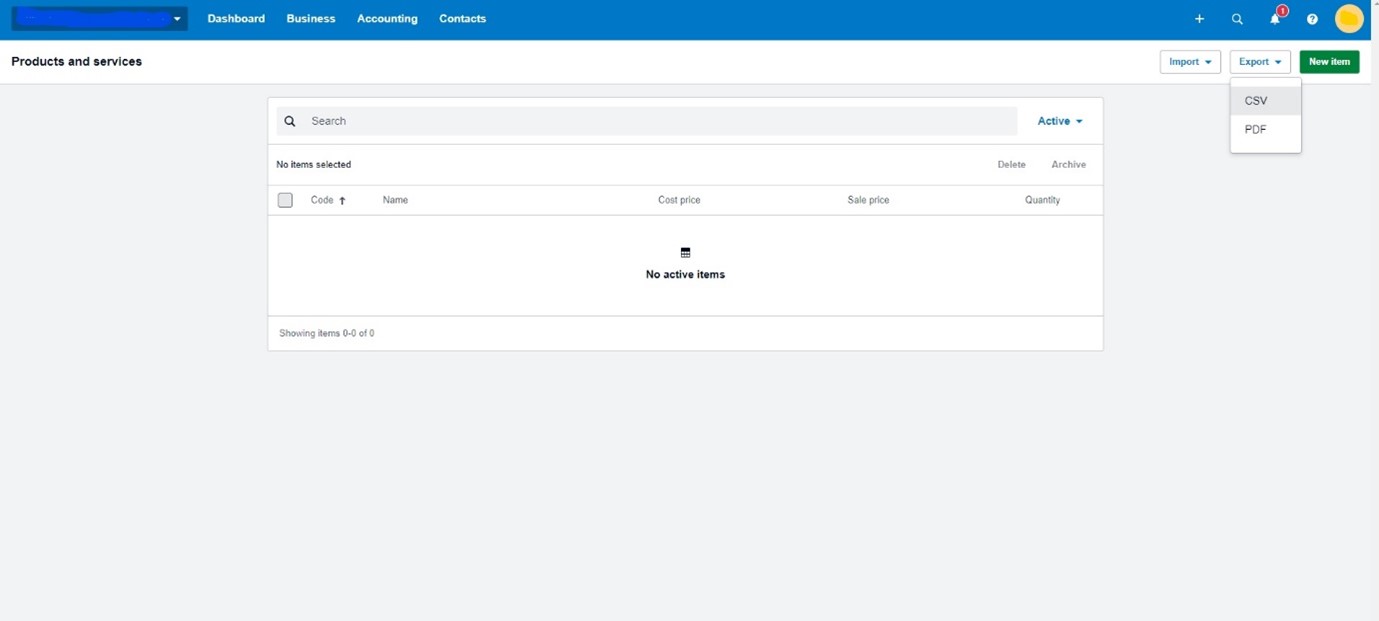

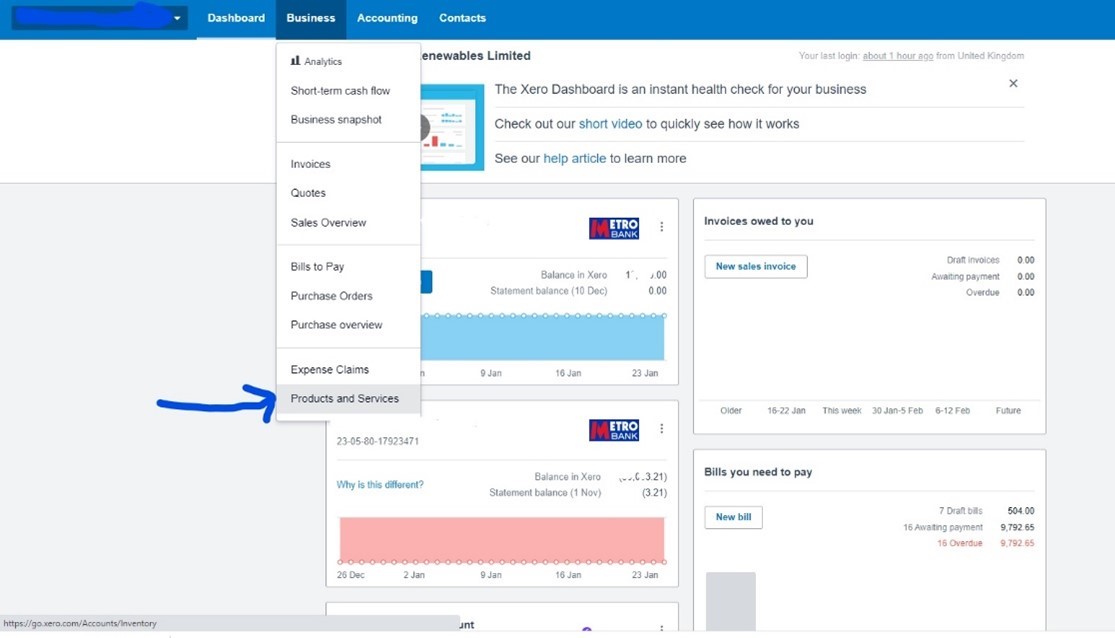

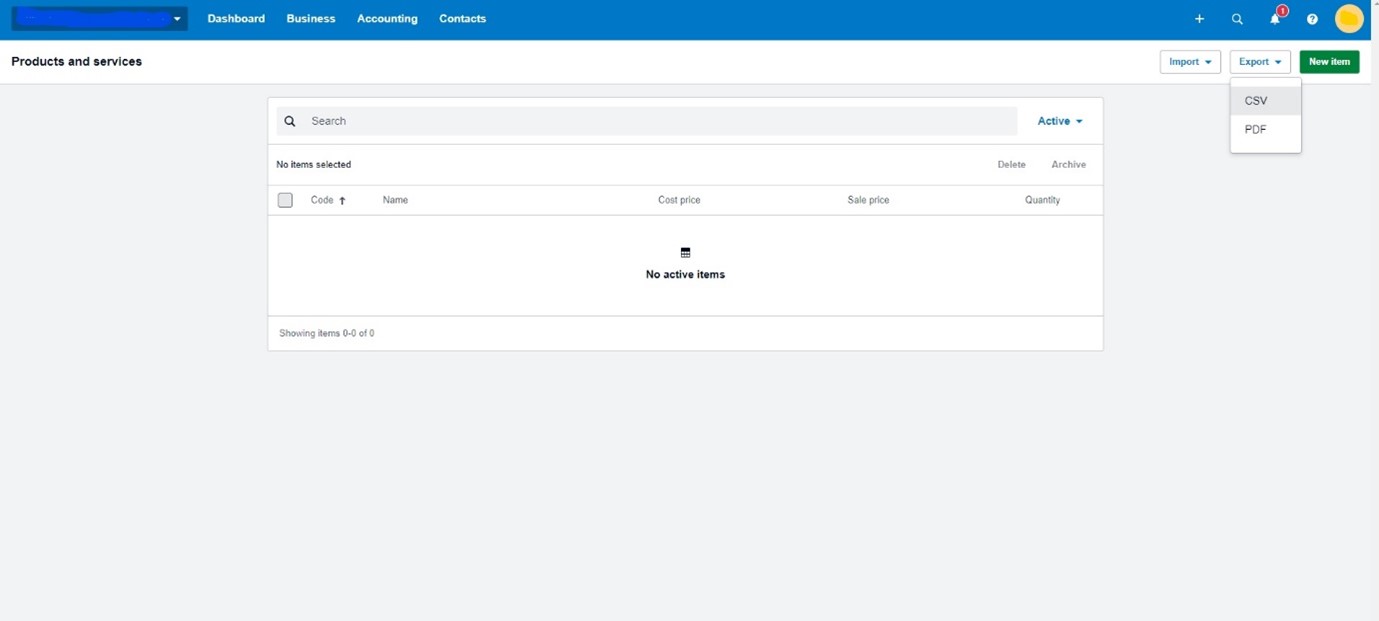

In Zoho Books, Items are considered as the goods and services associated with your business. To export your inventory items from Xero: From the Business menu > Select Products and services > Click Export > Select CSV.

You must enable Inventory before importing your items into Zoho Books - if you want to track your inventory. You can enable Inventory by: Go to Settings > Preferences > Items > Mark the Enable Inventory Tracking option > Select the Inventory Start Date (Must be the same as your Opening Balance Date) > Click Save.

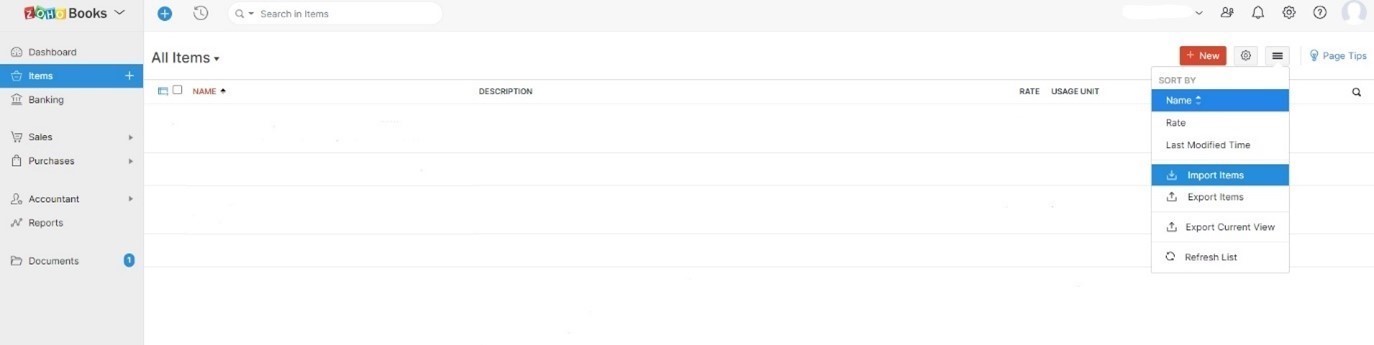

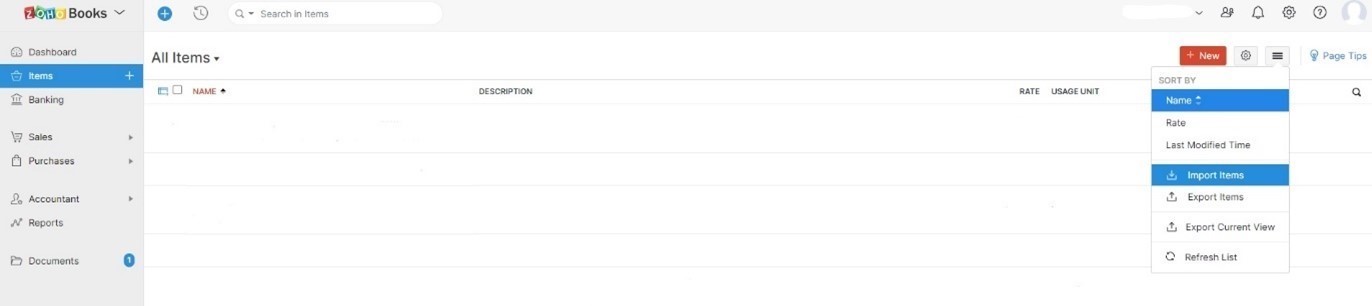

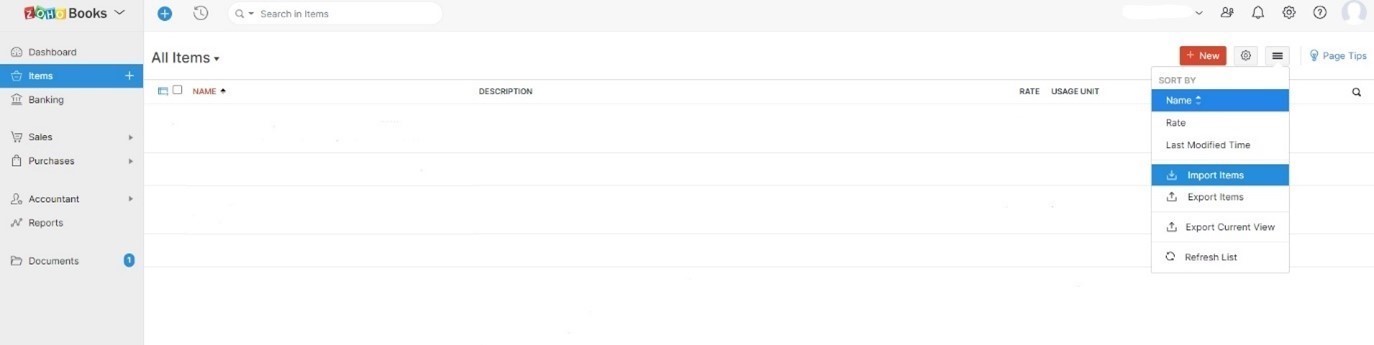

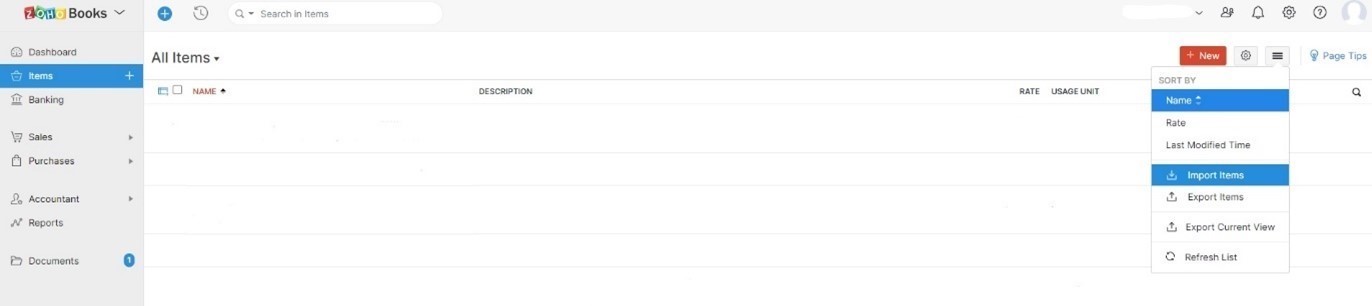

Follow the following steps to import items into Zoho Books:

- Select the Items module in Zoho Books – it is on the left sidebar – and choose Items.

- Click the Hamburger icon in the top-right corner and select Import Items from the drop-down menu that appears.

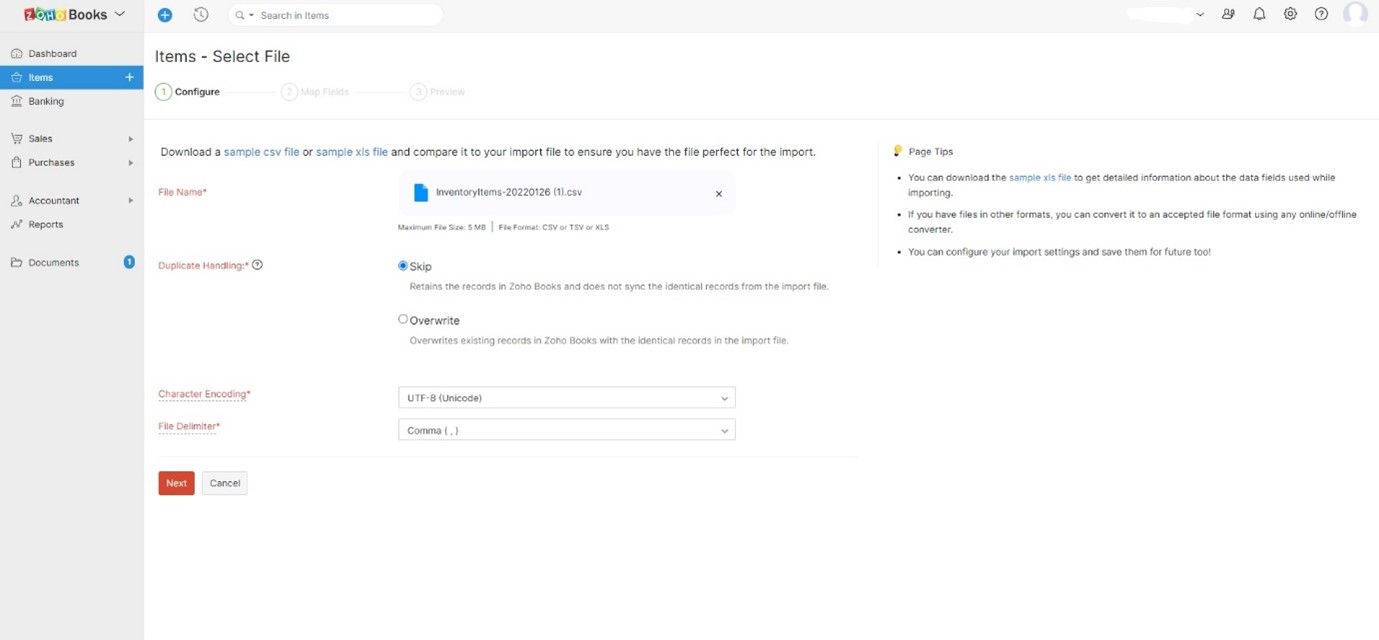

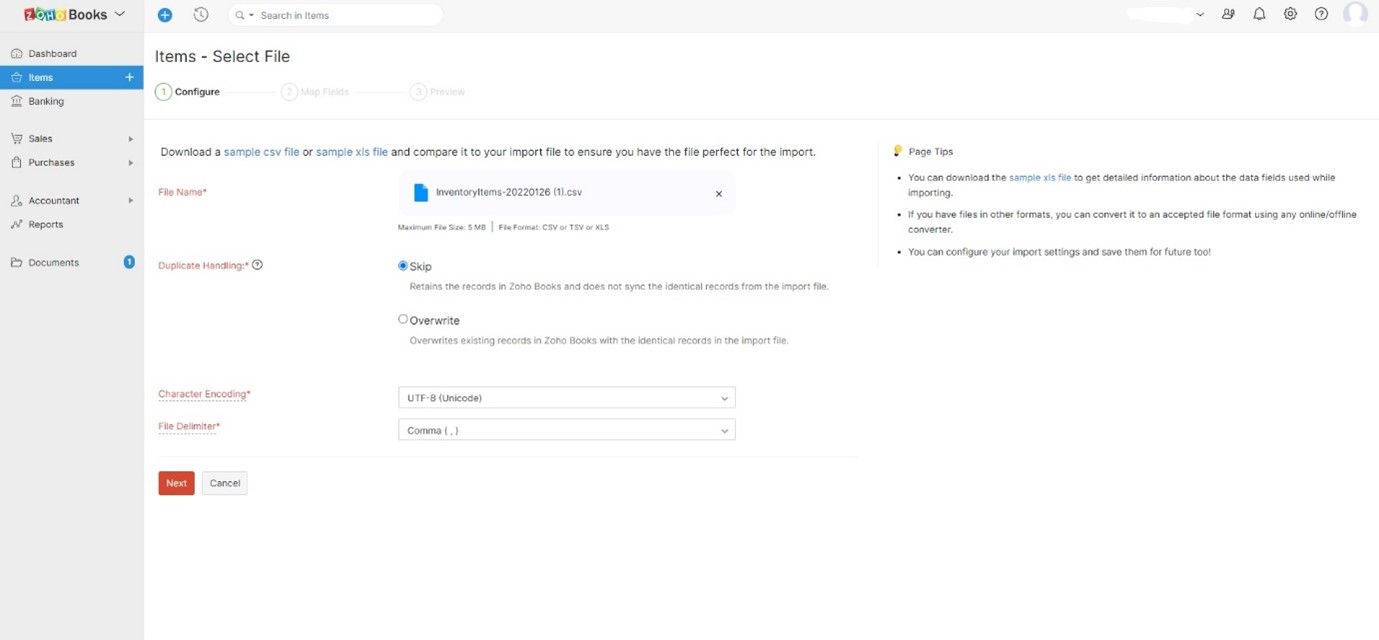

- Select the file to be imported after clicking Choose File.

- Choose the correct Character Encoding and File Delimiter according to your import file – and click Next.

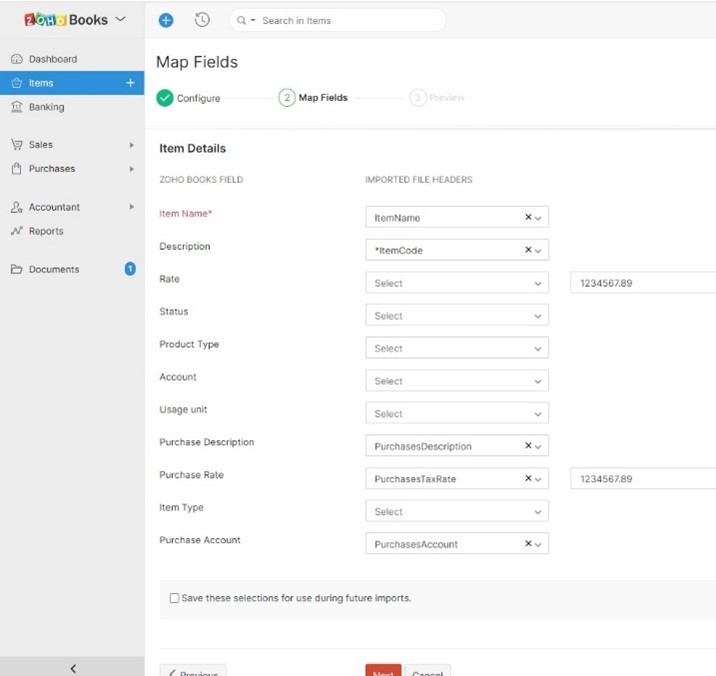

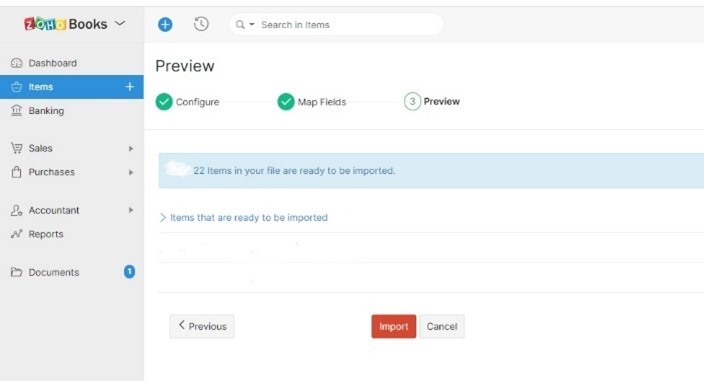

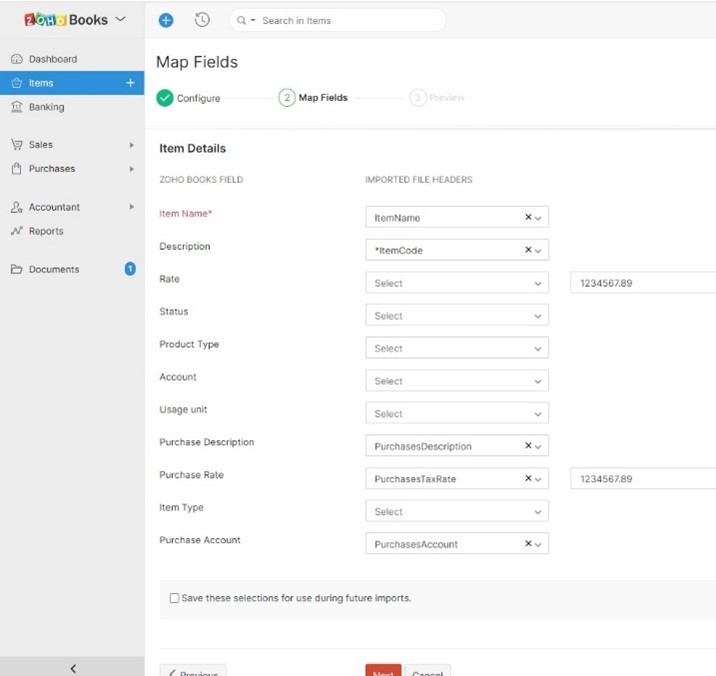

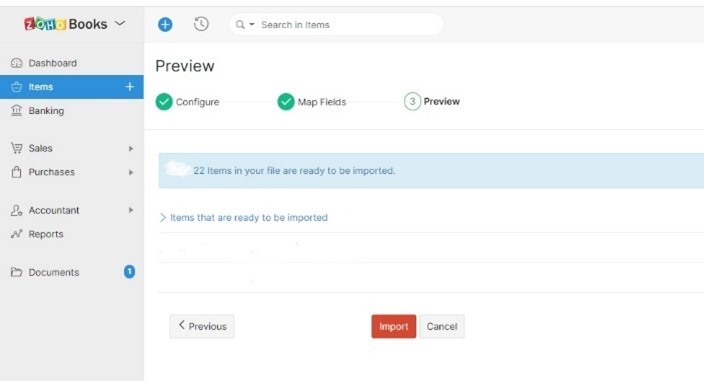

- Choose the headers in your import file that need to be mapped with their corresponding Zoho Books fields on the Map Fields page - and Click Next.

- You can view the summary of your data in the Preview screen and click Import.

If you had inventory adjustments in Xero, you could also import them into Zoho Books by:

- Enable inventory tracking.

- Select the Items module from the left sidebar.

- Click Inventory Adjustments.

- Click the Gear icon in the top-right corner.

- Decide if you want to Import Quantity Adjustments or Import Value Adjustments.

- Continue with the steps of importing inventory files – as stipulated above.

Step 7: Adding Bank or Credit Card Accounts

Adding your bank and credit account details to Zoho Books helps to accurately account for the payments made through them. If you include your bank and credit card details when importing your chart of accounts - they will be available in the Zoho Books Banking module. If not, you can add them manually by:

- Navigate to the Banking module – it is located on the left sidebar.

- Select the Add Bank or Credit Card button – it is in the top-right corner.

- Manually enter the bank account or credit card details OR connect a bank account that supports automatic feeds.

Step 8: How to enter Opening Balances

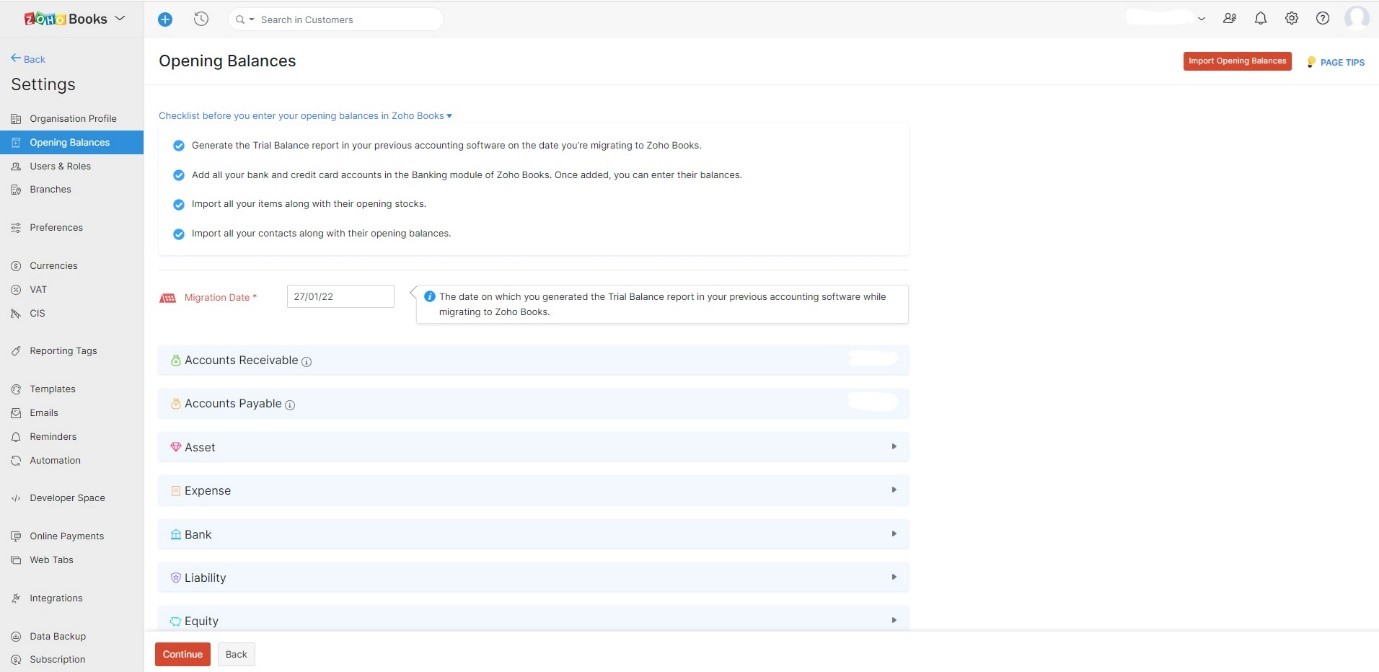

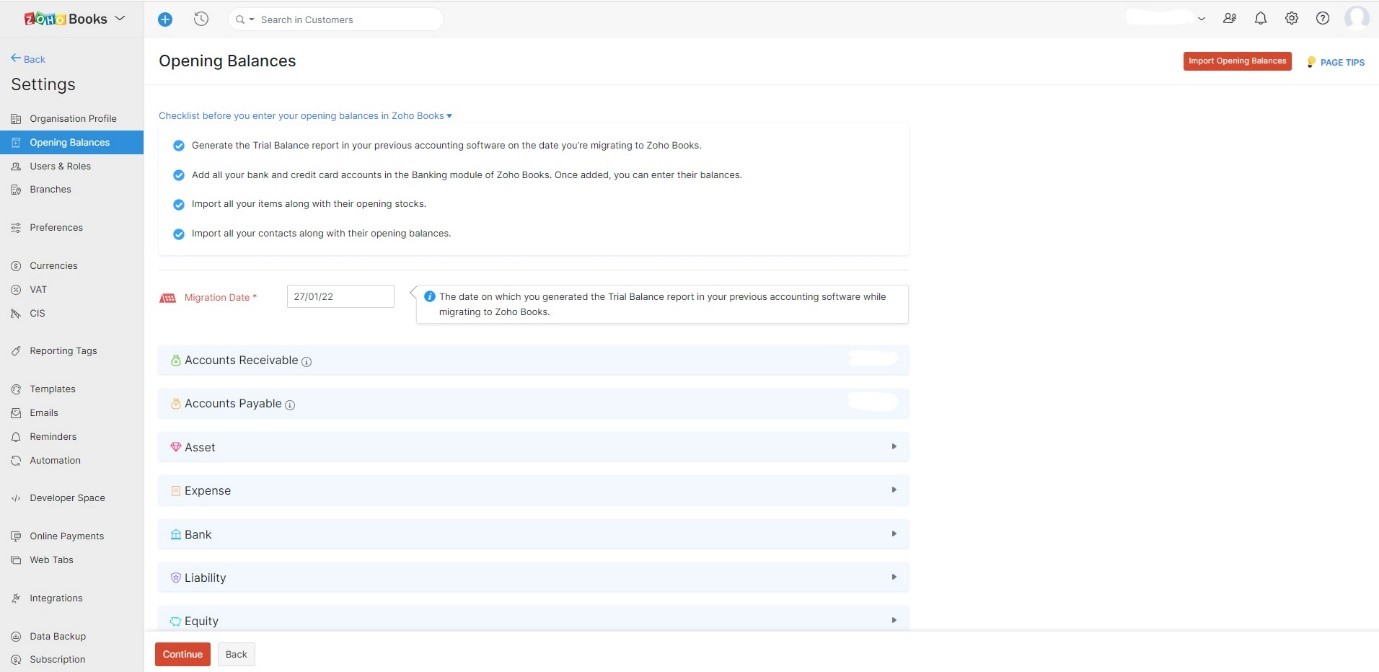

In relation to migration, your opening balance is the amount you have in different accounts of your business when switching from Xero. You must ensure that all your accounts and their balances are brought into Zoho Books when migrating.

When switching to Zoho Books from Xero:

- At the end of the financial year - the closing balances of the previous year should be entered as your opening balances for the current year.

- At any other time of the financial year - generate a Trial Balance on the date of migration to identify all the debit and credit balances of your accounts.

To enter the opening balances in Zoho Books, you must have imported - Chart of Accounts, Customers and Vendors and Items with their Opening Stock.

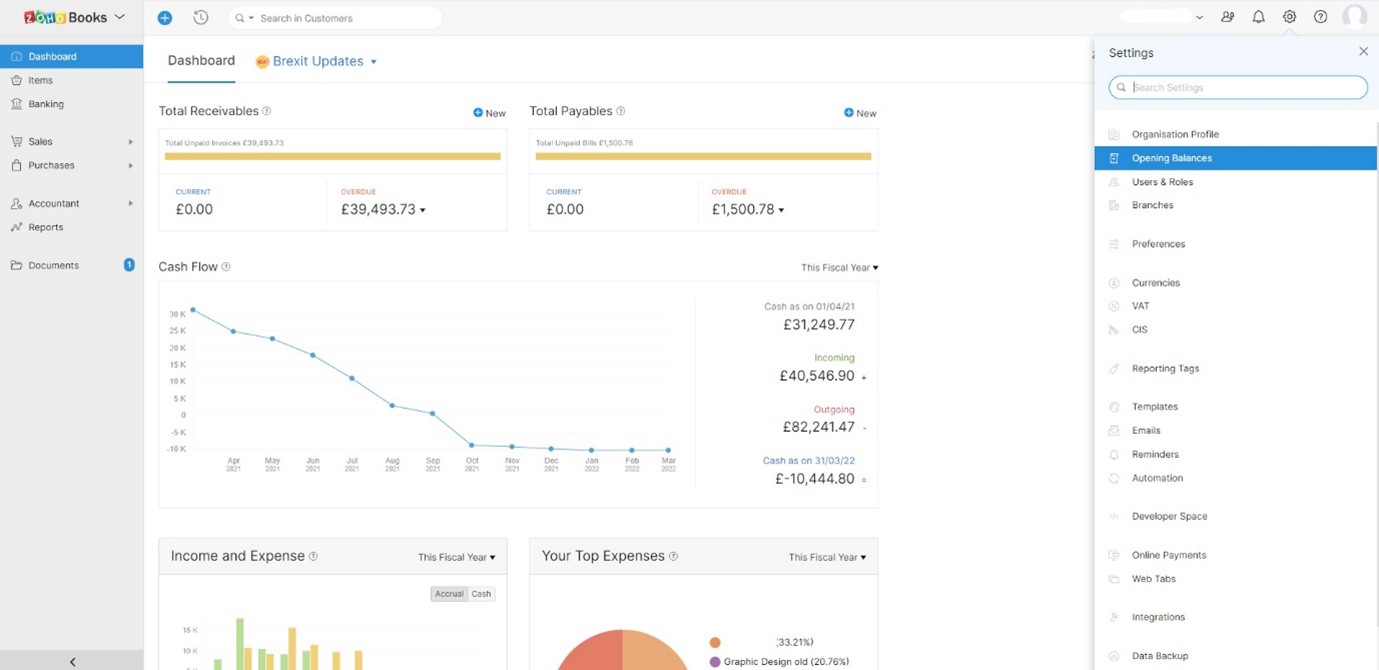

Afterwards, follow the following steps to enter Opening Balances in Zoho Books:

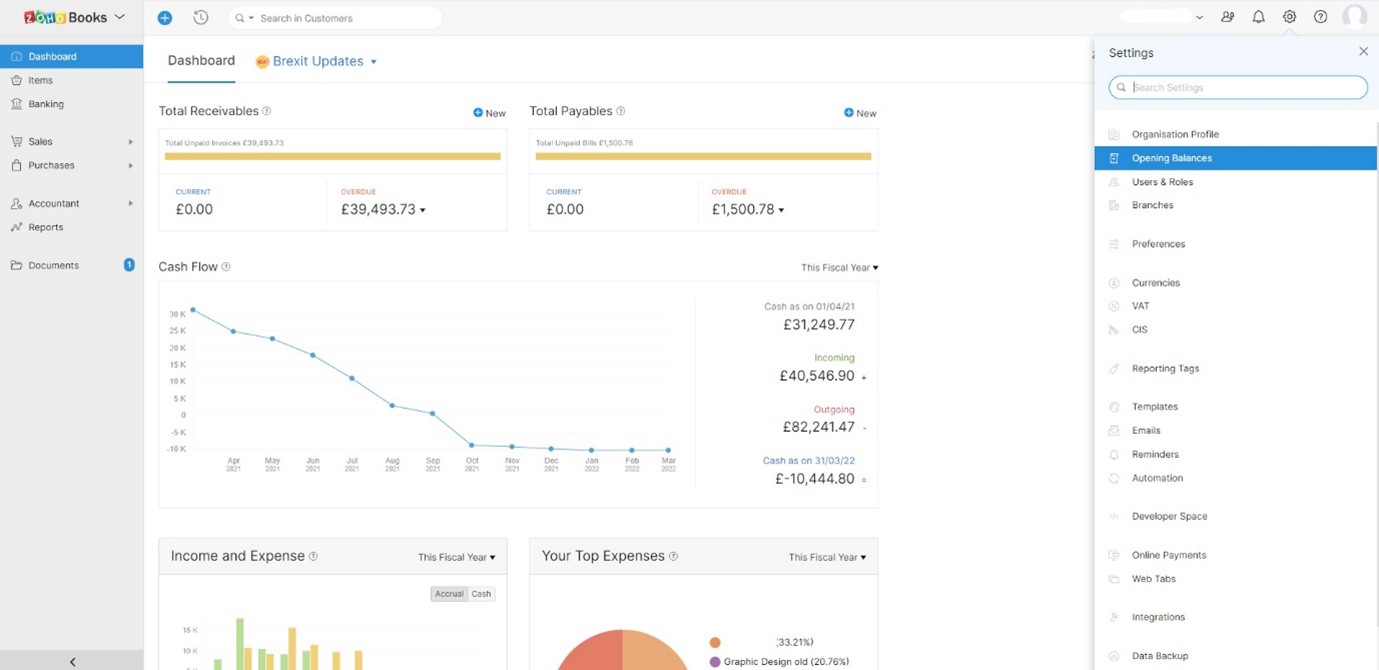

- Navigate to Settings and select Opening Balances.

- Put down the Migration Date – follow the process mentioned above.

- Fill in the balances for your customers in Accounts Receivable and vendors in the Accounts Payable sections.

- If you have balances in other currencies - Click + Enter balance in a foreign currency button.

- Fill out the balances for your different Bank accounts.

- Enter Debit and Credit balances for the other categories like Asset, Expense, and Liability by clicking on each of them.

- Upon entering all the balances - Click Continue.

- Confirm all the balances in the next screen and click Confirm.

It is worth bearing in mind that you can edit the opening balances at any time by clicking the Edit option in Settings and selecting Opening Balances.

Step 9: How to Import Transactions

Import all your required transactions into Zoho Books sequentially as – Projects, Purchase Transactions, Sales Transactions and then Journals.

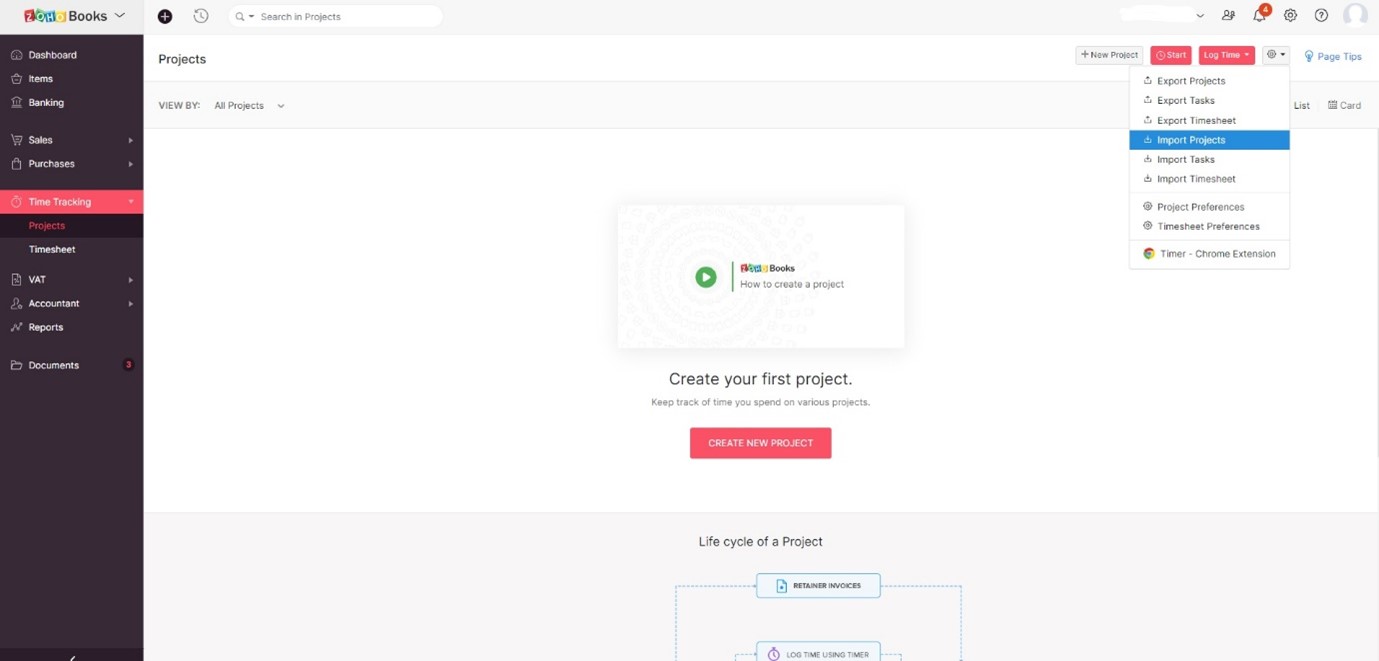

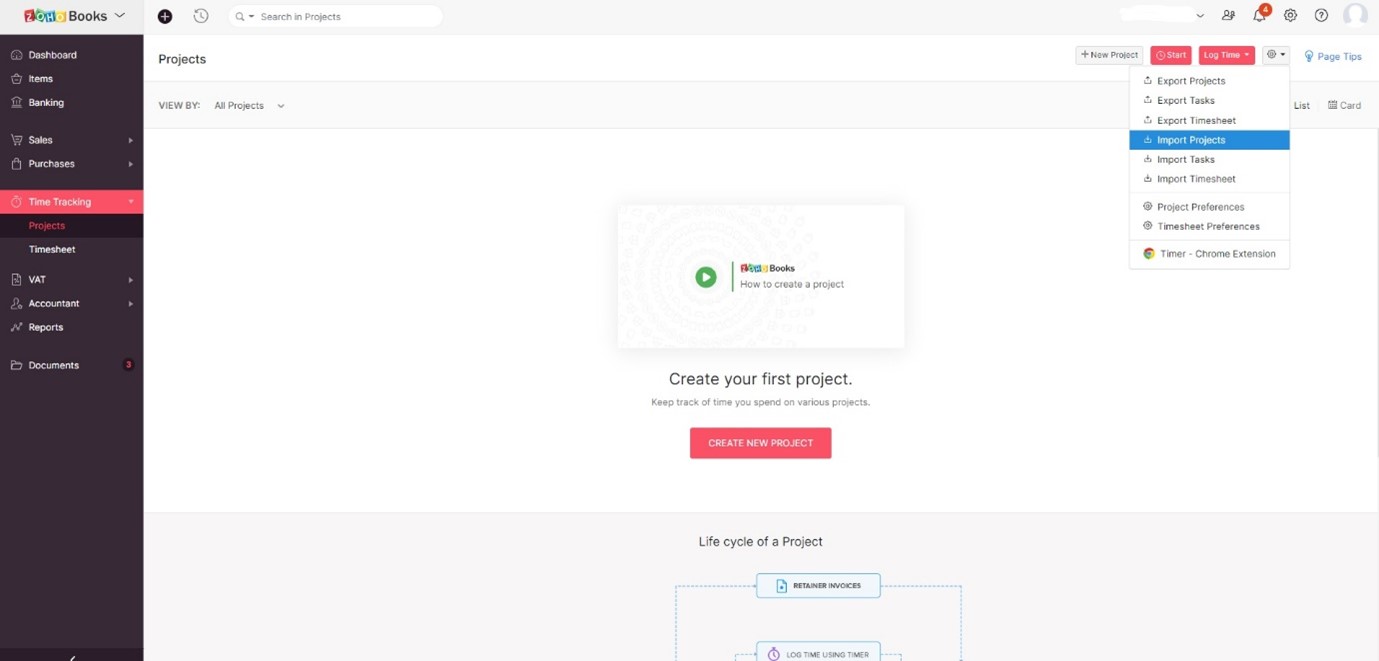

How to import Projects

To import your projects into Zoho Books:

- Select the Time Tracking module and click on Projects.

- Click the Gear icon located in the top-right corner and select Import Projects from the drop-down menu.

- Click Choose File to select the file to be imported.

- Choose the correct Character Encoding and File Delimiter according to your import file and click Next.

- Choose the headers in your import file to be mapped with their corresponding Zoho Books fields In the Map Fields page - and then click Next.

- View the summary of your data in the Preview screen and click Import.

NOTE: You can also import project tasks and timesheets in the same manner.

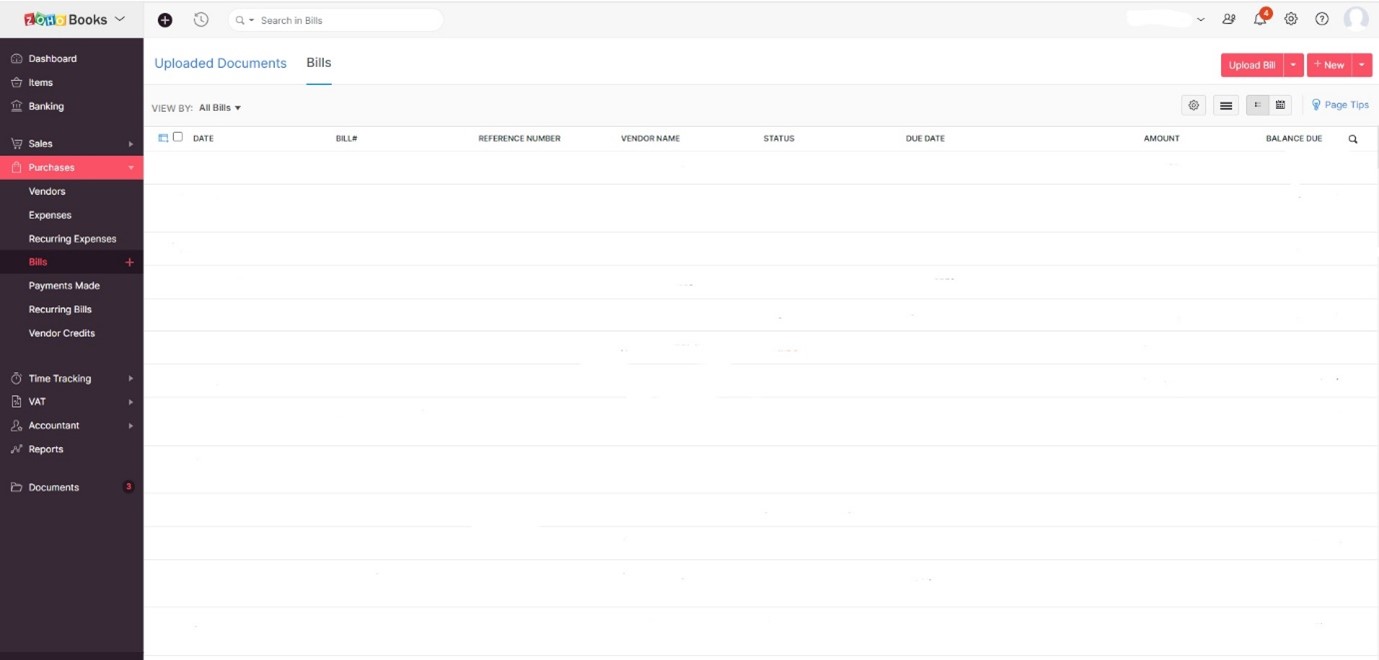

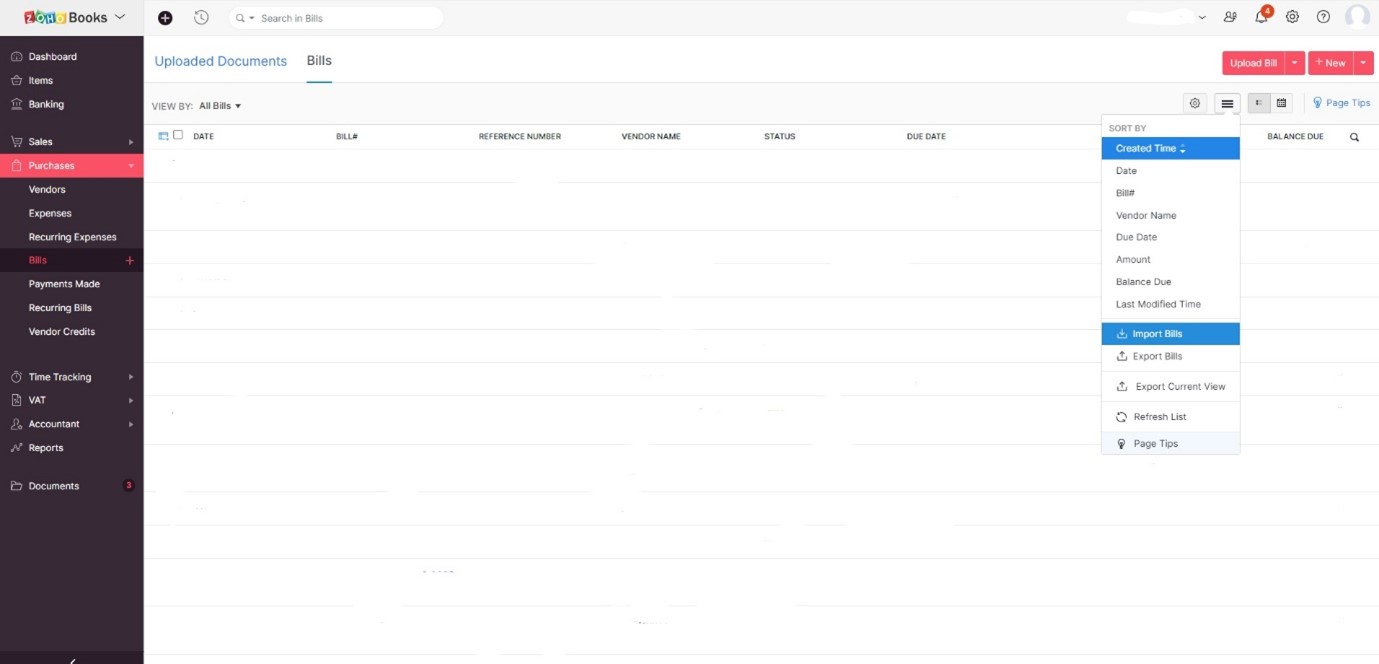

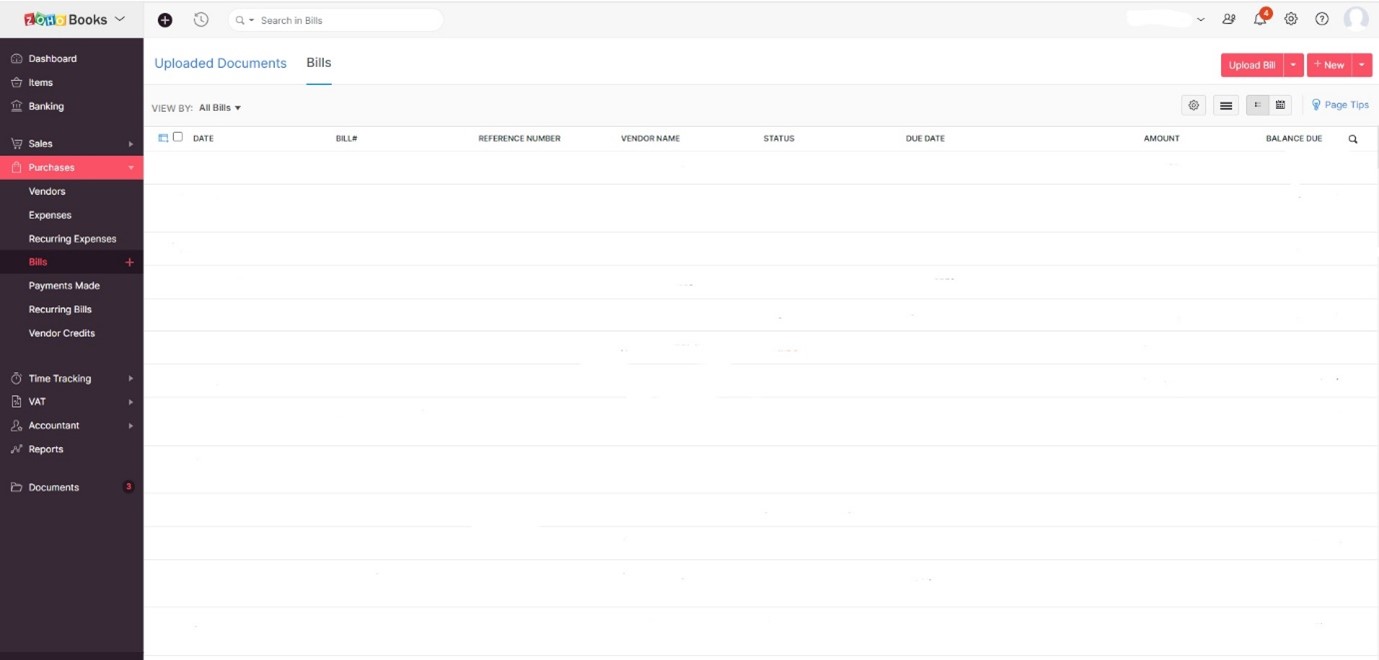

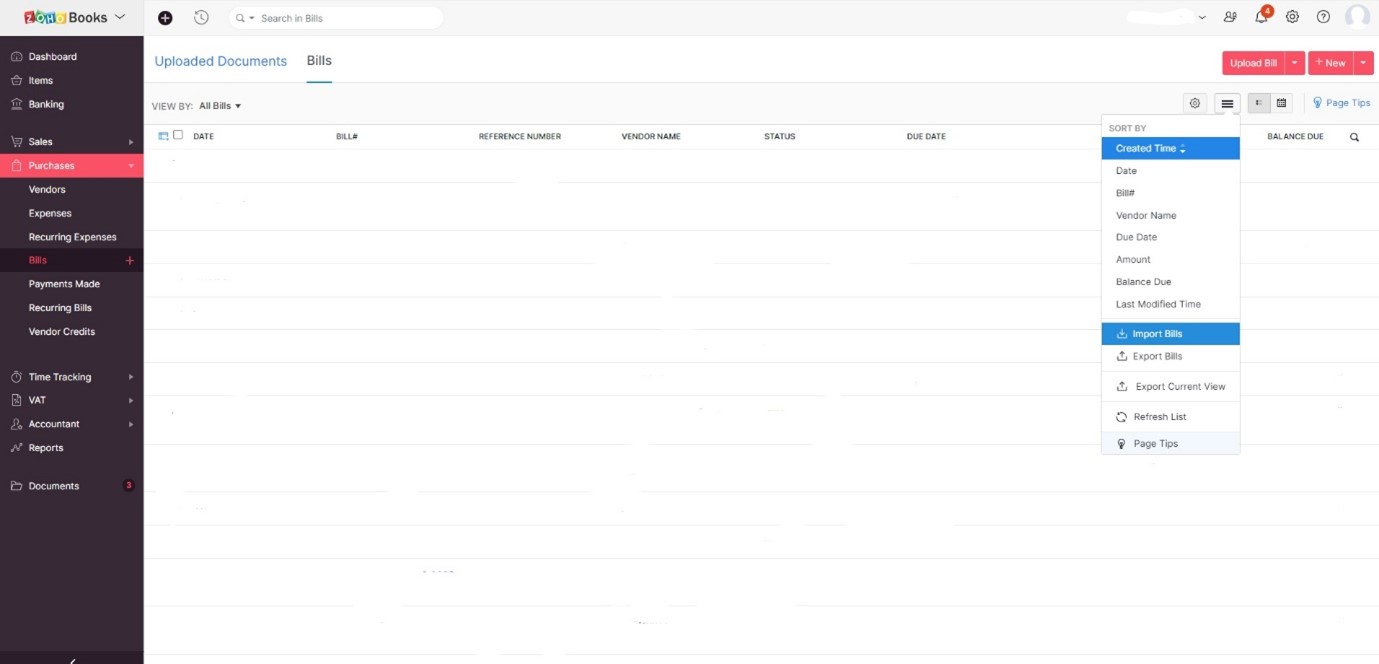

How to Import Purchase Transactions

Zoho Books allows you to import the modules (Expenses, Bills, Purchase Orders, and Payments Made) that you require for your business.

To export bills from Xero, go to Business menu > Purchases overview > Select the Bill tab you want to export from (To export all Bills - click See all) > Click Export.

To import bills into Zoho Books:

- Navigate to the Purchases module and select Bills.

- Click the Hamburger icon in the top-right corner and select Import Bills from the drop-down menu.

- Follow subsequent prompts.

Likewise, you can import the other purchase transactions and vendor payments.

How to import Sales Transactions

Zoho Books allows you to import modules for the different sales transactions (Estimates, Invoices, Retainer Invoices, Sales Orders, and Payments Received) – needed for your business.

To export sales transactions from Xero, go to: Business menu > Sales overview > Select the invoice you want to export (To export all invoices - click See all) > Click Export.

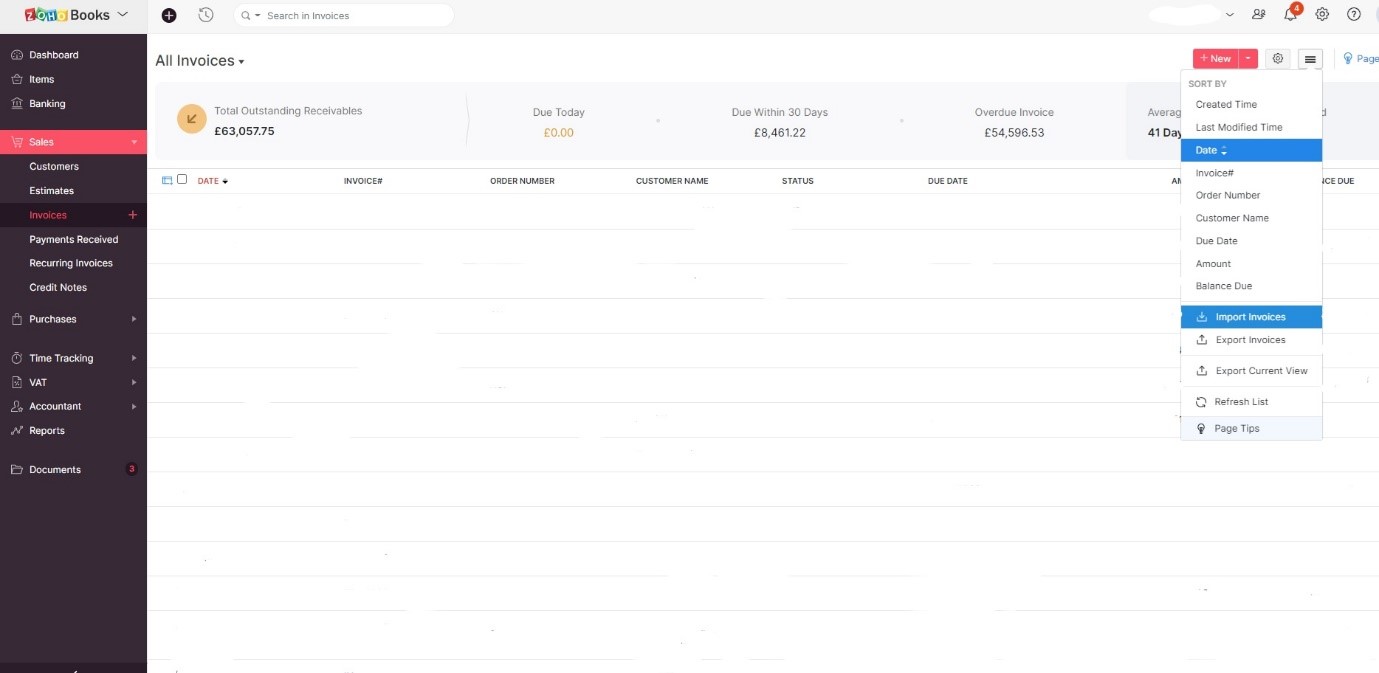

You can Import invoices into Zoho Books by:

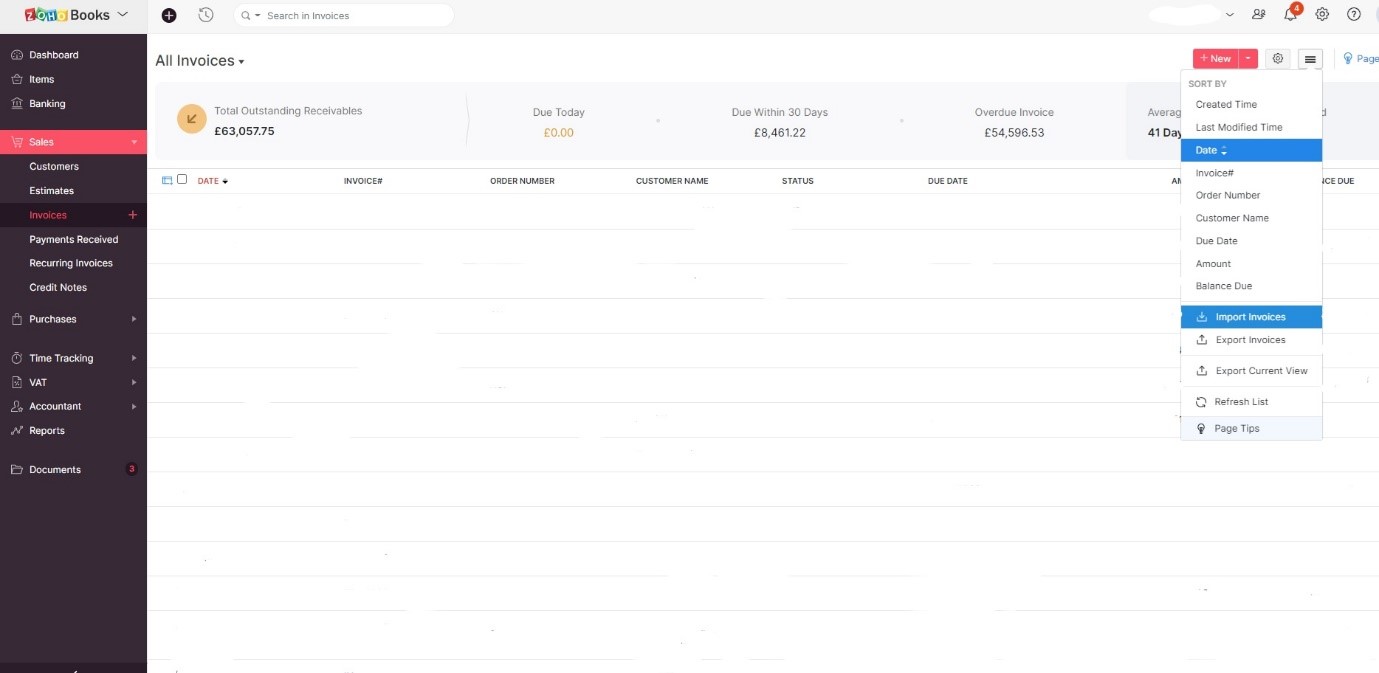

- Navigate to the Sales module from the left sidebar and select Invoices.

- Click the Hamburger icon located in the top-right corner.

- Select Import Invoices.

- Follow the successive prompts and steps to import your file.

You can also import the other sales transactions and customer payments following the same steps.

Importing Manual Journals

Since Zoho Books is a double-entry accounting system, the total debit and credit amount for a journal must be equal.

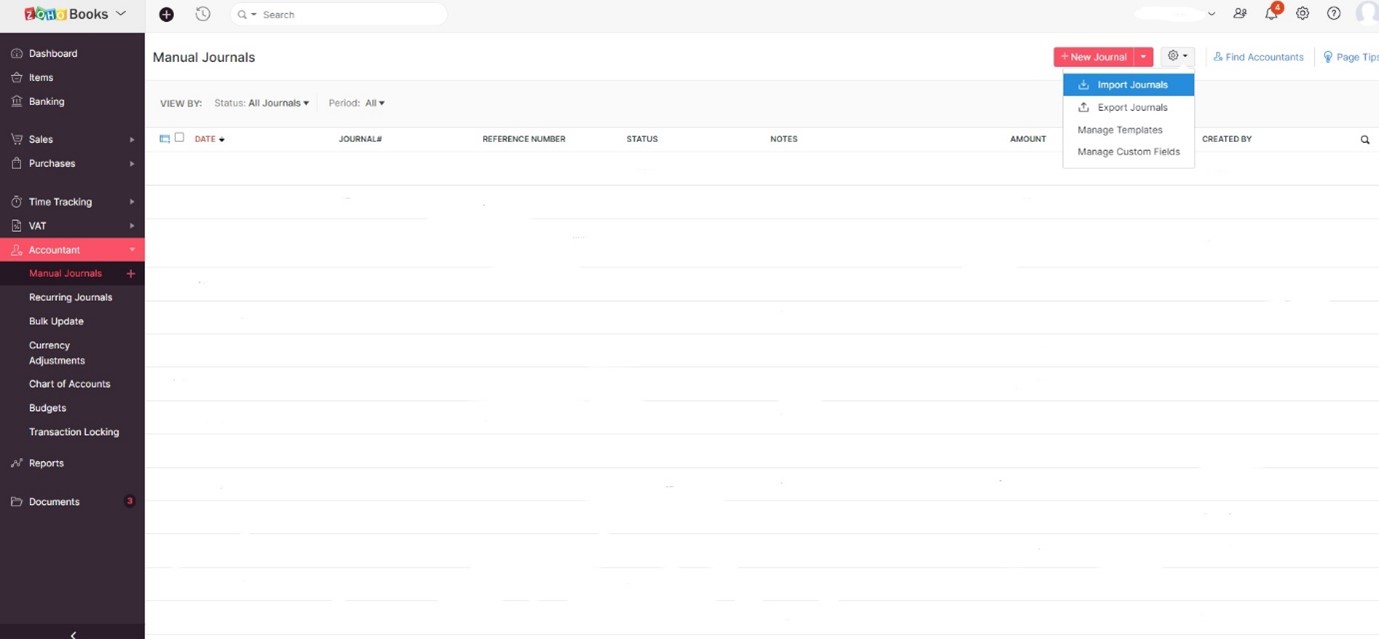

Follow the following steps to import manual journals:

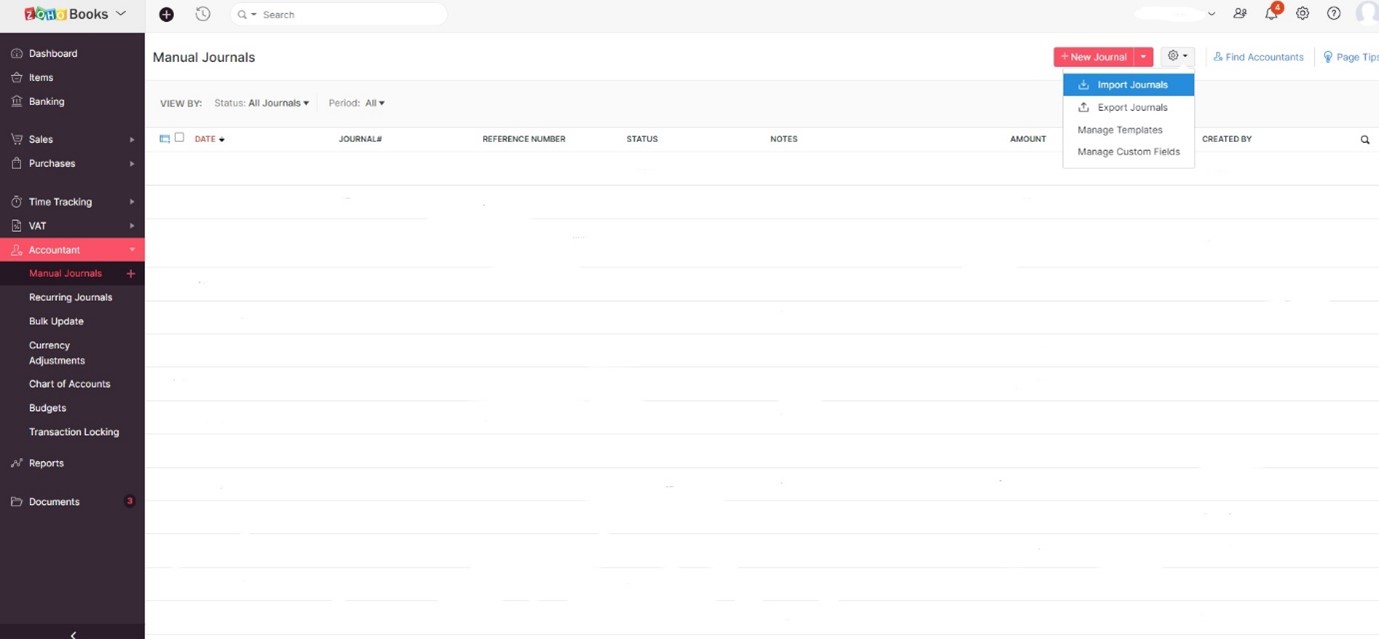

- Navigate to the Accountant module from the left sidebar and Select Manual Journals.

- Click the Gear icon in the top-right corner and select Import Journals from the drop-down menu.

- Follow the ensuing file upload prompts.

Step 10: How to Sync Transactions

To get accurate account values in the Trial Balance report, ensure all the imported transactions are properly synchronised with the Opening Balances.

To manually sync transactions that you had imported on or before the migration date with the Opening Balances in Zoho Books, you can:

- Navigate to Settings

- Choose Opening Balances.

- You will see the number of backdated transactions here.

- Click Sync.

If you have followed this process to the end, congratulations for successfully migrating to Zoho Books! You can now customise your organisation further and use Zoho Books features to ease your accounting processes.

Need help migrating from Xero to Zoho Books?

Spondoo Accountants can help you effectively migrate data from your current accounting system to Zoho Books. We offer:

- Top-rated data migration services: we can assist you in moving data to a new accounting system in the most precise way.

- Data protection: We have the best data safety practices for transferring your files under a safe link. Our programmers are also bound by a Privacy Policy of confidentiality when accessing your credentials during data import.

- Record preservation: We will ensure all the connections between your accounting documents are accurately maintained during the data transition.

Are you looking to migrate from Xero to Zoho Books? Give us a call at 02033 259 341 or send us an email at enquiries@spondoo.co.uk.