Your suppliers are legally bound to give you an invoice if you purchase a product or service from them. If you and your customer are VAT registered, they must provide a VAT receipt (or invoice) to make VAT claimable.

The Difference between an invoice and a receipt

In a nutshell:

Invoice | Receipt |

| A document issued by sellers to customers to collect payment. | A document that proves payment from a customer has been received by a seller. |

What to include

1. HMRC Legal requirements

Legally, their invoice must include:

- Comprehensible description of what the seller is charging.

- Unique identification number.

- Supplier/ seller’s company name, address, and contact information.

- Customer’s company name and address.

- The date when the goods or service were provided (supply date).

- The date of the invoice.

- Price/amount being charged.

- VAT amount if it applies.

- The total amount owed.

2. Other non-legal information to add to your invoice

They can choose to add details for:

- Payment terms like discounts for early payment and payment upfront.

- Bank account details if you are taking payments from online banking or BACS.

- If you send your invoices by email and use a service such as PayPal or GoCardless to collect payment from customers, include a link when you email the invoice - so that customers can pay with one click.

VAT invoices and receipts

HMRC has set out rules on different VAT invoice types – full VAT invoice, modified, and simplified.

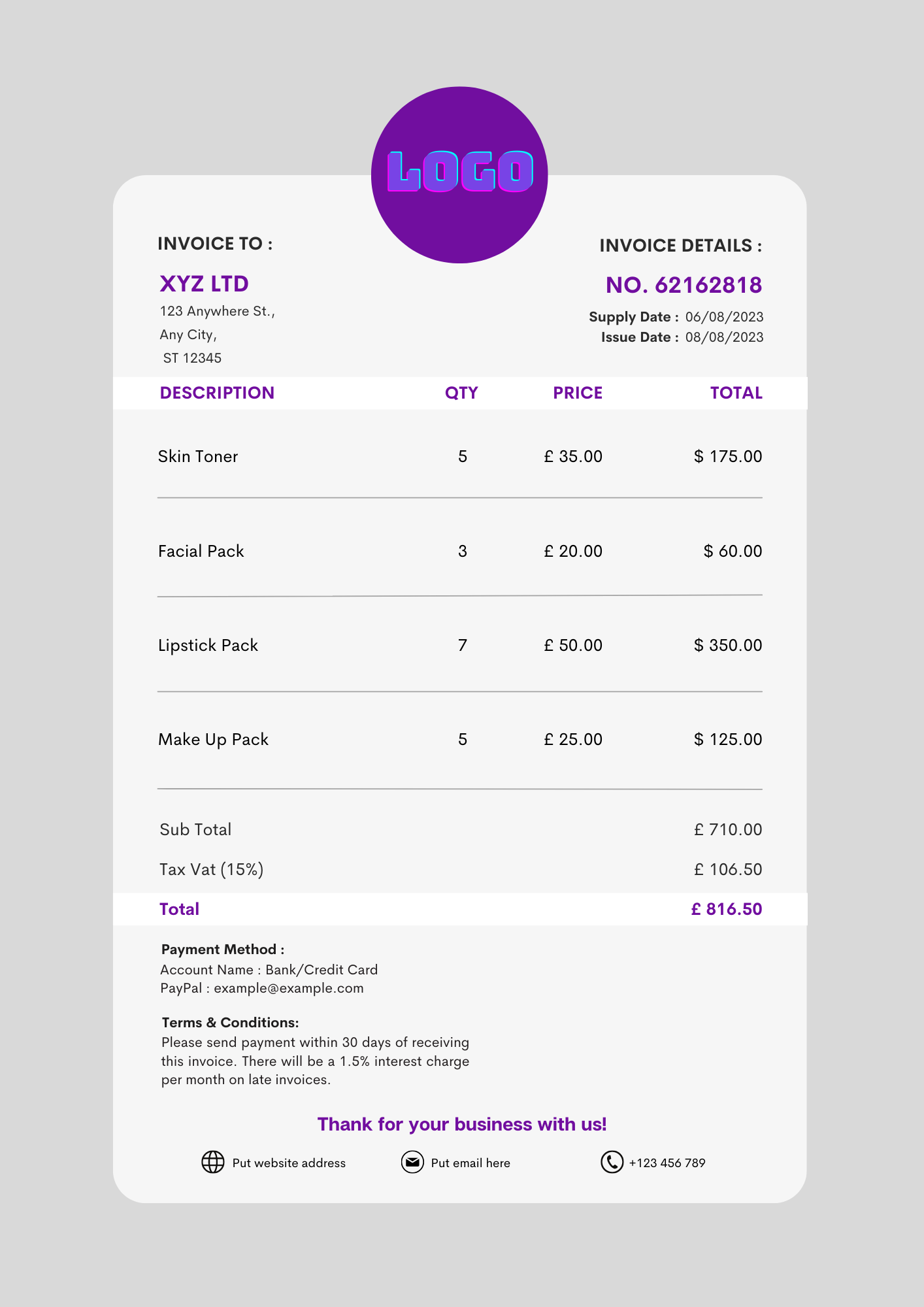

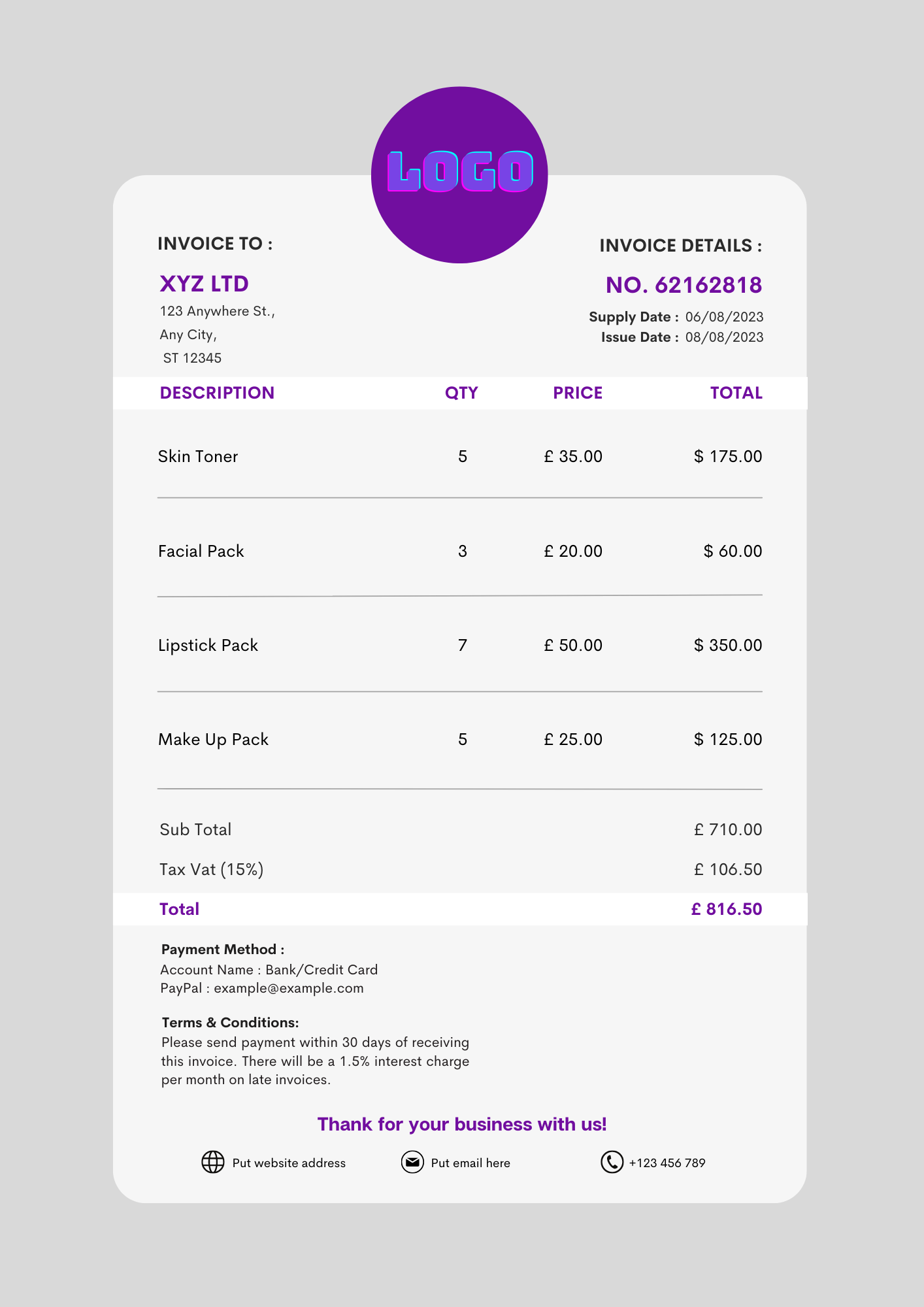

Full VAT invoice – with example

Before you can claim the VAT on an invoice your VAT-registered supplier invoices should have:

- Seller’s VAT number.

- Seller’s business name and address.

- Customer's name (or trading name) and address.

- A unique invoice number – the numbers should follow each other in succession. If you spoil or cancel a serially numbered invoice, do not dispose of it – you may need to show it to your VAT officer at your next VAT inspection.

- Invoice dates

- Tax point (the time of supply) if it is different from the invoice date.

- A clear description of goods or services supplied to the customer.

- Cash discount rate – if applicable.

- Total amount payable without VAT.

- The total amount of VAT charged - in sterling pounds.

- For each different type of item listed on the invoice, you must show:

- Unit price or rate of the sold item without VAT.

- Quantity of goods or the extent of the services.

- VAT rate that applies to the goods or services being sold.

- Rate of any discount for that item.

Invoices with zero-rated and exempt VAT

If you issue a VAT invoice that includes zero-rated or exempt goods or services, you must:

- Indicate a 0% or no VAT payable on those goods or services.

- Clearly show the total of those values separately.

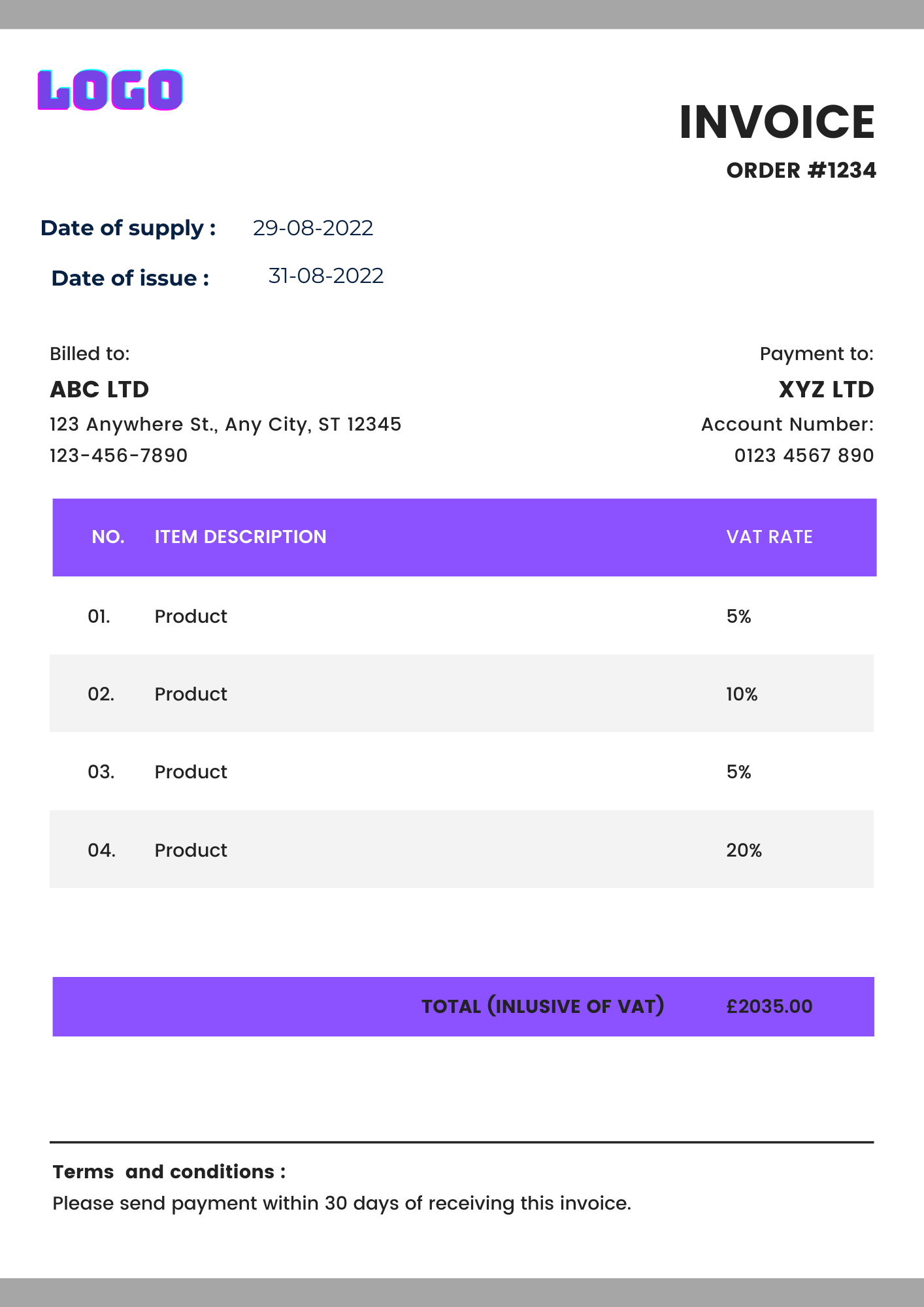

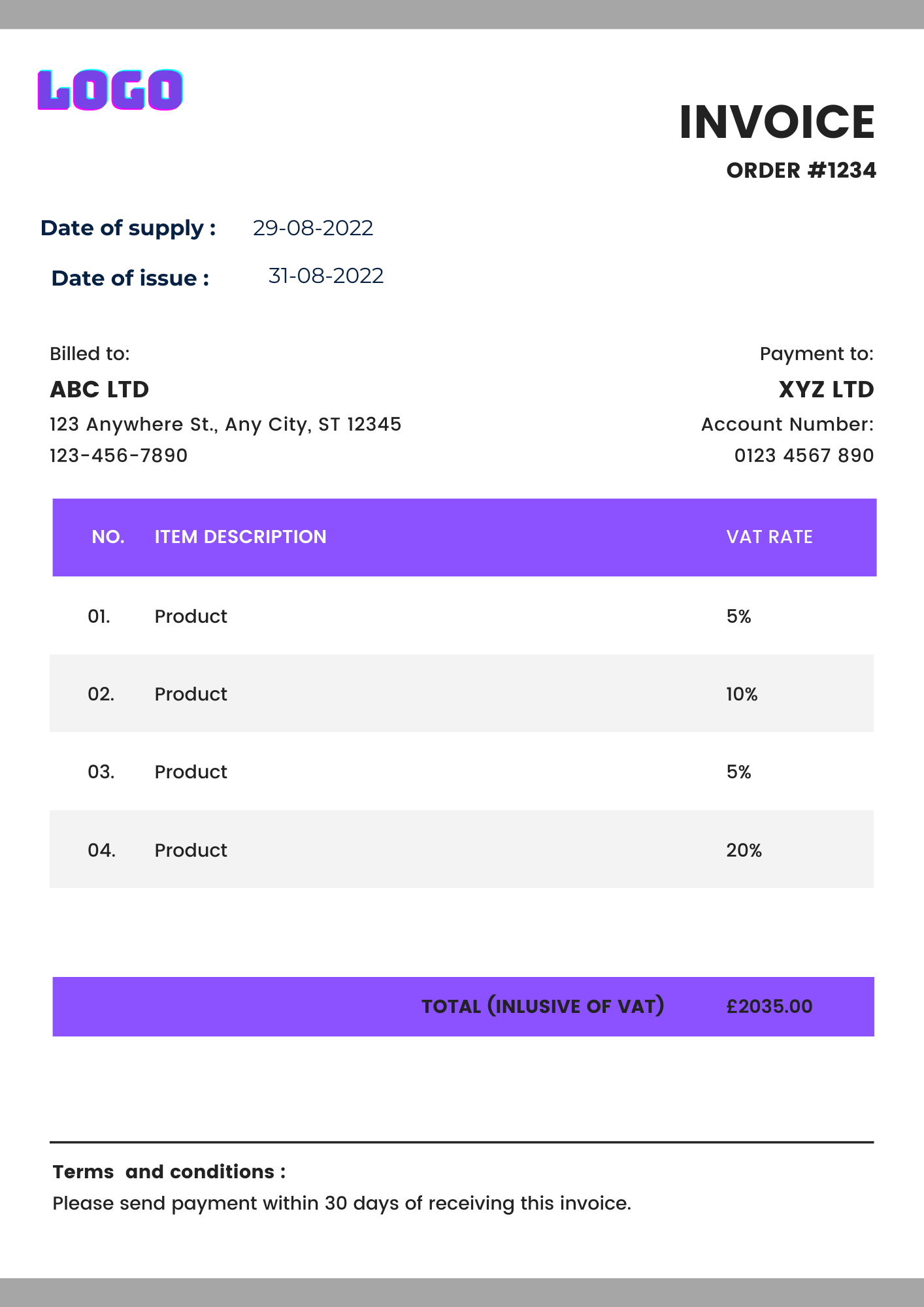

Simplified VAT invoice – with example

You can issue a simplified VAT invoice to your customer if you make a sale of goods or services for £250 or less (including VAT).

A simplified VAT invoice is a basic invoice version that shows the total amount to be paid by the customer. It only shows:

- Seller’s name, address, and VAT registration number.

- A clear description of the goods or services supplied.

- The date of supply.

- If the sale includes items at different VAT rates, then for each individual item it shows:

- The VAT rate was applied.

- Total price including VAT.

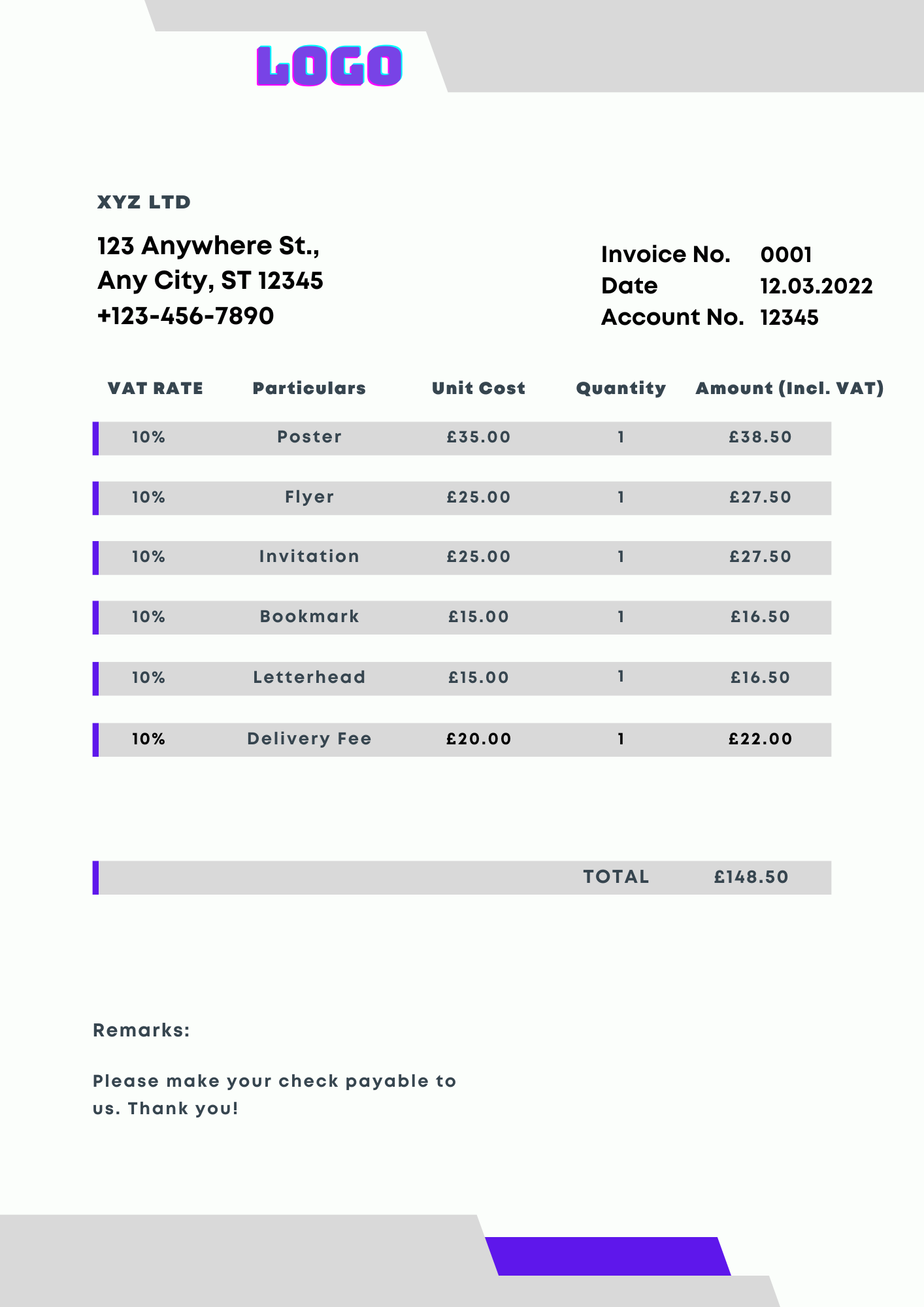

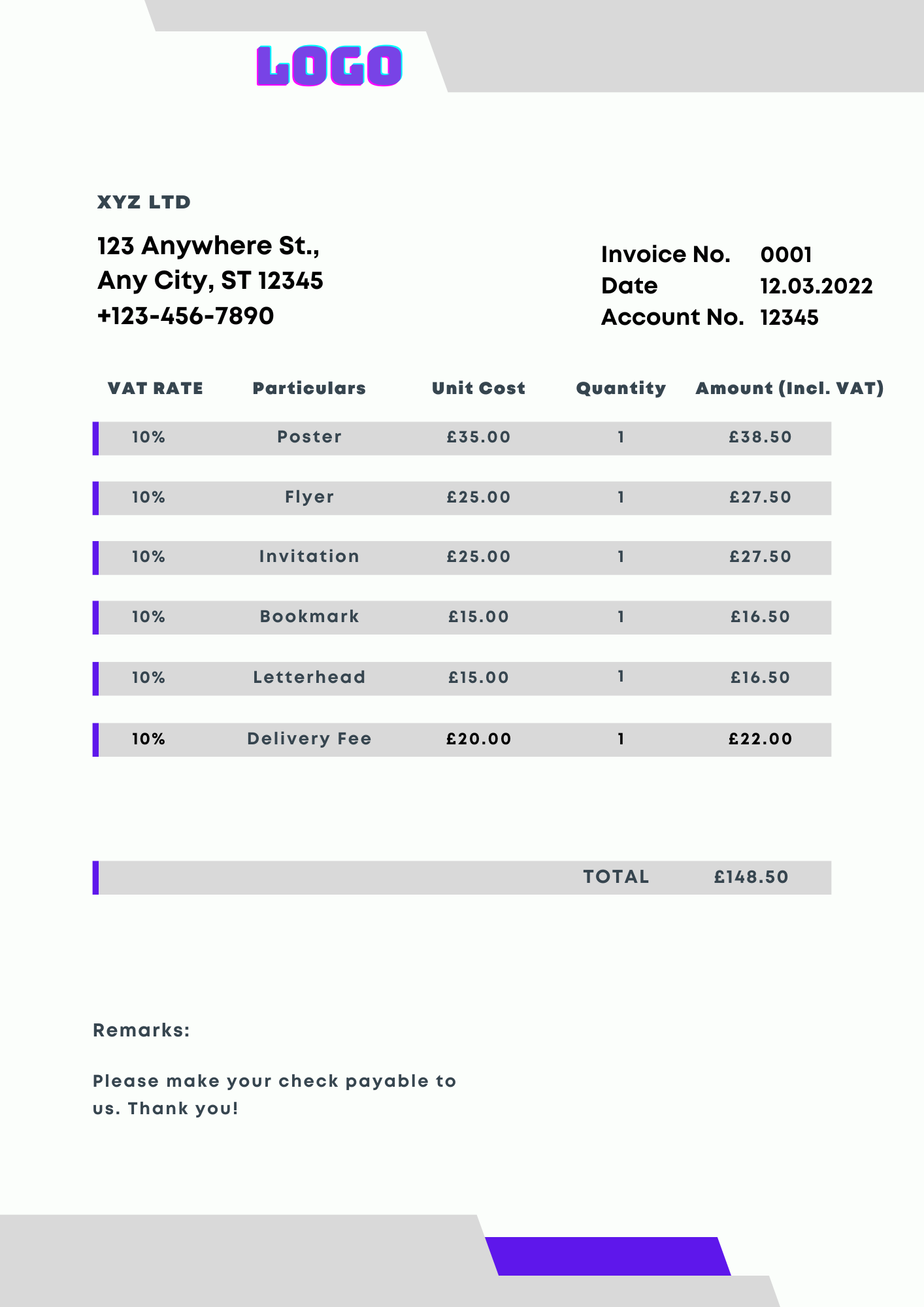

Modified VAT invoices – with example

If your customer agrees, you can issue them a modified invoice supposing you provided them with goods or services that exceed £250 plus VAT. These invoices show the VAT inclusive amounts (rather than the VAT exclusive values) for each standard rate or reduced rate item.

It is just like the full VAT invoice, but the foot of the invoice will show:

- The value of exempt items on the invoice.

- The value of zero-rated items that are on the invoice.

- VAT payable on those items.

- Value of those items excluding VAT.

Electronic Invoices (E-invoicing)

HMRC does not prohibit you and your supplier from exchanging invoice documents in an integrated electronic format. You do not need to inform HMRC if you plan to issue, receive, or store invoices electronically – provided the invoices meet the legal qualifications.

Self-billing invoices

To understand what to do if your customer prepares an invoice instead and gives you a copy - read our detailed Self-billing article here.

Should an invoice always be in the name of the business?

A tax invoice must show the correct name of the business – it acts as proof that goods or services were sold to you.

However, if your invoice is not - you must give HMRC alternative evidence of the taxable supply available to support the deduction.

Are credit card and debit card receipts and invoices allowable?

No, credit card and debit card receipts do not have details of:

- What was purchased

- Do not show that the purchases are wholly and exclusively for your business.

- Do not have a split on the VAT account if you are VAT-registered.

It is crucial to be cautious on invoices if you sell products or services with different VAT rates. If you need help with your accounting, bookkeeping and VAT - call us at 02033 259 341.